Since the crypto market sentiment turned bearish after a few weeks of improvement, many cryptocurrency prices have retraced. Many coins have barely held their gains, while others have surrendered the past month’s gains to the bears.

Even the Synthetix token is not safe from this downtrend, but surprisingly, it managed to sustain some of its gains over the past 30 days. At press time, SNX is up by nearly 8% in the past month. Initially, It was higher than that but later reduced as the daily decline pushed stronger.

New Ecosystem Improvements Sustaining Synthetix’s Price Gains While Others Decline

Digital asset prices rely partly on ecosystem improvements and utilities and largely on macroeconomic situations. The pressure on the coins is higher now that extreme macroeconomic conditions and external factors have affected the global cryptocurrency market cap with bearish sentiments. The increased uncertainty and fear in the market as the Feds continue their aggressive interest rate hikes have raised the bar for ecosystem innovations to sustain crypto asset prices.

Related Reading: Ethereum Founder Buterin Dumps These Meme Coins, What You Need to Know

Synthetix IO is on an innovative path with several ongoing projects that could boost SNX’s price. One of the latest developments in the SNX ecosystem is the Synthetix Perps Arbitrage. Synthetix Perps Arbitrage allows traders to profit while leveraging temporary fund rate discrepancies between trading platforms.

The Synthetix developing team has come up with back-to-back improvement projects for a better user experience. Preparations for the Sythetix Perps V2 update are nearly complete and are expected to go live soon. But as the V2 launch draws near, the community is already talking about the Perps V3 update, which will happen shortly after Perps V2.

Synthetix Perpetual futures (Synthetix Perps) allow users access to various tokens at low fees. It uses a distributed model on Sythetix where liquidity providers can delegate their liquidity to different pools and markets.

According to a note on Sythetix’s official Twitter account, liquidity providers now have direct access to profitable markets that minimizes loss over time. The features could attract new users to Synthetix while pushing SNX’s price as more people pay fees with it.

SNX Price Outlook Amid Bearish Market

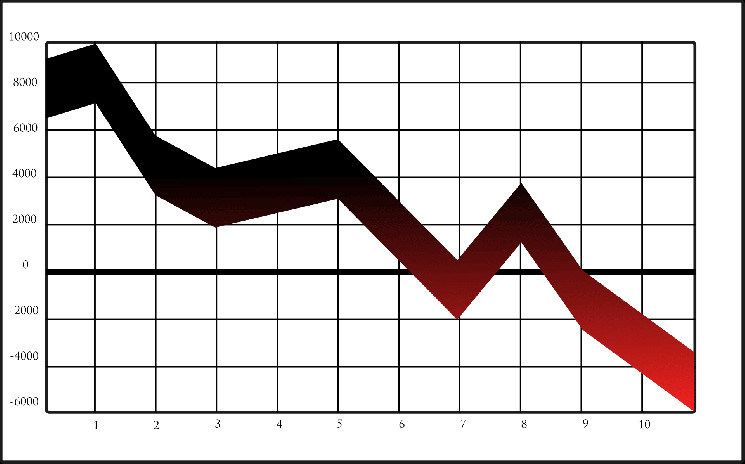

Synthetix token (SNX) is trading at $2.94, with a 9.22% price decline over the past 24 hours. Although it lost some percentages today, it scored gains over the past two days when other tokens recorded price declines. As of March 6, SNX’s price gained 7.6%, adding $0.218435 to its past-day price of $2.88. It also rallied by 0.3% on March 5, placing it among the weekly gainers in the bearish market.

SNX’s price retained gains over the past 30 days when top coins like Bitcoin fell. The token’s price increased considerably between February 25 and March 1, when it rallied from $2.47 to $3.03. Also, data from CoinMarketCap shows SNX trading volume saw an uptick during this period of the price rally.

As of February 26, SNX’s trading volume stood at $44.9 billion. The trading volume doubled to $87.4 billion on February 27 and increased again to $114.54 on the 28th. This observation suggests an increased network activity, which might be responsible for the price rally.

Related Reading: Maker (MKR) Registers 15% Gains In The Last Week, What’s Pushing It?

The market-wide downturn is primarily because many investors, especially the buy-and-hold investors, are scared of purchasing any coin as they fear what might happen once the next interest rate hike bps kicks off. However, the ongoing innovations on the Sythetix Network might sustain the token’s price against the odds in the broader crypto market.

newsbtc.com

newsbtc.com