This week’s on-chain data report by the analytics company Glassnode looks into three major events — the depegging of the $USDC stablecoin, net capital outflows and futures open interest data.

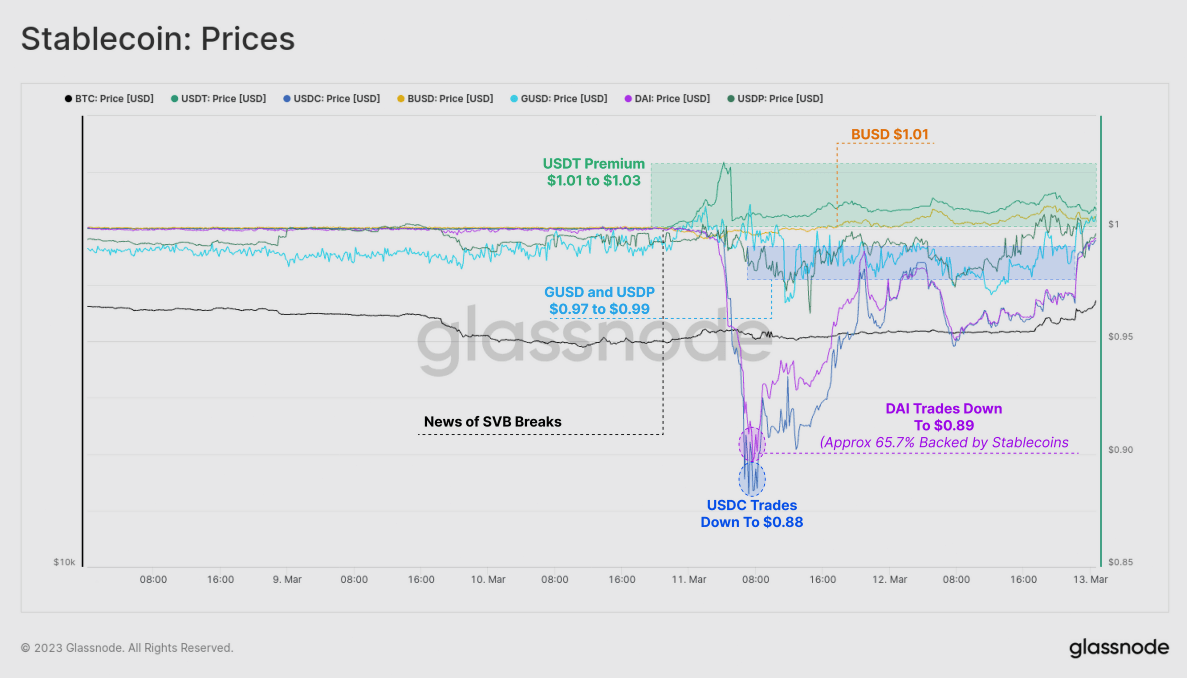

This has caused $USDC and $DAI to trade at lower values of $0.88 and $0.89 respectively. $DAI’s value drop is because it is backed by stablecoin collateral of only about 65.7%. Gemini’s GUSD and Paxos’ USDP also dipped below their $1 peg, while $BUSD and Tether traded at a premium.

Tether, in particular, traded at a premium between $1.01 and $1.03 during the weekend, which is ironic because it is seen as a safe haven in the face of potential risks in the heavily regulated US banking sector. This is the first time since the LUNA-UST project collapse that there has been volatility in stablecoin prices.

