Today is shaping up like another interesting day within the cryptocurrency industry as the issues surrounding quite a few banks in the US are still undergoing.

Moreover, the US Bureau of Labor Statistics will be releasing the CPI numbers later today – an event that’s typically associated with considerable volatility. Let’s dive in.

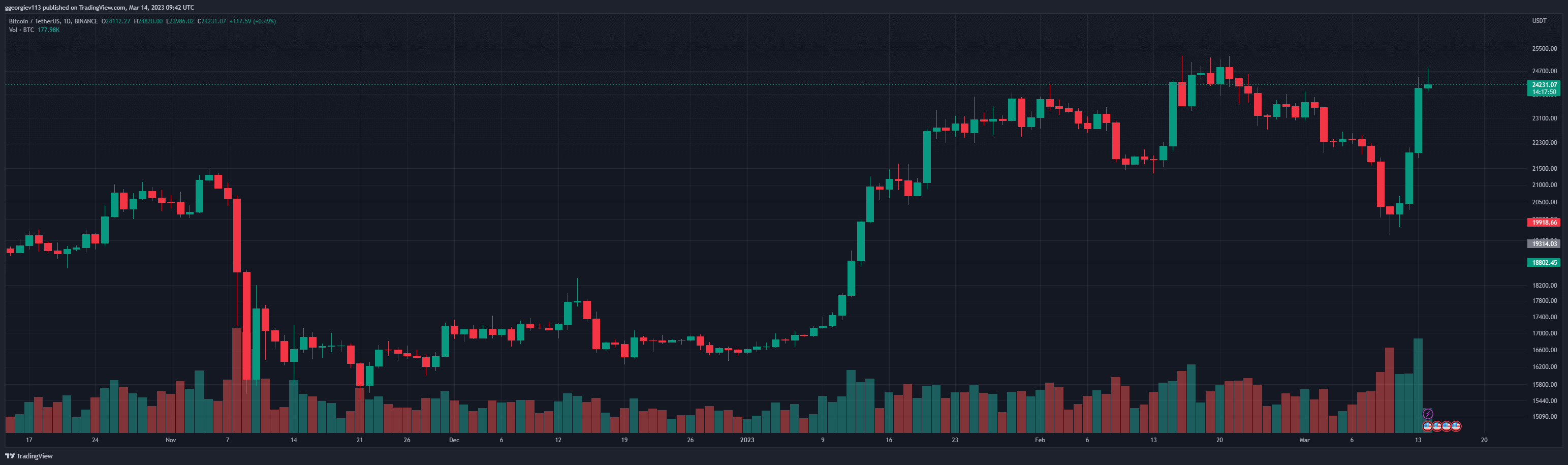

Bitcoin Price Pushes to a 20-Day High

Ever since the US Government, in the face of the Treasury, the Federal Reserve, and the FDIC, jointly committed to saving depositors at Silicon Valley Bank, the cryptocurrency industry has been booming.

Bitcoin’s price is currently trading above $24,000, having reached a peak at around $24,820 (on Binance) earlier today. This marks a 20-day high.

Part of the increase is also the fact that Binance decided to convert roughly $1 billion (from their Industry Recovery Initiative) from BUSD to Bitcoin, Ethereum, and Binance Coin.

With the CPI release coming later today, though, the market volatility is expected to pick up. It’s also worth noting that following the developments with SVB, Signature Bank, and Silvergate Bank, many big institutions are pressuring the Federal Reserve into not hiking rates during the FOMC meeting, which is later in March. This has also put upward pressure on the market.

