Good morning. Here’s what’s happening:

Prices: Bitcoin and ether spend their Wednesday in the red.

Insights: Embattledcrypto exchange FTX and several venture capital firms hold a ton of illiquid tokens such as Serum (SRM).

Prices

The Market Goes to the Doges

By Sam Reynolds

Bitcoin and ether are beginning the business day in Asia well into the red.

The world’s largest digital asset is down 2% on-day, while ether is down 3.2%.

Layer-1 Solana, which began the year with a sharp rally thanks to the success of Shiba Inu-themed Bonk, is down nearly 8.5% on-day.

There’s been some debate as to the driver of the rally. While the market is in a meme coin mood, there is a deeper debate about the brewing storm in Washington and what it means for risk assets like crypto.

"In our view, crypto (and bitcoin in particular) has been somewhat misunderstood. It is not an inflation hedge, but more of a debasement hedge that protects holders from fiscal/monetary profligacy and policy error,” Jonah Van Bourg, Global Head of Trading at Cumberland, told CoinDesk in a note. “Any risk of US debt default is indeed a form of US Dollar debasement and/or policy error, and the increased demand we're seeing (expressed in higher crypto prices) is this use case bearing itself out.”

Giles Coghlan, Chief Market Analyst at HYCM, told CoinDesk that the correlation between crypto and tech stocks continues, and that’s the factor to watch going forward.

“Tech stocks have rallied on the assumption that U.S. inflation is retreating and that short-term interest rate market predictions of two Federal Reserve rate cuts this year are correct. We can see a similar recovery in the crypto markets,” he told CoinDesk, dismissing any connection between the debt ceiling debate and the crypto rally. “Ultimately, the crypto rally should continue as long as tech stocks stage their recovery. However, as all eyes turn to earnings season, things could change quickly.”

Still, blockchain analytics firm Santiment wrote in a note that rallies of DOGE and other dog-themed meme coins are a contrarian indicator of the market’s health. When these prices skyrocket it means the market has gotten too hot and hedonistic.

"Every time that [the] price of DOGE starts rising rapidly, there's a market-wide crash following just moments later," the firm wrote.

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Shiba Inu | SHIB | +2.6% | Currency |

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Gala | GALA | −11.0% | Entertainment |

| Loopring | LRC | −9.7% | Smart Contract Platform |

| Terra | LUNA | −9.5% | Smart Contract Platform |

Insights

Where Are FTX's Illiquid Holdings?

By Sam Reynolds

A court filing has revealed some of FTX’s largest liquid holdings, which are largely to be expected: solana, bitcoin, ether, aptos and dogecoin. These are widely held tokens that, for the most part, would be found on the balance sheet of any major exchange.

