Lookonchain tweeted that the price of Rocket Pool (RPL) increased by 31% after it was listed on Binance exchange. Moreover, the tweet reads that there were three wallet addresses that bought RPL before it was listed on Binance and sold it upon listing, and made profits.

1/ After the listing of $RPL on Binance, the price of $RPL increased by 31%.

We found 3 addresses that bought $RPL before the listing, then sold immediately after the rose and made a profit.👇 pic.twitter.com/PE3JWwyg12

— Lookonchain (@lookonchain) January 18, 2023

In the thread which consists of four tweets, Lookonchain clearly stated the address, how much RPL was bought at what price, the time frame and how much it was sold for. One of the posts read:

Address “0x5f2c” received 200,000 $USDT from #OKX yesterday and bought 6,193 $RPL at $32.29 10 minutes before the $RPL listing announcement.

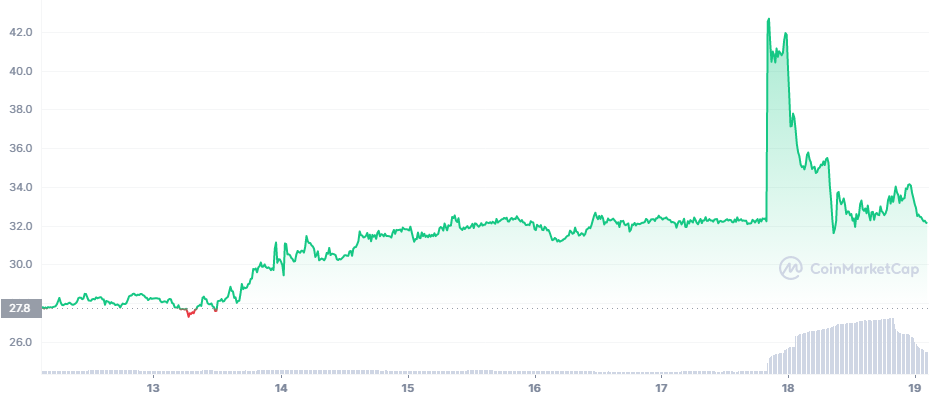

RPL kicked off the week trading at $27.8. Just a few hours into the first day of the week, RPL delved into the red zone and reached its lowest price of $27.29. After its quick dive into the red zone, the token found some momentum and started making higher-lows. However, RPL could not reach higher-highs as its range of motion was restricted between the $30-$32 range.

Although at times it was able to fluctuate slightly above its upper limit of $32, RPL really struggled to climb. Nonetheless, on the sixth day of the week, when RPL was listed on Binance, the token surged from $32.22 to $42.62, registering a 31% increase, as mentioned by Lookonchain.

Since RPL broke out of the 200-day MA, the bulls have kept RPL above the 200-day MA as shown below. Although the bears tried to pull RPL down, the 200-day MA provided its support and therefore RPL ricocheted off of it.

Currently, RPL is above the 200-day MA and is increasing the gap. However, after the spike that came as a result of listing on Binance, the token has lost its momentum and the bulls seem to be pulling RPL down. If the bulls pull the token, it will be looking at landing on support 1. But the question lies whether the 200-day MA will be able to resist the pressure that the bears build up.

As the RSI is at 47.12, the trend seems to be well set. But, the RSI is tilting down, hence it could tank into the oversold region. But, if the bulls can contend with the bears, RPL could move sideways.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk, Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

coinedition.com

coinedition.com