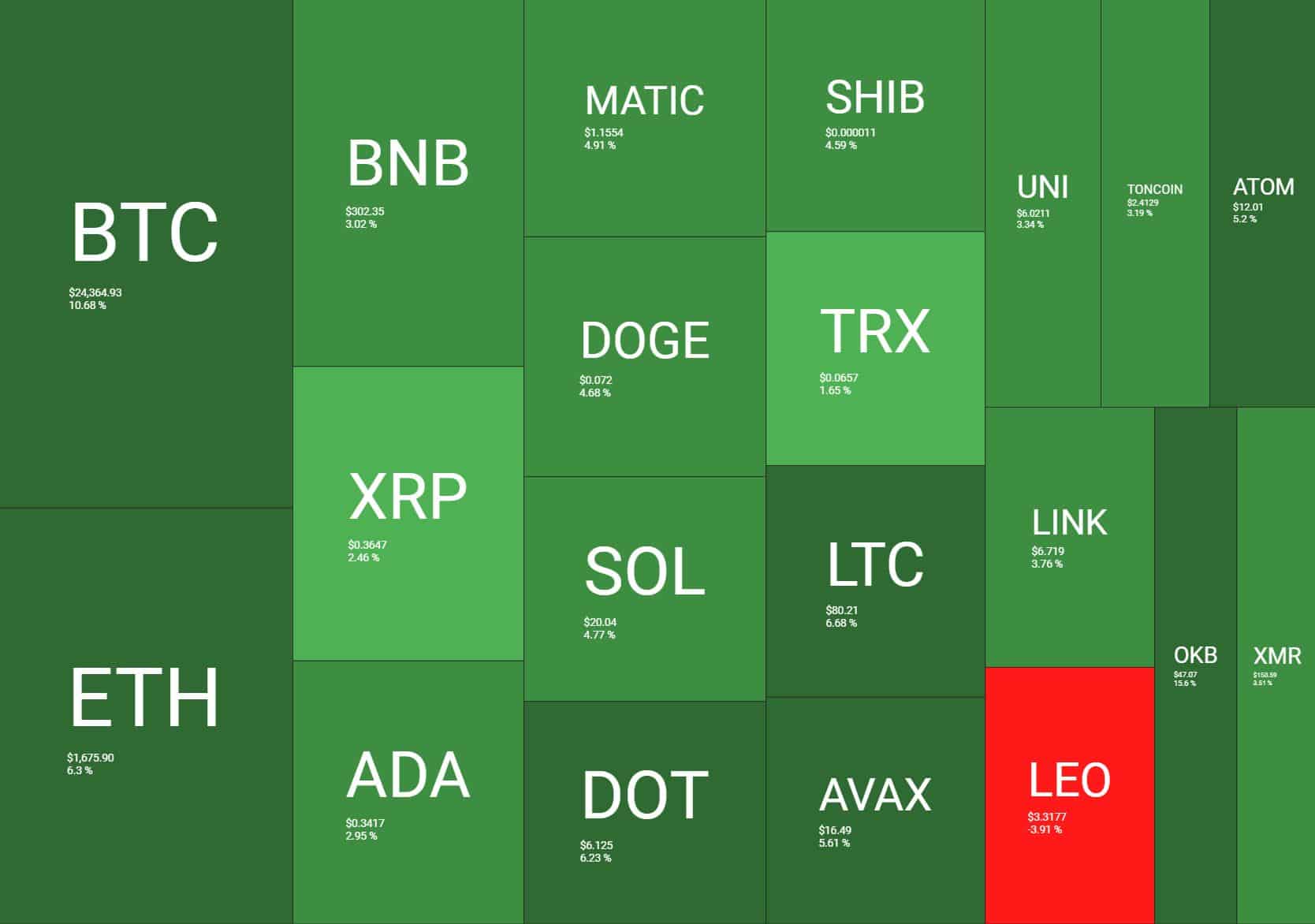

Altcoins Painted Green

Altcoins are also performing very well, although it’s evident that BTC has done better than some. Ethereum managed to tap $1,700, and it’s interesting to see if the cryptocurrency will be able to overcome this important level.

At the same time, others, such as LTC and DOT, are also charting considerable gains. However, all in all – the past few days saw Bitcoin’s dominance spike. This is the metric that tracks its capitalization relative to that of the rest of the market, and it’s indicative of BTC’s strength at the moment.

The best performer from the top 100 coins over the past 24 hours is CFX – up a whopping 30%. WBT is also up around 17%, followed by OKB and RPL – both of which are up around 14% at the time of this writing.

On the other end of the spectrum, we have LEO, which failed to increase and even dumped by about 5%.

cryptopotato.com

cryptopotato.com