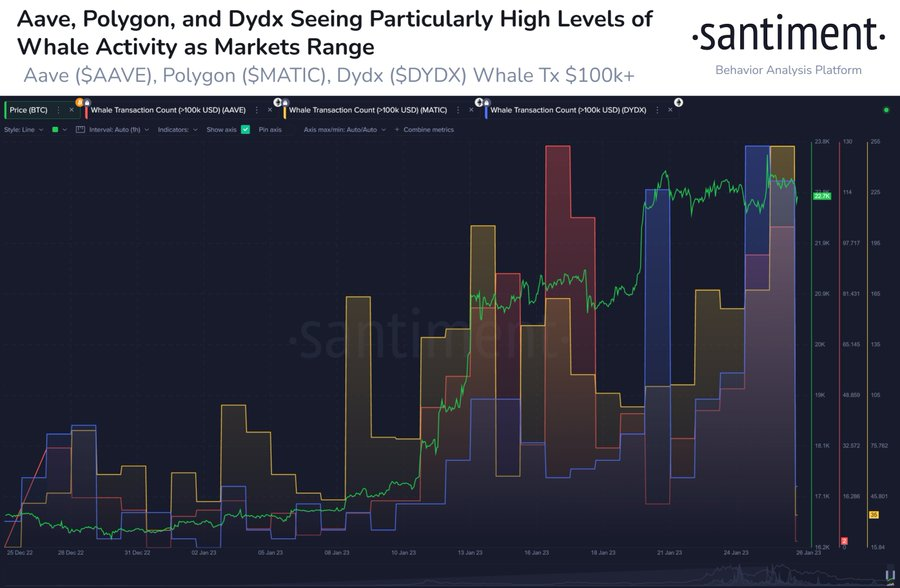

The market intelligence platform known as Santiment took to Twitter earlier today to share some interesting statistics on recent whale activity. According to the post, Aave (AAVE), Polygon (MATIC), and dydx (DYDX) have seen massive rises in the number of whale transactions on their respective networks over the last month.

AAVE saw an increase of more than 50% over the last thirty days, while MATIC and DYDX saw respective increases of +15% and +94% each. Santiment concluded its post by stating that traders would be smart to keep an eye on these numbers when making decisions about where to put their money.

CoinMarketCap indicates that AAVE is currently trading hands at $87.27 after a 2.01% increase in price over the last 24 hours. The crypto is also still in the green by more than 8% over the last week.

Also in the green zone is AAVE’s 24-hour trading volume which currently stands at $133,820,199 after a more than 18% increase since yesterday.

MATIC is another crypto in the green for today, and is currently worth $1.09 after a more than 8% increase in price over the last 24 hours. The altcoin was also able to strengthen against Bitcoin (BTC) and Ethereum (ETH) by about 9.13% and 10.74% respectively.

Also in the green for today is DYDX. The crypto is trading hands at $2.24 after a 7.22% price increase since yesterday. DYDX is also still up by more than 68% over the last seven days. The altcoin’s 24-hour trading volume, however, is currently down by more than 31% and stands at $243,230,821.

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

coinedition.com

coinedition.com