The Crypto.com ($CRO) price broke out from a descending resistance line despite overwhelmingly bearish news.

Firstly, on Jan. 11, the firm announced that it would delist Tether ($USDT) for Canadians in order to comply with the Canadian Securities Administrators (CSA). Two days later, more negative Crypto.com news surfaced. The exchange announced that it would lay off 20% of its workforce, resuming the recent wave of job cuts following the collapse of FTX.

Despite these two negative pieces of news, the $CRO price has performed admirably this year, increasing by roughly 45%.

Crypto.com Price Jumps by 45%

The $CRO price has increased since Dec. 20, 2022. It created a higher low on Dec. 30 and accelerated its rate of increase afterward. Since then, it has moved upwards by 45%.

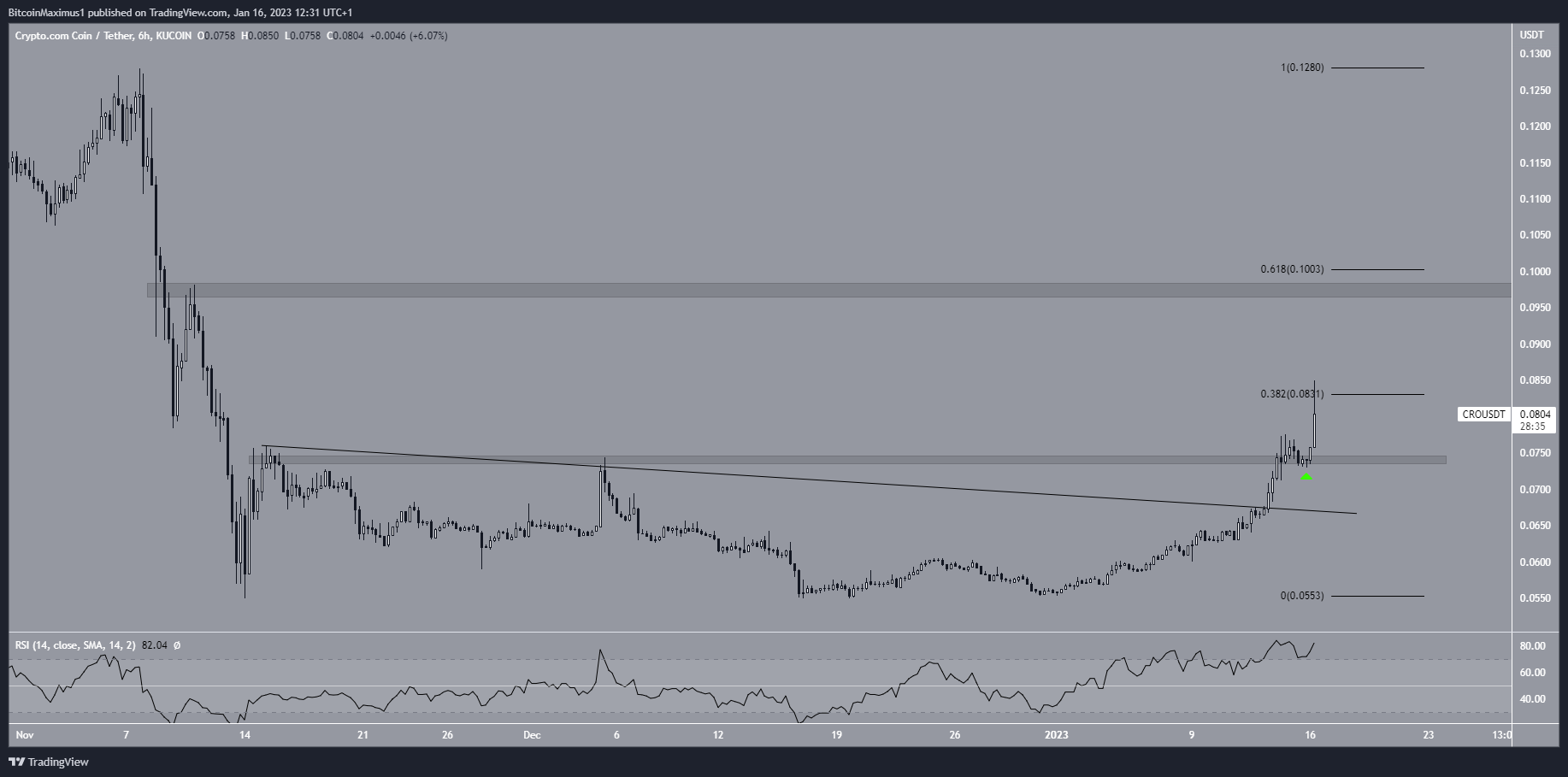

On Jan. 13, the Cypto.com price broke out from a descending resistance line. It then moved above the $0.074 resistance area two days later. On Jan. 16, the $CRO price validated the line as support (green icon) and then bounced. This led to a high of $0.085.

Currently, the $CRO price faces resistance from the 0.382 Fib retracement resistance level. However, the main resistance area is close to $0.10, created by a horizontal resistance area and the 0.618 Fib retracement resistance level.

Even though the RSI is overbought, it has not generated any bearish divergence. As a result, the upward movement may continue, leading the $CRO price to the $0.100 resistance area.

On the other hand, a close below the $0.074 support area would invalidate this bullish hypothesis.

Short-Term $CRO Price May Bounce Before Completing Wave Five

The technical analysis from the short-term two-hour chart shows that the $CRO price is likely in wave four of a five-wave upward movement (black). The sub-wave count is given in red, showing that the Crypto.com price completed sub-wave five over the last 24 hours.

If the count is correct, the $CRO price will decrease toward the sub-wave four region at $0.072 before bouncing and completing the fifth wave. The most likely target for the top of the fifth wave would be at $0.10, aligning with the previously outlined resistance area.

A decrease below the wave one high (red line) at $0.060 would invalidate this bullish wave count.

To conclude, the most likely $CRO price forecast is an increase toward at least $0.100. Whether the price breaks out from this level or gets rejected could determine the future trend. On the other hand, a decrease below $0.060 would invalidate this bullish price projection.

beincrypto.com

beincrypto.com