$DAI / $USDC

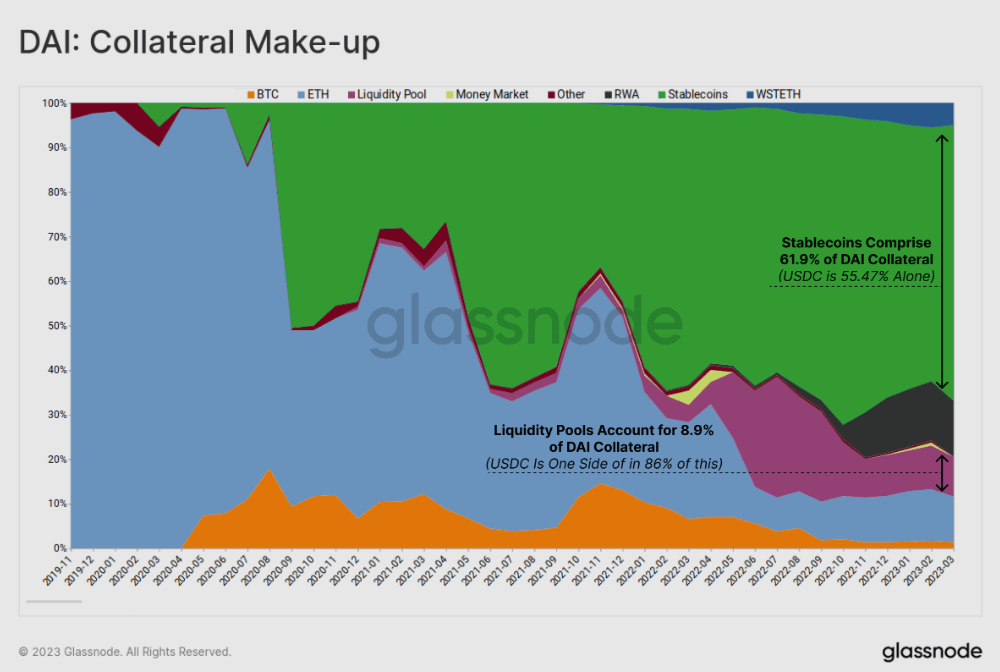

Stablecoins, particularly $USDC, have become the primary form of collateral supporting $DAI. This trend has been consistent since mid-2020, with $USDC making up around 55.5% of direct collateral and a significant portion of Uniswap liquidity positions, totaling to about 63% of all collateral.

According to Glassnode data, dependence on stablecoins for collateral raises questions about the decentralized nature of $DAI. This recent event highlights how $DAI’s price is closely tied to the traditional banking system due to its collateral mix, which also includes 12.4% in tokenized real-world assets.

Tether USDT dominance

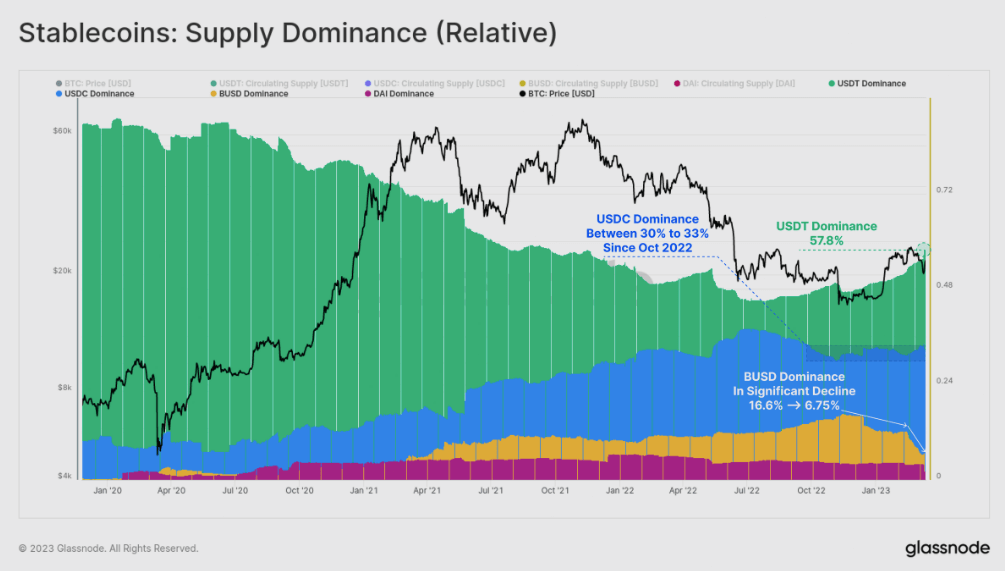

In mid-2022, Glassnode reported that Tether’s dominant position in the stablecoin market had been declining structurally since mid-2020. However, due to regulatory actions against $BUSD and concerns regarding $USDC stemming from its recent depegging, Tether’s dominance has rebounded to over 57.8%, it’s highest level in 18-months.

Since October 2022, $USDC has maintained a dominant market share of between 30% and 33%. However, it remains to be seen whether its supply will decrease as the redemption window reopens on March 20. On the other hand, $BUSD has experienced a significant decline in recent months, with issuer Paxos ceasing new minting, and its dominance falling from 16.6% in November to only 6.8% at present.

