BeInCrypto looks at five biggest altcoins losers in the entire crypto market this week, specifically from Feb. 17-24.

The altcoins that have fallen the most in the entire crypto market are:

- Loopring ($LRC) price fell by 13.62%

- Render Token (RNDR) price fell by 12.13%

- dYdX ($DYDX) price fell by 11.89%

- Fantom (FTM) price fell by 10.25%

- Aptos ($APT) price fell by 9.03%

Loopring ($LRC) Price Leads Crypto Losers

The $LRC price broke out from a descending resistance line on Jan. 23. The increase led to a high of $0.49 on Feb. 16. However, the price created a long upper wick and has fallen since.

Whether the $LRC price breaks out above $0.50 or continues to decrease will likely determine the future movement. A breakout could take the price to $0.60, while the continuing of the decrease could cause a fall to $0.33.

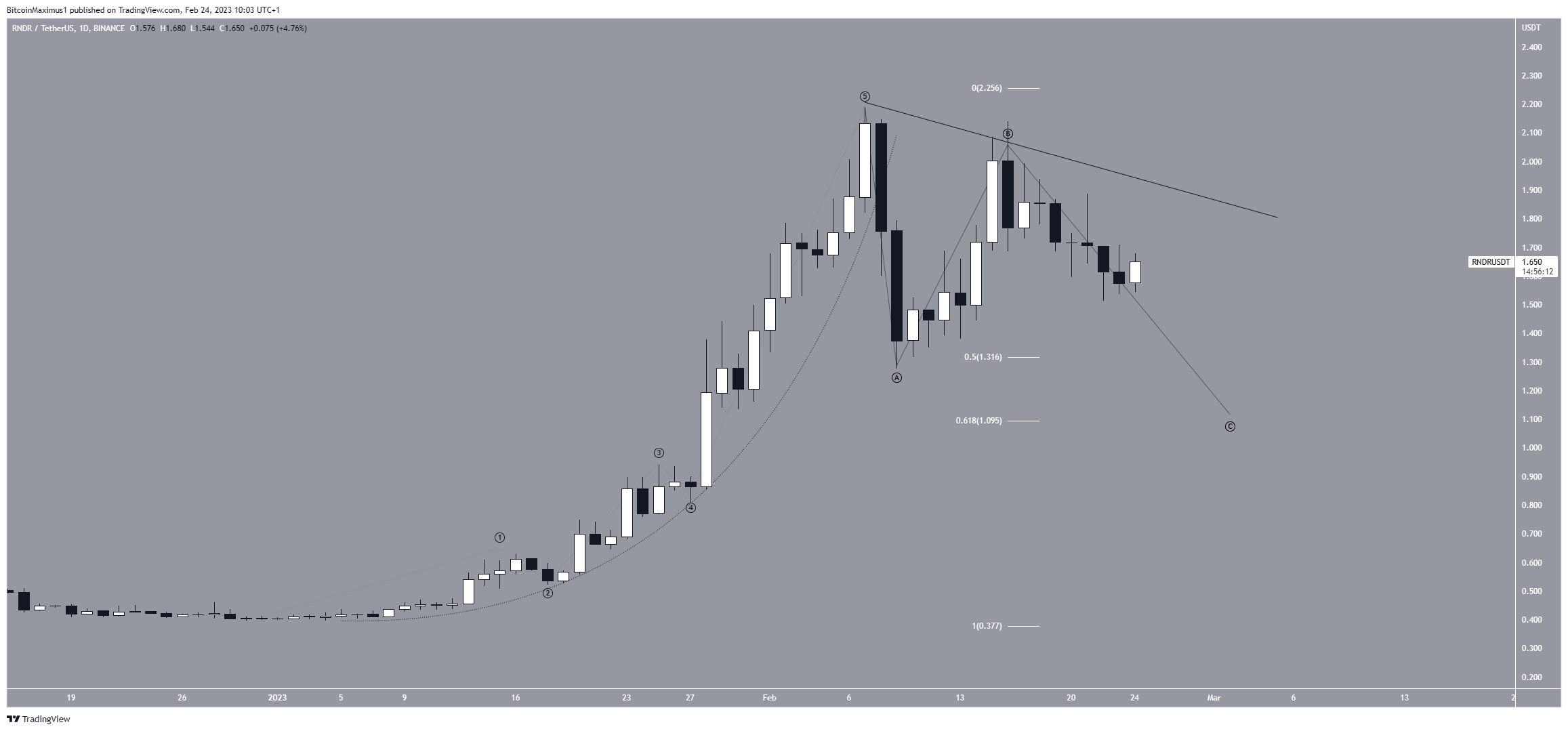

Render Token (RNDR) Breaks Down From Parabola

The RNDR price had increased alongside a parabolic ascending support line since the beginning of the year. The increase led to a high of $2.19 on Feb. 7.

