Avalanche (AVAX) has garnered attention in recent weeks for displaying strong alpha price performance as it outperformed the rest of the digital asset market. Avalanche is a smart contract platform and AVAX is the native token that powers transactions on the network.

In the last 30 days, AVAX is up by ~39%. Over the same period, the prices of Bitcoin (BTC), Ethereum (ETH), and Cardano (ADA) were down ~10%, ~3%, and ~23%, respectively.

AVAX’s rise up the cryptocurrency market cap chart has been nothing short of meteoric. On January 1st, Avalanche’s native token AVAX was the 70th largest asset in crypto. It had a market cap of US$267.2 million and each token was priced at US$3.47. Approximately 10 months later, AVAX is the 12th largest asset in crypto with a market cap of ~US$15.1 billion and each token is priced at US$69.35. The market cap of AVAX has risen by ~5,555% since the start of the year and the price of the token is up ~1,899%.

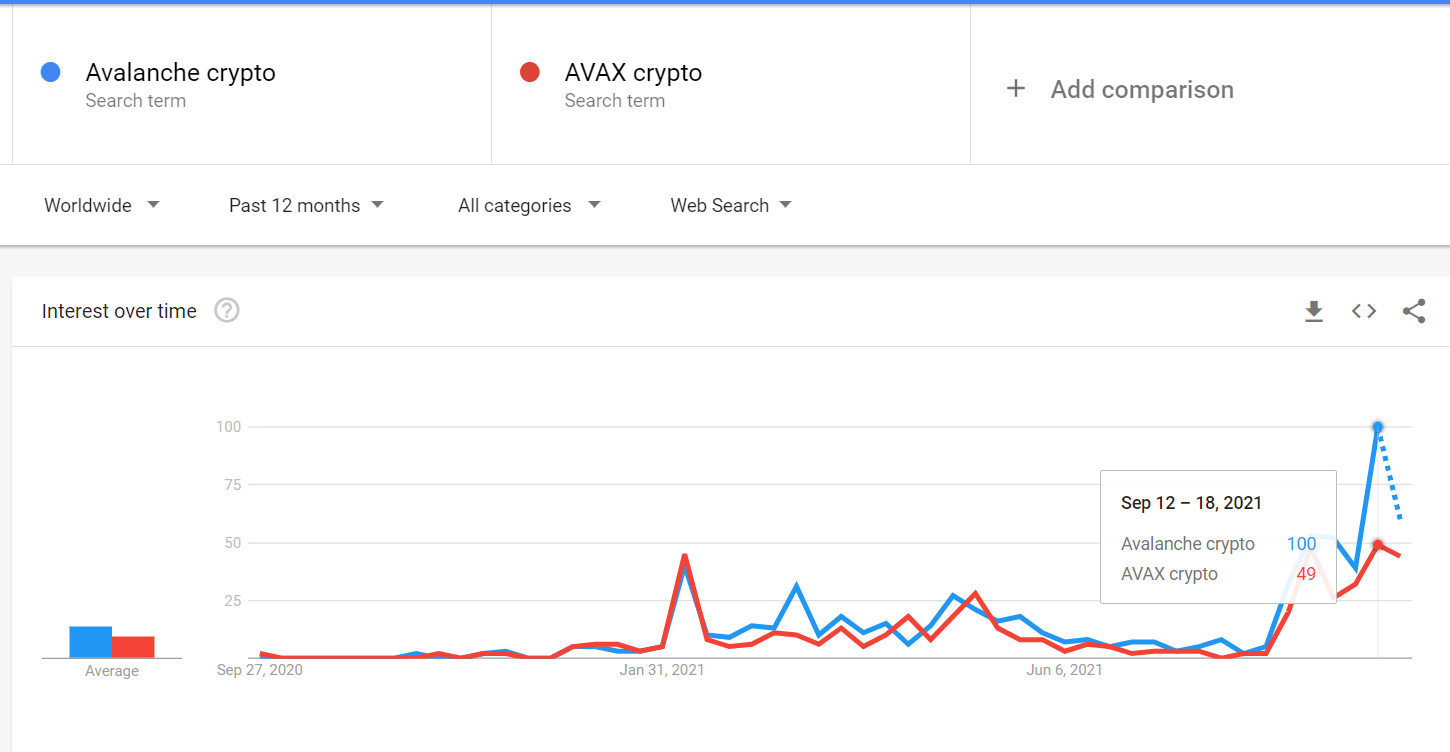

Source: Google Trends

Google search interest for ‘Avalanche Crypto’ and ‘AVAX Crypto’ has also soared. Search interest for both terms hit new all-time-highs in the week between September 12th-18th. The price gains have been matched with new interest and discovery for the asset and the blockchain. Search interest for both terms is particularly high in the European region with the terms particularly popular in Greece, Ireland, France, and Finland.

