1 INCH token looks bearish on the daily charts, with bulls draining momentum near the supply range of $0.650. The token rejects from 200 days EMA and now persists on 20 EMA. If bulls attain to close over it, then a pullback may be seen. Despite the corrective move, delivery volume in the last session increased by 35%, showcasing investors’ interest. Moreover, the token now brings support near the 38.2% Fib level at $0.570. A flattering ruin toward $0.500 may be tested if the token splits the lower trendline.

In the last 7 days, 1 INCH sank nearly 17%, switching the trend in favour of bears for the short term. At the same time, the price actions replicate that token facing resistance near $0.650 and rejecting multiple times already in the past. The bears maintained their firm grips near the mark of $0.650.

At the time of writing, 1 INCH is trading at $0.5754 with a drop of 3.23%. Moreover, the market cap also decreases by 3.02%.

Daily Charts Shows Selling Pressure

On the daily chart, 1 INCH token showcases slight profit booking behind the pullback and bounce back in the recent ongoing sessions. The bulls are strong-fronted muscles, with the start of 2022 gaining traction and recovering from the demand zone. However, if the token persists in holding above $0.550, then bulls gain the muscles and further bounce till the trajectory supply level again may be tested.

1 INCH token price action tells that with the decisive up move attained by the bulls in the last month, the sellers are engaged and struggling to book profits acquired now in the last week.

Short Term Charts Shows Bulls penetrates to hold range

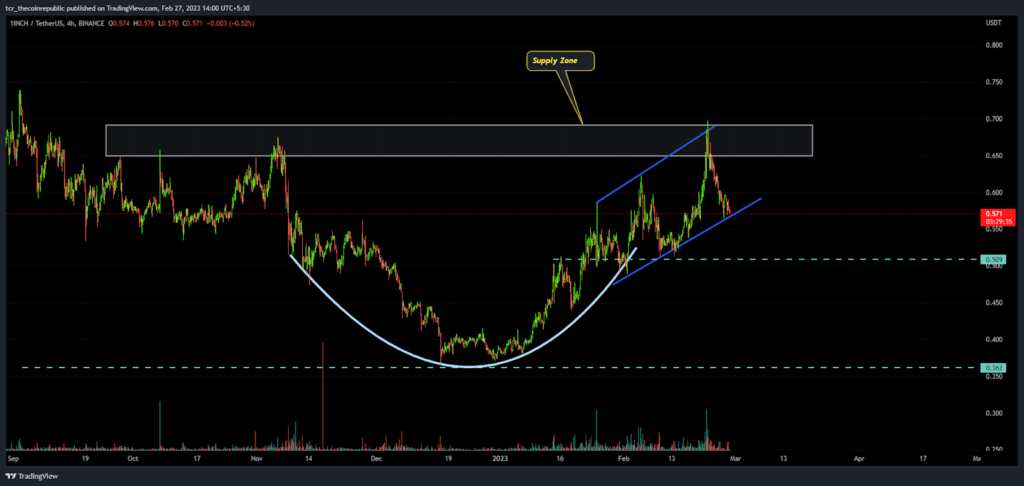

On the 4-hour chart, the token trades inside the rising parallel channel and hovers near the channel’s lower trendline. Moreover, the token price is also near the lower Bollinger band, which, if it breaks, leads to fresh selling in the token. 1INCH shows a rounded bottom shape recovery from the lows, forming a rising channel in the recent sessions.

The token persisted in forming higher highs, but bears diminished the bulls momentum, resulting in the lagging pace of action near the supply range. Moreover, if the candle breaks the previous higher lows, the trend will lead to more bearish actions for the token.

Traditional Indicator On 1 INCH

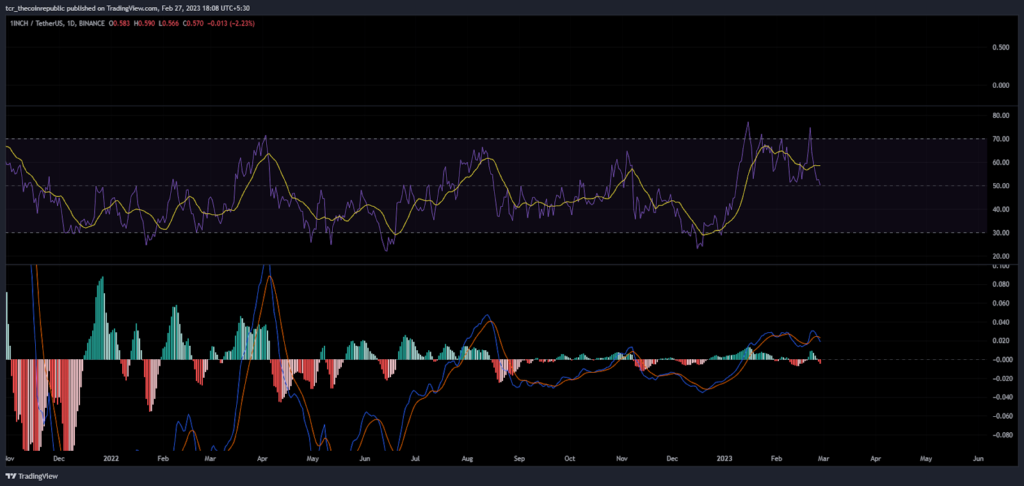

RSI ( Neutral ) The RSI curve slips from the buying range and hovers near the neutral range of 50. The RSI indicates that the bulls are lacking the momentum because of sellers participation.

MACD ( Bearish ) The MACD curve is giving bearish crossover in the last session and plotting red bars on the histogram and more selling pressure on the token will be attained in the near sessions.

Technical Levels

Support Levels: $0.500 and $0.450

Resistance Levels: $0.600 and $0.650

Conclusion

1 INCH token is now reverting trend from bullish to mild neutral and if the token breaks the lows of channel trajectory then fresh selling may be glimpsed. The upper range for the token opens when price escapes above the supply mark of $0.600.

thecoinrepublic.com

thecoinrepublic.com