However, the price broke down from the parabola the next day. It is now likely in the C wave of an A-B-C corrective structure. The most likely level for the correction to end would be at the 0.618 Fib retracement support level at $1.09.

However, if the RNDR price breaks out from the current short-term descending resistance line, it could increase to $2.20.

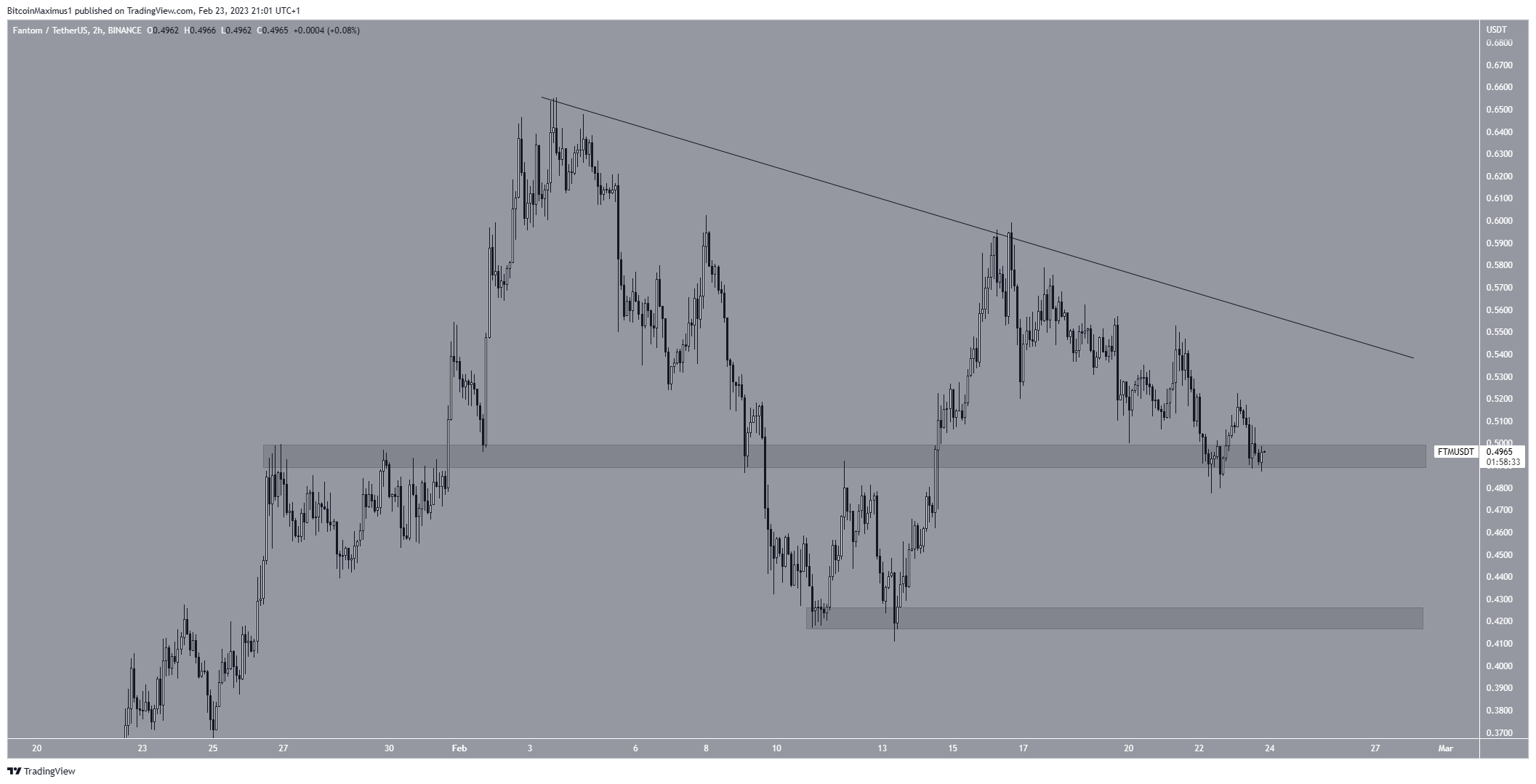

Fantom (FTM) Trades Inside Support

Similar to $APT, the FTM price has fallen under a descending resistance line since Feb. 3. More recently, the line caused a rejection on Feb. 16.