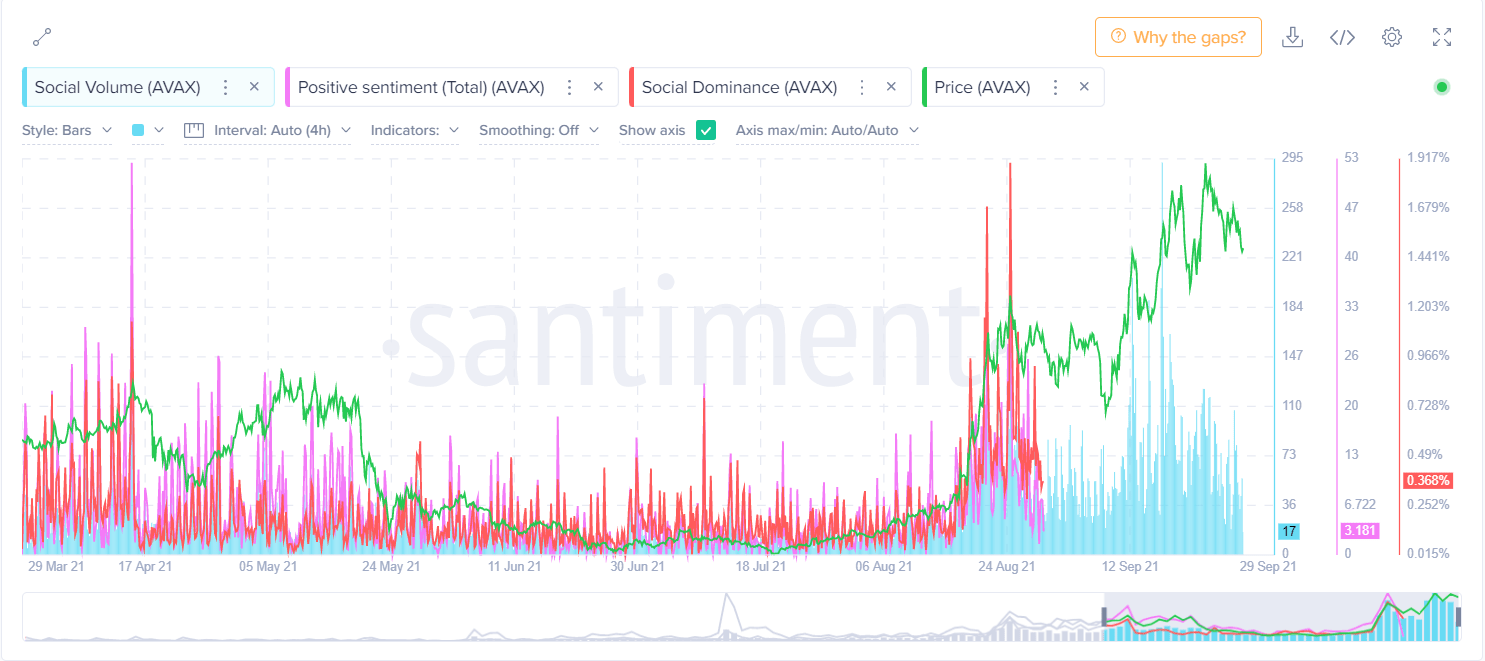

Source: Santiment

Social sentiment data from crypto data providers suggests that Avalanche and AVAX have experienced positive spikes in social sentiment since the start of the year, notably in mid-April, late August, and mid-August. The spikes in social sentiment correlate with rises in the price of the AVAX token.

At one point in mid-August the Social Dominance of AVAX, in the context of crypto, was ~1.92%. The market cap dominance of AVAX in the context of crypto is ~0.95%. This suggests that at one point AVAX was perhaps overvalued and overhyped by social media users. The social dominance of AVAX dropped down to 0.362% by early September.