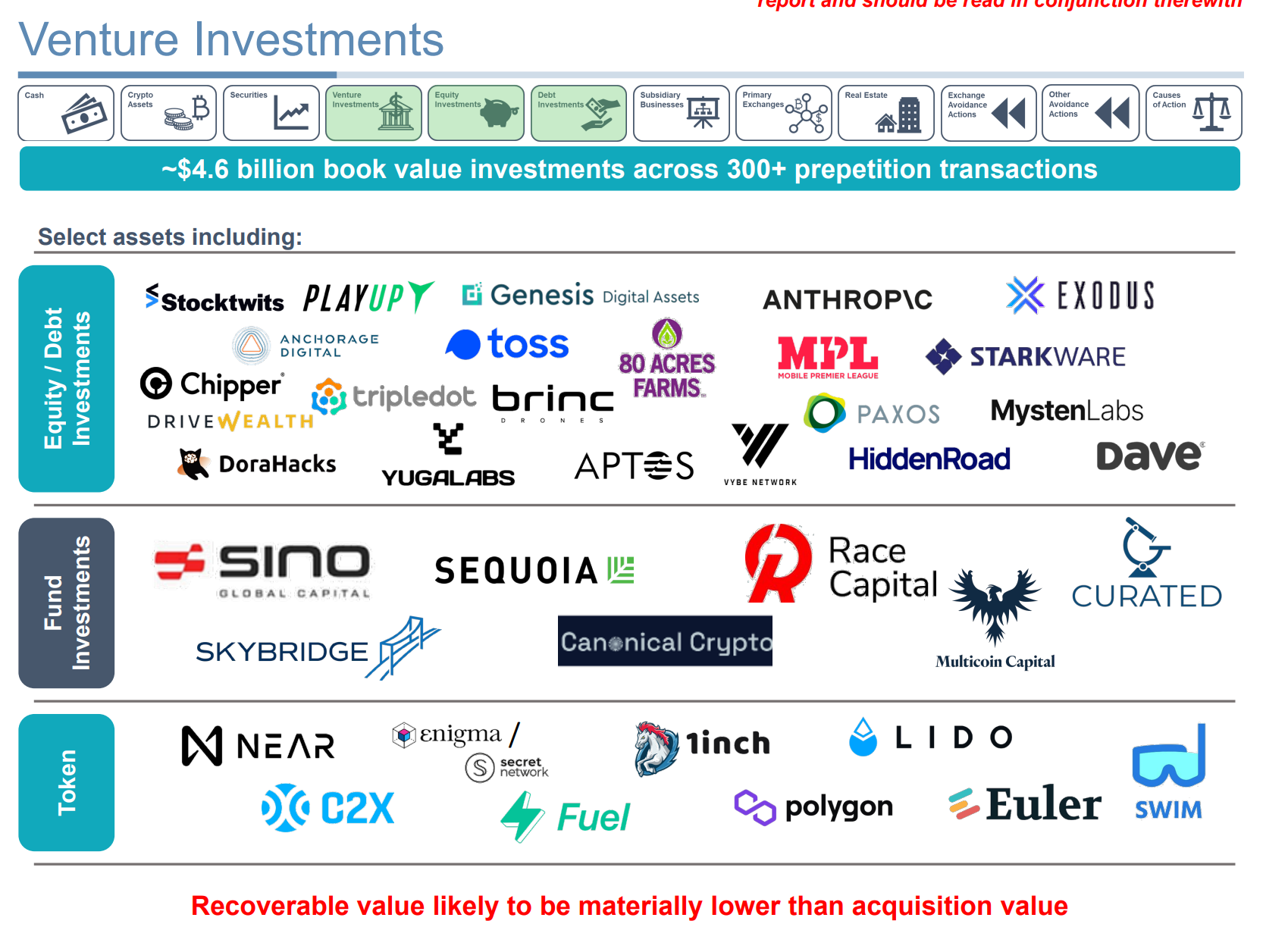

But what about the illiquid holdings? These aren’t exactly household names, but were tokens in the Sam Bankman-Fried-Alameda universe that failed to launch. A good portion of them can be found on the balance sheet of funds including Sino Global and Multicoin Capital. FTX invested in these funds, and their names often appear alongside FTX as co-investors.

FTX has close ties with Sino Global Capital, which is noted on the venture investments slide of the filing. On Sino’s balance are many of these same tokens.

FTX-invested Multicoin capital also counts SRM and OXY on its balance sheet.

(Multicoin Capital)

The only good news is that their exposure is probably small. FTX, by some calculations, owns nearly 99% of OXY and SRM.

(So much for decentralization.)

Multicoin, as CoinDesk had previously reported, is stuck with the double whammy of not just having illiquid Sam coins like OXY and SRM on its balance sheet but also having 10% of its assets stuck on FTX.

The U.S. Securities and Exchange Commission is already looking into the due diligence process – or lack thereof – FTX investors engaged in.

No doubt some of these tokens will also come up in the investigation, and later we’ll learn more about why otherwise shrewd VC firms aped into tokens whose selling point was largely Sam Bankman-Fried.

Let’s hope that these VCs take this as a lesson, so they don’t get stuck with another illiquid bag of tokens when the next bull market cycle cracks.

coindesk.com

coindesk.com