The FTM price is currently trading inside the $0.495 support area. Whether it bounces or breaks down could determine the future trend’s direction. A bounce could lead to a retest of the resistance line, while a breakdown could lead to a fall toward $0.420.

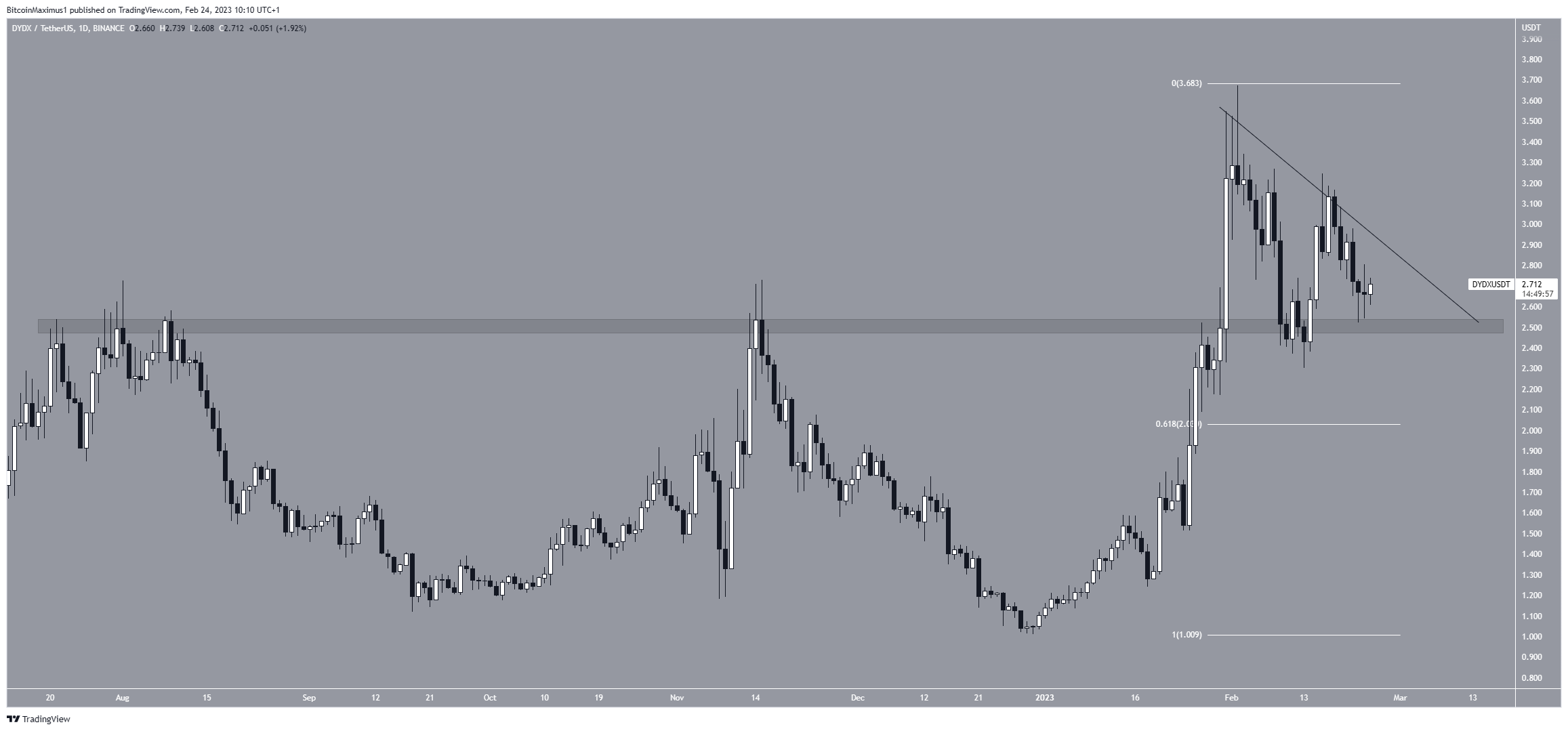

dYdX ($DYDX) Bounces at Support

The $DYDX price has fallen below a descending resistance line since Jan. 30. The line caused a rejection on Feb. 16.

Currently, the price is trading between the $2.50 horizontal support area and the descending resistance line. If it breaks out from the line, it could increase to $3.50.

