Good morning. Here’s what’s happening:

Prices: Bitcoin traded above $21,000 for a fourth consecutive day.

Insights: Why are tokens for metaverse majors rallying when the platforms are struggling to keep users engaged?

Prices

Bitcoin, Other Cryptos Trade Sideways

By James Rubin

For a fourth consecutive day, bitcoin liked the air above $21,000.

The largest cryptocurrency by market capitalization was recently trading at $21,215, up 1.2% over the past 24 hours but a marked improvement from its levels little more than a week ago. $BTC's roughly 25% surge over the past seven days has come amid rising investor confidence that inflation is waning and the economy will land softly.

Ether was recently changing hands at 1,573, a 1.5% gain from Monday, the same time. $ETH is up 20% during the past seven days. Other major cryptos were largely in the green with popular meme coin Shiba Inu recently jumping more than 12% and $DOT, the token of the smart contract platform Polkadot rising more than 4%. The CoinDesk Market Index (CDI), an index measuring cryptos' performance, recently increased 0.97%.

"The fact that we are now flirting with $21,500 is amazing," JJ Kinahan, CEO of trading provider IG North America, told CoinDesk TV's "First Mover" program. "It correlates a little bit to the equity markets now, in that we're starting to see people put out a little more risk. Volatility has come off there."

Kinahan added: "We're going to get up to about the $22,500 level, before you really start to see resistance."

A day after the long, U.S. holiday weekend, equity markets were mixed with the tech heavy Nasdaq up ever so slightly, but the Dow Jones Industrial Average and S&P 500 sinking, as investors weighed fourth-quarter declines in profits at financial service giants Goldman Sachs and Morgan Stanley, which are among the first companies to report earnings.

And Silvergate Capital (SI) offered a harsh reminder that digital asset markets remain buried in a severe bear market, as the crypto bank reported a net loss of $1 billion for the fourth quarter on Tuesday, compared with a net income of $40.6 million for the third quarter and net income of $18 million for the same period a year earlier.

In a note, Arcane Research, which provides crypto research and analysis, called cryptos' last week "remarkably strong and lively," but added warily that "short-term, the momentum seems overextended."

Arcane noted: "Last week saw seven consistent days of green returns for the first time since March 2022, and the RSI momentum indicator has pushed toward extreme highs. The recent surge has predominantly been fueled by a short squeeze led by consistent aggressive shorting. $BTC’s push above $20,000 has been followed by a stabilizing open interest, suggesting that short traders have grown cautious, which may lead prices to stabilize in the short term."

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Shiba Inu | SHIB | +12.5% | Currency |

| Gala | GALA | +10.8% | Entertainment |

| Polkadot | $DOT | +4.3% | Smart Contract Platform |

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Loopring | LRC | −0.8% | Smart Contract Platform |

| Solana | SOL | −0.5% | Smart Contract Platform |

Insights

The Unlikely Rally of Metaverse Majors

By Sam Reynolds

Among the highlights of the latest crypto rally, in which bitcoin has topped $21,000, has been the performance of the metaverse majors: Decentraland’s $MANA, Sandbox’s $SAND and Axie Infinity’s $AXS.