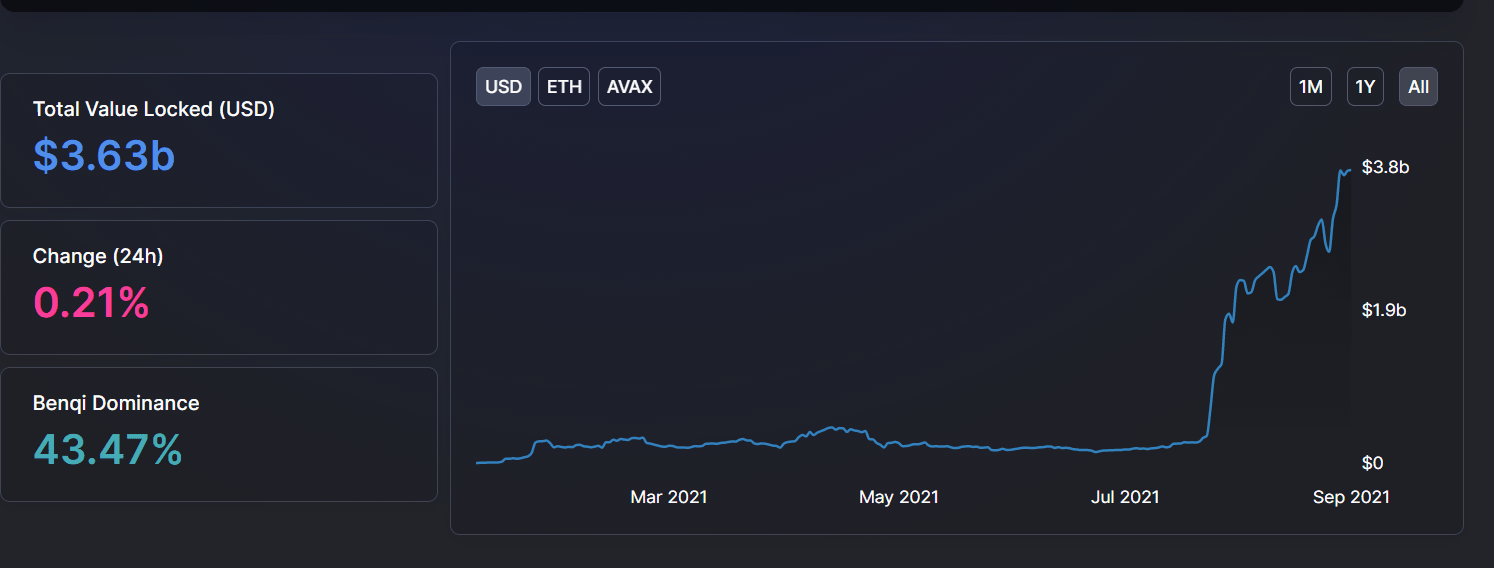

Source: Defi Llama

The total value locked (TVL) into the Avalanche blockchain’s DeFi ecosystem is US3.63 billion. Fundamentals appear to back up the strong price performance of Avalanche. The total value of assets in the network's decentralized ecosystem currently sits at ~US$3.6 billion. This number is up a staggering 977% since August 19th, when TVL on the network began to skyrocket.

The most popular decentralized application (Dapp) on Avalanche is Benqi, dominating the ecosystem with 43.4% of the value locked. Benqi is a non-custodial borrowing and lending protocol that is described as similar to Compound but with collateral sourced from lending markets. I.e. if a user has lent AVAX, they can use this as collateral to borrow USDT.

Avalanche offers builders the exact same functionality as Ethereum because it supports the Solidity programming language and is integrated with the Ethereum Virtual Machine. Applications can be built to be completely interoperable with EVM chains, while still maintaining the transaction model of Avalanche.

On September 17th the project announced that it had raised US$230 million in a private sale of AVAX tokens. Well-known crypto funds Three Arrows Capital and Polychain led the raise. Big-name VCs willing to spend on a project is a sign to markets that it may have the legs to sustain bullish momentum through multiple market cycles.

A major factor in AVAX’s rise in the last 6 weeks has been the US$180 million Avalanche Rush liquidity mining incentive program announced on August 19th. Phase 1 of the program is ongoing and set to last for 3 months. It involves offering AVAX incentives to liquidity providers on Aave and Curve. US$20 million in AVAX will be allocated to Aave users and US$7 million to Curve users. The program will support the launch of Avalanche deployments of Curve and Aave. Just before Avalanche Rush, Avalanche Bridge was launched to allow assets to be moved easily between blockchains including Avalanche.

The Avalanche Bridge has already proven popular with US$2.39 billion worth of assets being ported over from the Ethereum network to Avalanche. Most of these assets are sent straight to Ethereum-like solutions (Benqi-Compound, Pangolin-Uniswap). The Avalanche DeFi Dapps offer frictionless user experiences in comparison to Ethereum ones. Operations like trading, compounding yields, and removing assets from vaults, which incur heavy gas costs on Ethereum, are cheap and fast on Avalanche. The bridge simplifies the first step of moving the assets from Ethereum to Avalanche.

Avalanche pitches itself as an Ethereum alternative blockchain network with sub-second transaction times and low fees. Avalanche joins a group of cheaper, faster direct Ethereum alternatives that include the Binance Smart Chain and Fantom.

Source: Twitter user @Rareliquid

# The Avalanche model

The Avalanche blockchain was created by Ava Labs and launched its mainnet in September 2020. The wider Avalanche mainnet is made up of multiple smaller subnets which contain multiple blockchains within them. They are connected by a novel proof-of-stake consensus model that is purported to support transaction speeds of up to 6500 transactions per second.