However, if it breaks down below $2.50, the price could fall to $2.00.

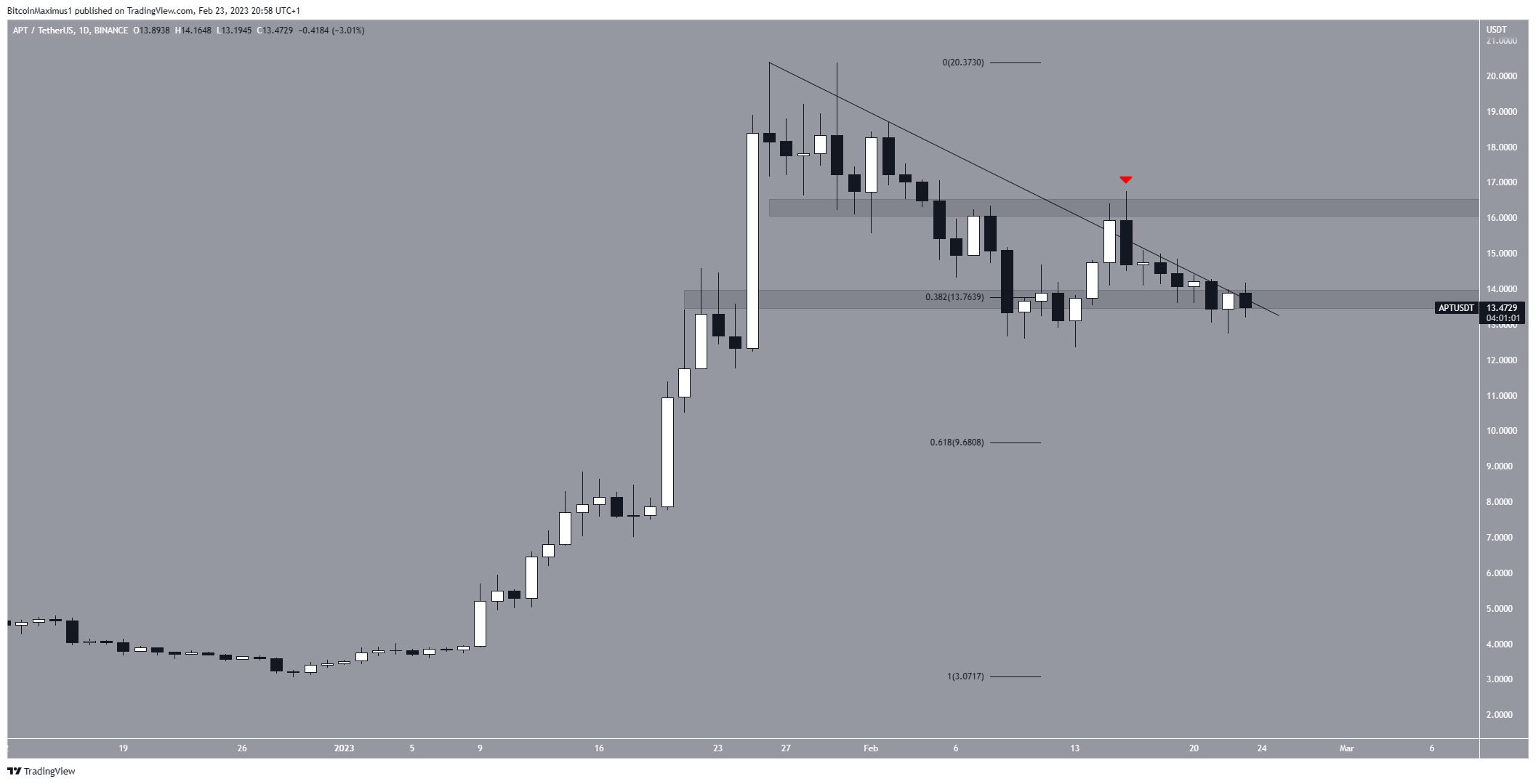

Aptos ($APT) Price Follows Resistance Line

The $APT price has fallen below a descending resistance line since Jan. 26. The line has caused numerous rejections, most recently on Feb. 16 (red icon).

When combined with the $13.76 support area, the price action creates a descending triangle, which is considered a bearish pattern. As a result, a breakdown from it would be the most likely future price forecast. In that case, the $APT price could fall to $9.68.

However, if the price breaks out from the triangle instead, an increase toward $16.50 could follow.

beincrypto.com

beincrypto.com