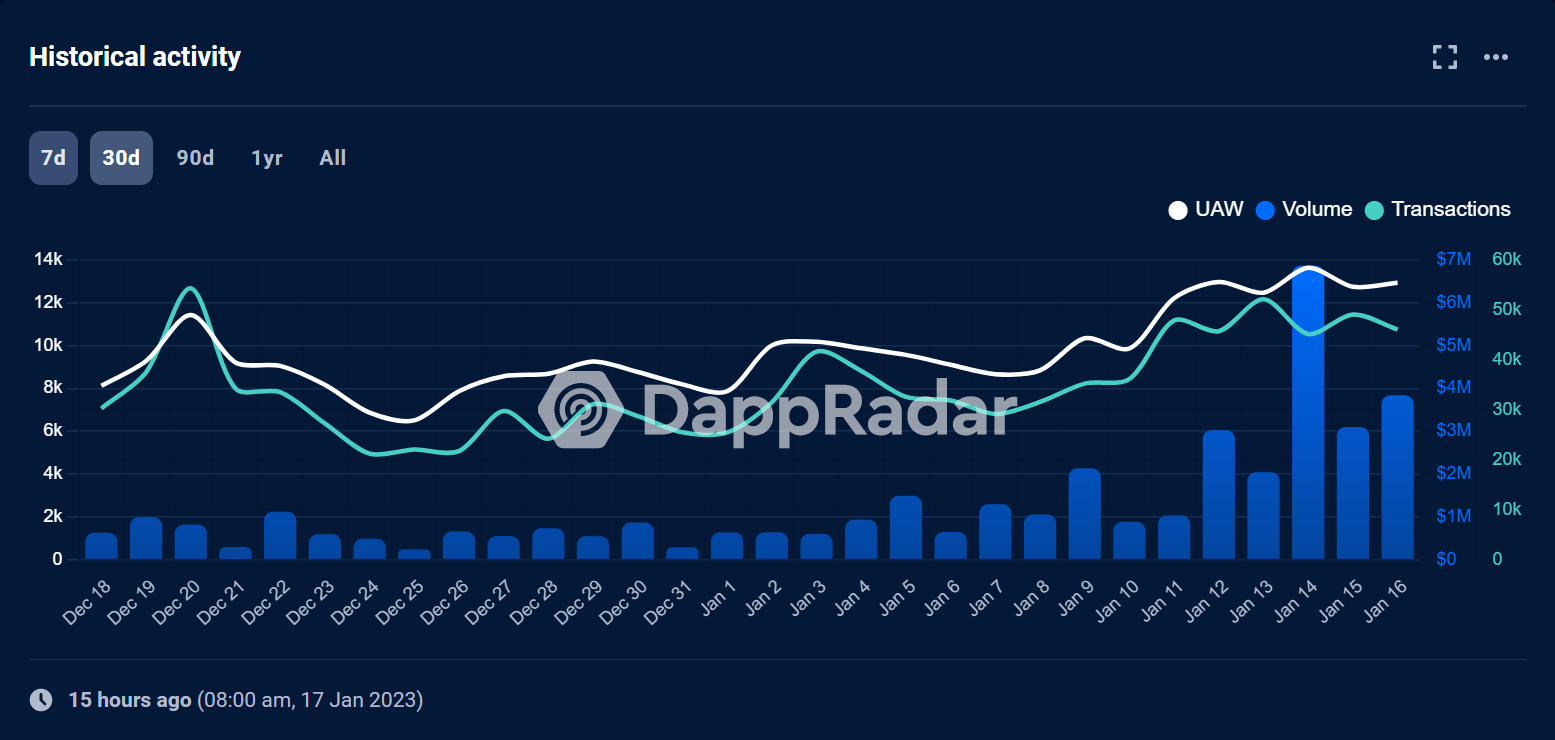

DappRadar’s figures show that the number of unique active wallets has fallen 3% during the last 30 days. The number of transactions has risen, however, 6%.

To be sure, DappRadar’s Decentraland numbers are controversial. While it's debatable whether DappRadar’s measurement of unique active wallets (UAW) can accurately capture the number of users within Decentraland, it does, by virtue of tracking wallets, capture those that are transacting. These transacting users would be the ones generating value and having a material impact on the token price.

The overall number of Decentraland users would be larger, as CoinDesk recently documented, but this includes those that don’t transact and interact with the blockchain, like someone that passively watched a concert on Decentraland.

What’s causing the Sandbox ($SAND) rally?

Just like the other platforms, Axie Infinity’s user count doesn’t reflect the rocketship-like value in its token price.