Chains on Avalanche are designed to support a variety of virtual machines (like computer systems) and allow chains within Avalanche to have specific functionality. For example, the current most active Avalanche chain is the C-chain which uses the popular Ethereum Virtual Machine (EVM). Other virtual machines, like the WASM, could conceivably be included. These chains exist within subnets of Avalanche which have their own set of validators and incentive mechanisms. This model resembles architecture used by networks like Polkadot and Ethereum 2.0.

Three blockchains currently absorb most of the activity on the Avalanche mainnet. The X-chain is for exchanging and managing assets like AVAX, the C-chain is where smart contracts and Dapps live, and the P-chain is for co-ordinating validators. The X-chain uses the Avalanche consensus protocol and the other two use the Snowman consensus model.

The Avalanche protocol has all nodes working in parallel to check other validators’ transaction confirmations randomly. After enough random sub-sampling, a transaction is determined to be probabilistically true. Snowman is similar but uses a more linear process with blocks.

This style of consensus uses Directed Acyclic Graphs or DAGs, a method for distributed network consensus first popularized by the IOTA network. It has historically not always worked smoothly.

Nodes on the Avalanche network only communicate with each other directly occasionally. There is no network-wide consensus that needs to be achieved on every finalized block or to confirm the state of the network. This is very different from operations on proof-of-work networks and is the reason Avalanche is able to process transactions so quickly and cheaply.

The three-chain system is designed to split up the work of the blockchain, to prevent it all converging and congesting to one chain, further boosting potential throughput. The AVAX token is used across all three chains, the asset is common, usable across all three chains, and is needed for staking and paying network fees.

# Staking rewards

As mentioned, Avalanche is a proof-of-stake blockchain where users can either run their own validator nodes or assign their stake to a validator which will earn rewards on their behalf. This means that anyone who holds AVAX can choose to delegate some of their tokens to one or more validators, who process transactions and run the network.

StakingRewards.com lists Avalanche as the 5th-largest blockchain by value of assets staked - with US$$17,072,250,012 staked. There are just ~63.6% of token holders participating in Fantom, which implies 36.% of token holders are passively holding their AVAX and are likely just speculators.

Avalanche is an emerging proof-of-stake still in its early adoption phase. This means rewards for stakers are still relatively high.

The current estimated interest rate for FTM holders who delegate their tokens to a validator is 9.5%. Adjusted for the inflation rate of network supply, however, this interest rate drops to 2.9%. According to Staking Rewards, validators running a Fantom Node will earn an interest rate of 10.1% but once adjusted for network supply inflation this drops to 3.5%.

Users can delegate their tokens to a staking pool that will, for a fee, participate in the network’s proof-of-stake consensus on behalf of the delegator. Or they can run a node themselves and directly participate in consensus. Staking rewards.com describes the complexity of delegating AVAX to a staking pool as ‘easy’. A minimum required amount for staking is 25 AVAX (~US$1604). This is a relatively high minimum amount required and may explain the low participation rates.

According to the documentation on the official Avalanche channel, users can run nodes with commodity or off-the-shelf hardware because the network is lightweight at this stage. It does state, however, that as the network grows more complex, hardware will be needed to maintain a node. The minimum percentage of the time a validator must be correct and online in order to receive a reward is 80%.

Stakingrewards.com does not list how complex it is to run Validator. The minimum required amount for staking is 2000 AVAX (~US$126,280). The minimum amount of time one can stake funds for validation and delegation is two weeks.

Avalanche price technical analysis

Brave New Coin lead analyst Josh Olszewicz analyzed the Avalanche network and the price of the AVAX token on September 29th. Josh backs the token’s liquidity incentives as a value driver but is somewhat skeptical of its DAG-based consensus model. On the technical side, Josh says with the price of the token soaring, value has risen to a point where RSI is tightening and a wedge pattern is forming. This implies a reversal in the bullish trend is incoming. Josh says Avalanche needs more new users and renewed external demand to continue using AVAX if the bullish momentum is to be maintained.

# Conclusion

Avalanche is pitched as a cheaper, faster version of Ethereum. At this stage, it can be viewed as a direct substitute for Ethereum using the same wallets, virtual machines, and developer tools. In the future, however, its multi-chain, multi-virtual machine model may mean it can evolve from being seen as an Ethereum clone.

Driving activity value into the chain in recent months are the profitable early adopter yield programs and an efficient bridging tool that makes the transition to the new chain for early users very straightforward.

The network has big-name VC backers and is attracting developers to build on it. It has a relatively large quorum of validators but appears to run on a consensus model that isn’t entirely bulletproof. The key to its future success will be to find a way to continue getting users and liquidity providers to continue participating in the network after initial reward programs dry up.

bravenewcoin.com

bravenewcoin.com