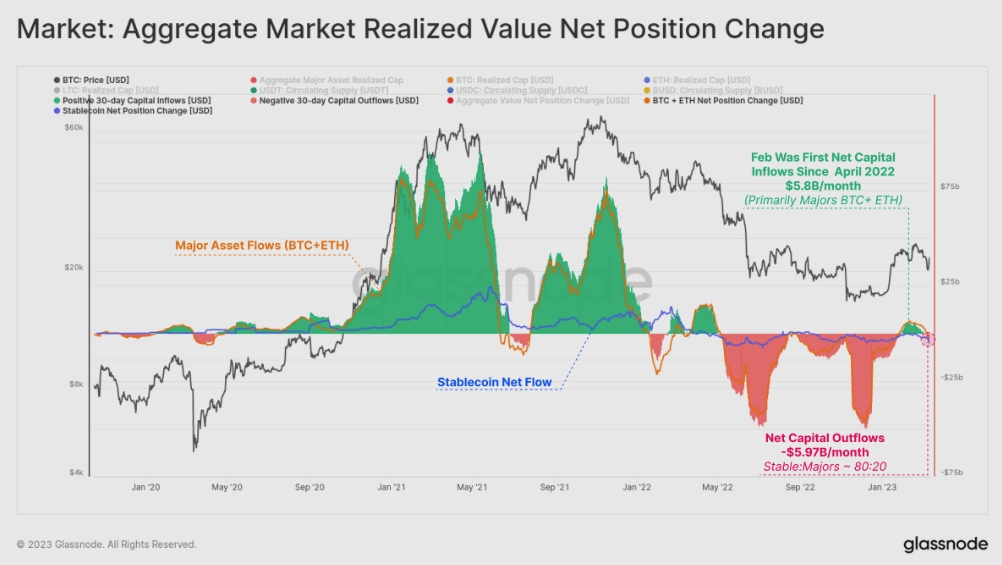

Aggregate Capital Outflows

Estimation of the true capital inflows and outflows, Glassnode estimates that the last month, the market has seen a reversal outflow of -$5.97B, with 80% of that a result of stablecoin redemption ($BUSD primarily), and 20% from realized losses across $BTC and $ETH.

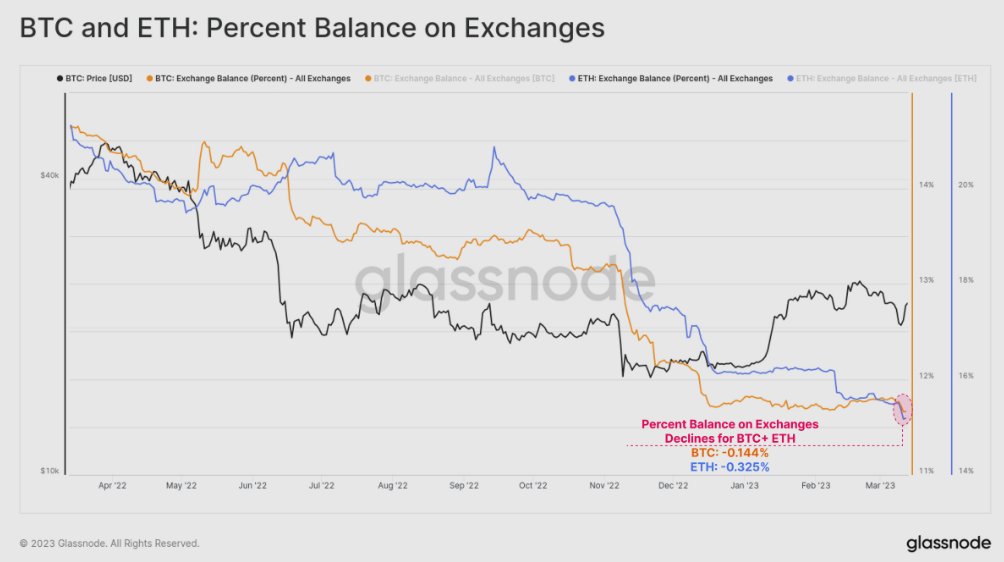

SVB fall out on percentage of $BTC and $ETH on exchanges

Approximately 0.144% of all $BTC, and 0.325% all $ETH in circulation was withdrawn from exchange reserves, demonstrating a similar self-custody response pattern to the FTX collapse. On a USD basis, the last month saw over $1.8B in combined $BTC and $ETH value flow out of exchanges.

cryptoslate.com

cryptoslate.com