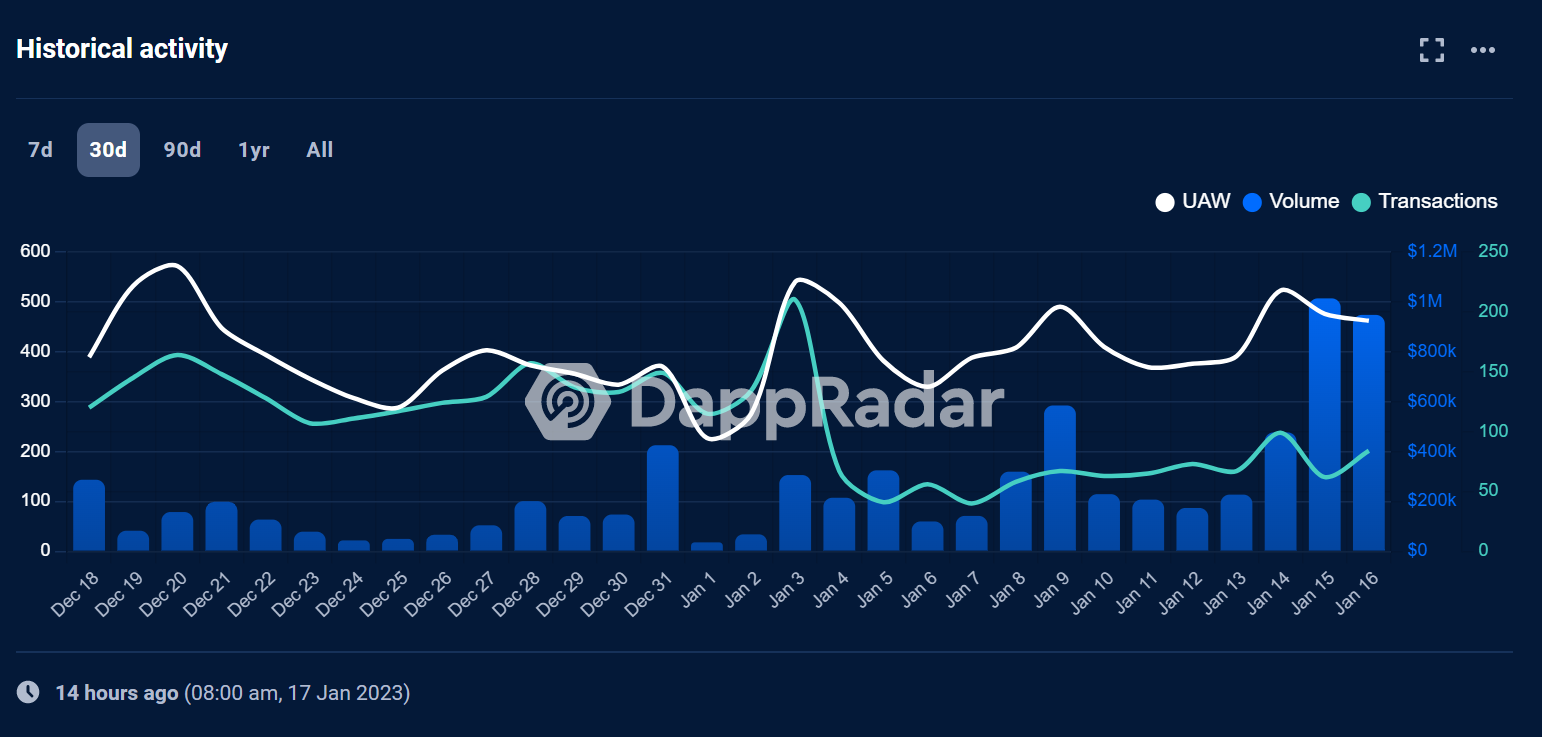

Despite $AXS gaining nearly 35% during the last month, DappRadar reports that its count of unique active wallets is down almost 6%.

The fiat equivalent balance in $AXS smart contracts is up, like it is in all of the metaverse majors, simply because of a general uptick in token prices.

What about the derivatives market?

As CoinDesk has previously reported, traders are beginning to be skeptical about this price rally that’s seemingly disconnected from the fundamentals of the platforms.

Funding rates are a measure of the cost of holding positions, either bearish or bullish, in the perpetual futures market. A negative rate indicates shorts are paying longs to keep their positions open.

$AXS’ open interest funding rates have flipped negative, implying that traders are shorting the rally.

Coinglass data shows similar trends occurring for Decentraland’s $MANA, with funding rates hitting negative on some of the major exchanges. Sandbox’s $SAND seems to be the exception, with rates remaining positive for now.

coindesk.com

coindesk.com