Crypto analytics firm Santiment warns that the native token of the Bored Ape Yacht Club non-fungible token (NFT) ecosystem, ApeCoin (APE), stands a high chance of retracing after a modest rally.

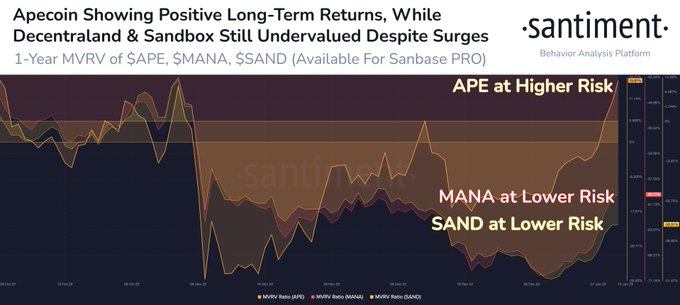

Santiment says that ApeCoin’s market-value-to-realized-value (MVRV) ratio sits at 15.981%, suggesting that it is relatively overvalued.

According to the crypto analytics platform, the MVRV ratio of decentralized virtual worlds Decentraland (MANA) and The Sandbox (SAND) is -59.77% and -33.31%, respectively, suggesting that they are “still undervalued.”

“While altcoins are resetting a bit after the hot start in 2023, you can reallocate your portfolio based on which assets still show traders are under water. While APE’s 1-year MVRV is at +16%, MANA (-60%) and SAND (-33%) may be more appealing for now.”

MVRV, which is the ratio of a crypto asset’s total market cap relative to its realized capitalization, is used to determine whether that asset’s price is below or above the fair value.

The higher the ratio, the more likely a crypto asset will come under selling pressure as holders take profits. An MVRV ratio in the negative territory indicates a lower risk of the crypto asset coming under selling pressure.

Since the start of the year, ApeCoin went up by about 52% from a low of $3.62 to a 2023 high of $5.49. Apecoin is trading at $4.54 at time of writing.

Decentraland and The Sandbox have gone up by 151% and 96% from their 2023 lows to 2023 highs, respectively. Decentraland is trading at $0.639 at time of writing while The Sandbox is changing hands at $0.696.

Generated Image: Midjourney

dailyhodl.com

dailyhodl.com