The OKB price reached a new all-time high on Feb. 5. It has not shown any signs of weakness, suggesting that the upward movement could continue.

OKB is a cryptocurrency created by the OK Blockchain Foundation and OKEx, a Maltese cryptocurrency exchange. It is the native token of the OKEx exchange. OKB is a utility token allowing users to access the cryptocurrency exchange’s unique features.

The coin is used to calculate and pay trading fees, to grant users voting and governance access on the platform, and to reward users for holding OKB. It is worth mentioning that the OKEx exchange currently has $7.97 billion in assets and $4.01 billion in open interest. The ratio of less than two to one is in stark contrast to Binance, which has a ratio of more than six to one.

OKB Price Reaches New All-Time High

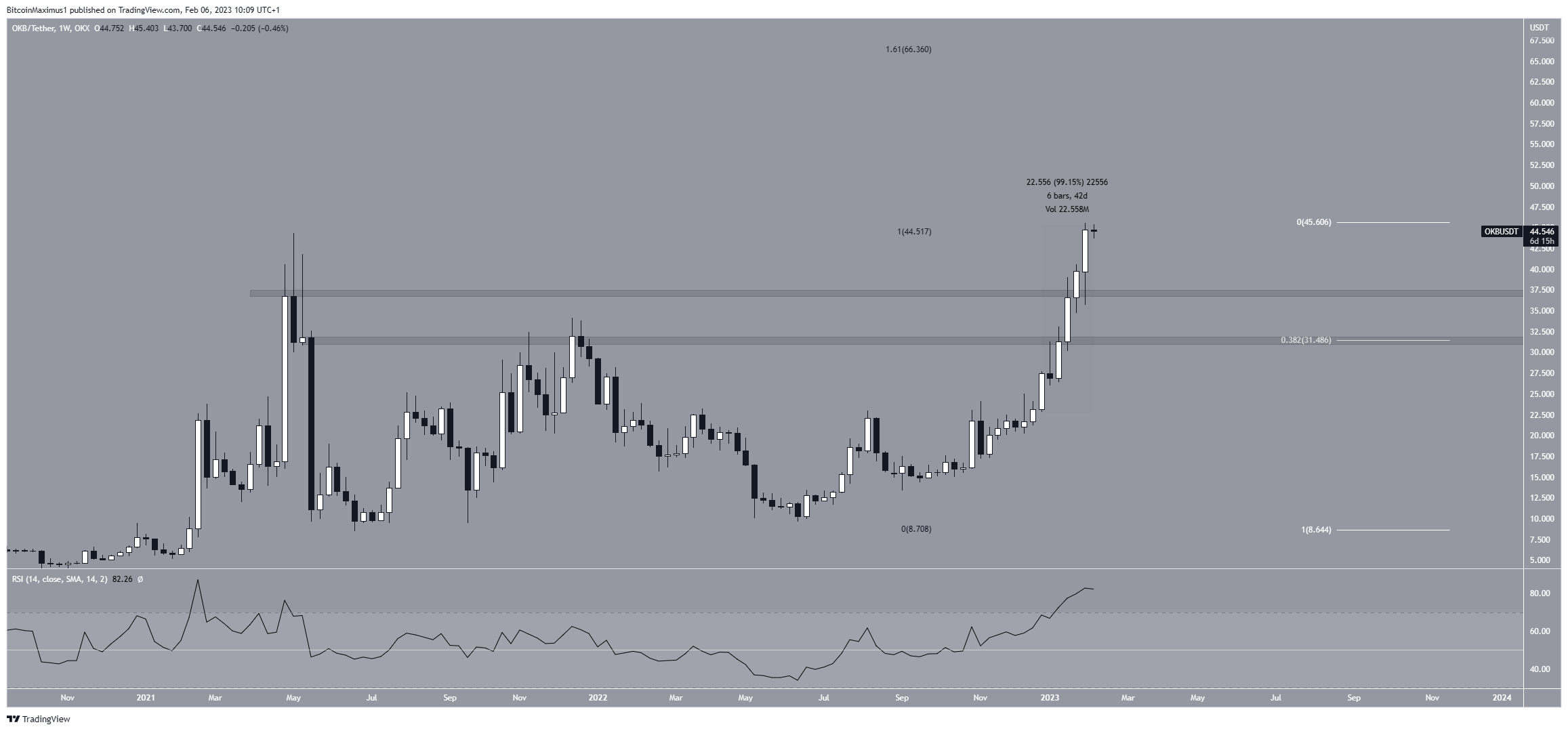

The OKB price has increased since June 2022. The rate of increase accelerated in December of the same year, and the price has posted gains of 99% since then. On Feb. 5, the OKB price reached a new all-time high of $45.54.

Despite the massive increase, there are no signs of weakness yet. The weekly RSI is oversold but has not generated any bearish divergence yet.

The closest support areas are found at $37 and $31.50. On the other hand, the next resistance is estimated to be at $66.36, created by the 1.61 external Fib retracement of the most recent drop.

OKB Price Prediction for February: No Signs of Weakness Yet

The daily chart shows that the move accelerated after the OKB price broke out from a descending resistance line. Since then, it has increased in a parabola (dotted).

The price is at the 2.61 extension of wave one, so it could get rejected. If not, the upward movement could continue to the next resistance at $58.10.

Currently, it seems that the OKB price is in wave three of a five-wave upward movement.

In any case, a breakdown from the parabola would likely mean that the price is in a corrective phase in wave four.

To conclude, the OKB price outlook is still bullish, and an increase toward $58-$66 is likely. However, a breakdown from the parabola would mean that the upward move is finished and the price could correct back to the $31-$37 range.

beincrypto.com

beincrypto.com