The Filecoin (FIL) price could soon break out from a crucial resistance level, accelerating the rate of increase in the process.

FIL is the native token of the Filecoin network, which offers decentralized storage services. The FIL price has decreased below a long-term descending resistance line since March 2021, when it had reached an all-time high of $237.73. The downward movement led to a low of $2.37 in December 2022. Afterward, the price began a bullish reversal that is still ongoing.

While the FIL price was rejected by the resistance line (red icon), it still trades above the $5.55 horizontal support area. Whether it breaks out from the resistance line or falls below the support area could determine the future trend’s direction. A breakout could lead to an increase toward $25 while a breakdown would likely lead to a fall toward $2.

The weekly RSI is bullish, since it has generated bullish divergence and is nearly above 50. As a result, a breakout from the descending resistance line is more likely.

Filecoin (FIL) Price Resumes Bounce

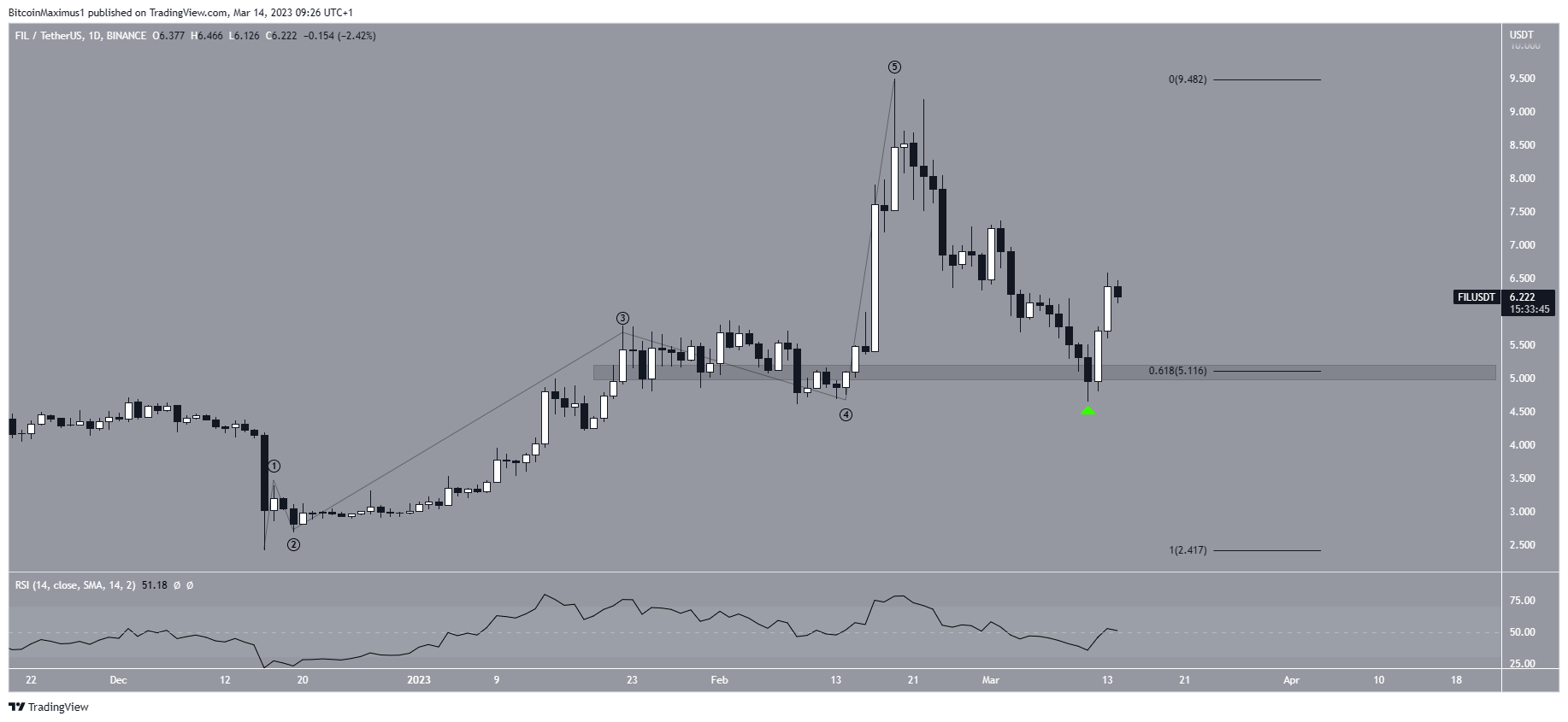

The technical analysis from the daily time frame is leaning bullish but does not confirm the bullish reversal yet. The price completed a five-wave upward movement on Feb. 17 and began to decrease afterward. It bounced on March 11 (green icon) and created a bullish engulfing candlestick the next day.

The bounce validated the $5.11 horizontal area as support. The area coincides with the 0.618 Fib retracement support level. The trend can be considered bullish as long as the price is trading above it. However, the daily RSI is not above 50 yet. Therefore, a breakdown below $5.11 could trigger a sharp fall toward $3.

The six-hour chart shows that the Filecoin price broke out from a descending parallel channel. Since such channels usually contain corrections, the breakout could mark the beginning of a new upward movement. The main resistance area is at $7.10, created by a horizontal level and the 0.5 Fib retracement resistance. Since a breakout from it would also mean that the FIL price broke out from the long-term descending resistance line, it would confirm that the long-term trend is bullish.

To conclude, the most likely FIL price forecast is a breakout above the long- and short-term resistance near $7.10. If this occurs, it could accelerate the rate of increase toward $25. On the other hand, another rejection could lead to a drop toward $3.

beincrypto.com

beincrypto.com