Crypto liquidations hit $300 million upon news of Silvergate’s closure and a lawsuit against KuCoin. The market is seeing red all over and could be in for a rough few weeks.

Liquidations in the crypto market are beginning to mount as news of Silvergate shutting down and the lawsuit against KuCoin is digested. Over the past 24 hours, liquidations have crossed $306 million, with Bitcoin being the most liquidated at $119.2 million. Ether follows with $75.5 million.

Unsurprisingly, nearly all the liquidations are on traders with long positions opened. Their positions were not entirely unwarranted, as before the recent reversal, the market had looked like it was building up momentum.

Most of the liquidations came from Binance, which accounted for $105.7 million of all liquidations. OKX and Huobi followed. Those who shorted also saw some losses, with the number of short position liquidations on Binance amounting to $14.11 million. Overall, this figure was $30.44 million.

The past few days have shaken the market, and recent developments do not offer an optimistic picture for the short-term future. The market is still reeling from the effects of the incidents last year, and this continues to have a cascading effect.

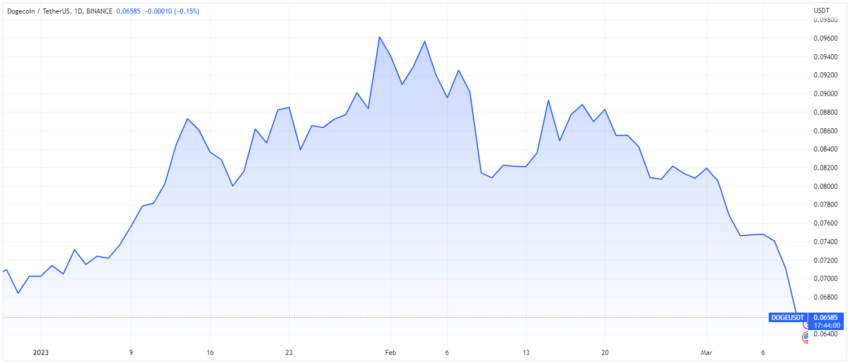

Some Tokens Approaching 2023 Lows

The market downturn has affected some tokens particularly hard. While many are hovering just above their 2023 lows, some have already dropped below. The next few weeks are crucial for the market, and investors will hope that it steadies itself.

Dogecoin, the original meme coin, has fallen to $0.065, its lowest value of the year. Similarly, XMR has also hit year-to-date lows. Meanwhile, ALGO is teetering close to its 2023 low.

Developments in the US Pummel Crypto Market

Many incidents have precipitated the bloodbath that the market is currently going through. Silvergate deciding to shut down is no doubt a big part of this, but the lawsuit against KuCoin is equally significant.

The closure of Silvergate has had some cascading effects. Bitcoin miner Marathon has decided to end its credit ties with the bank. A 30% tax on electricity usage for crypto mining is also under consideration by the Biden administration, which is also likely affecting the market.

beincrypto.com

beincrypto.com