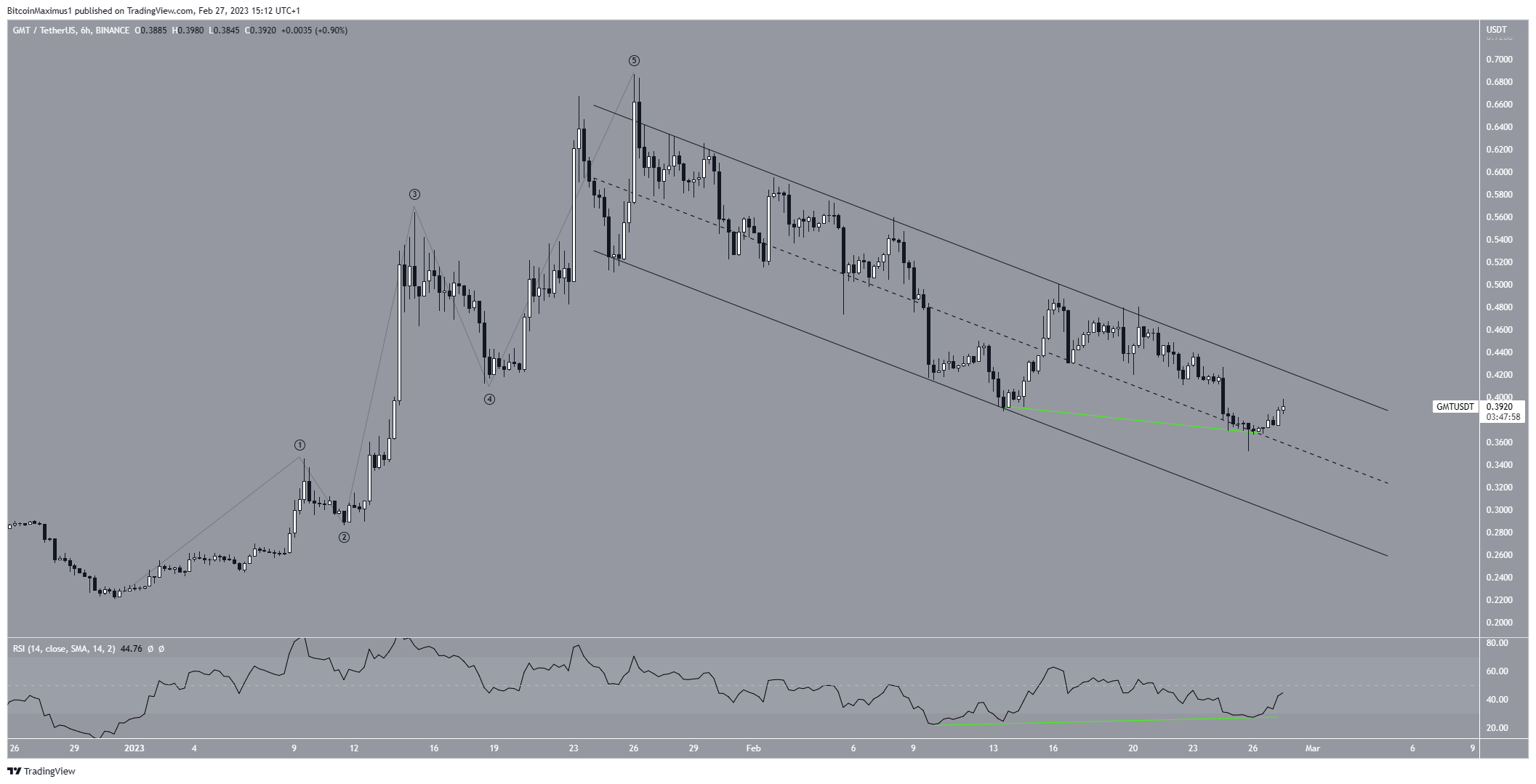

The STEPN (GMT) price is trading inside a short-term channel from which a breakout is expected.

The GMT price increased rapidly in January, reaching a high of $0.686 on Jan. 26. However, it created a long upper wick (red icon) and has fallen since. The price failed to close above the $0.59 horizontal resistance area, which had previously acted as support in June 2022. The trend can only be considered bullish once the price exceeds this area.

The drop led to a low of $0.352 on Feb. 25, also causing a breakout from the $0.415 resistance area. Therefore, the GMT price now trades below two important resistance areas. On the other hand, the closest support area is at $0.31.

Additionally, the daily RSI is decreasing and is below 50. Therefore, the most likely price forecast is for GMT to drop to the $0.31 support area.

On the other hand, reclaiming the $0.415 resistance could lead to the STEPN price moving upward toward $0.59.

STEPN (GMT) Price Could Break out Soon

Despite the relatively bearish outlook from the daily time frame, the technical analysis from the six-hour one provides a more bullish outlook. There are three reasons for this.

Firstly, the GMT price is trading inside a descending parallel channel. Such channels usually contain corrective movements. The price is currently trading in its upper portion, increasing the chances of a potential breakout.

Secondly, the six-hour RSI has generated bullish divergence (green line). Such divergences often precede price breakouts.

Finally, the preceding increase resembles a five-wave upward movement (red). This fits perfectly with the presence of the channel.

Therefore, the STEPN price is likely to break out from the channel and move toward $0.595.

However, a fall below the channel’s midline would invalidate this possibility. In that case, the GMT price could fall to $0.31.

To conclude, the most likely GMT price forecast is a breakout from the short-term channel and an increase to $0.590. However, a fall below the channel’s midline would invalidate this bullish forecast and could cause a drop to $0.31.

beincrypto.com

beincrypto.com