As the cryptocurrency market seems to be stuck in the game of tug-of-war between bears and bulls, Polygon (MATIC) is no exception, recording modest daily gains but trading largely in a sideways pattern for the major part of the week.

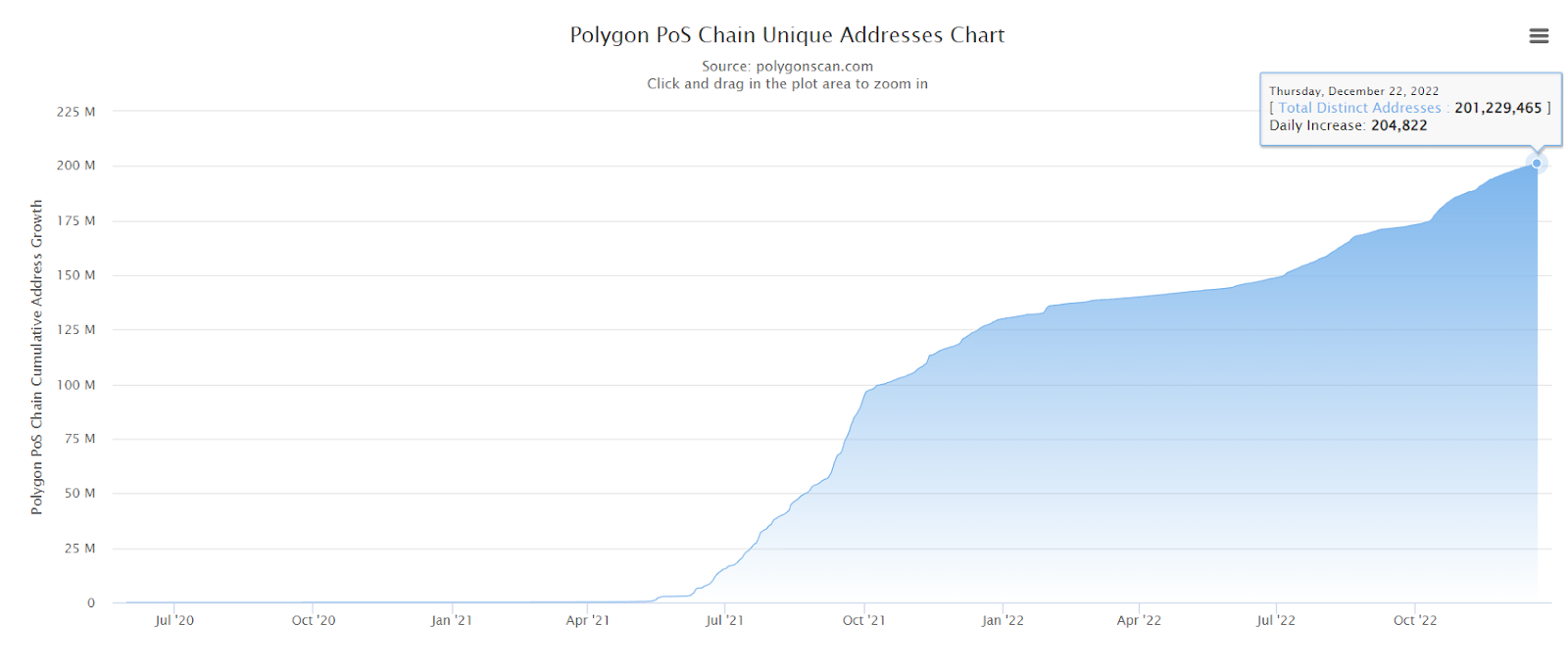

That said, the uneventful price trends have not affected the performance of Polygon in other areas, such as the number of unique addresses on its network, which has recently surpassed 200 million, as per PolygonScan data retrieved on December 23.

Specifically, the total number of distinct addresses on Polygon’s Proof-of-Stake (PoS) blockchain amounted to its all-time high (ATH) of 201,229,465 as of December 22, recording a daily increase of 204,822, as the chart demonstrates.

Since December 1, the Polygon chain became richer by 4,592,125 unique addresses, which means that an average of 208,737 new addresses have been created each day during the last month of 2022.

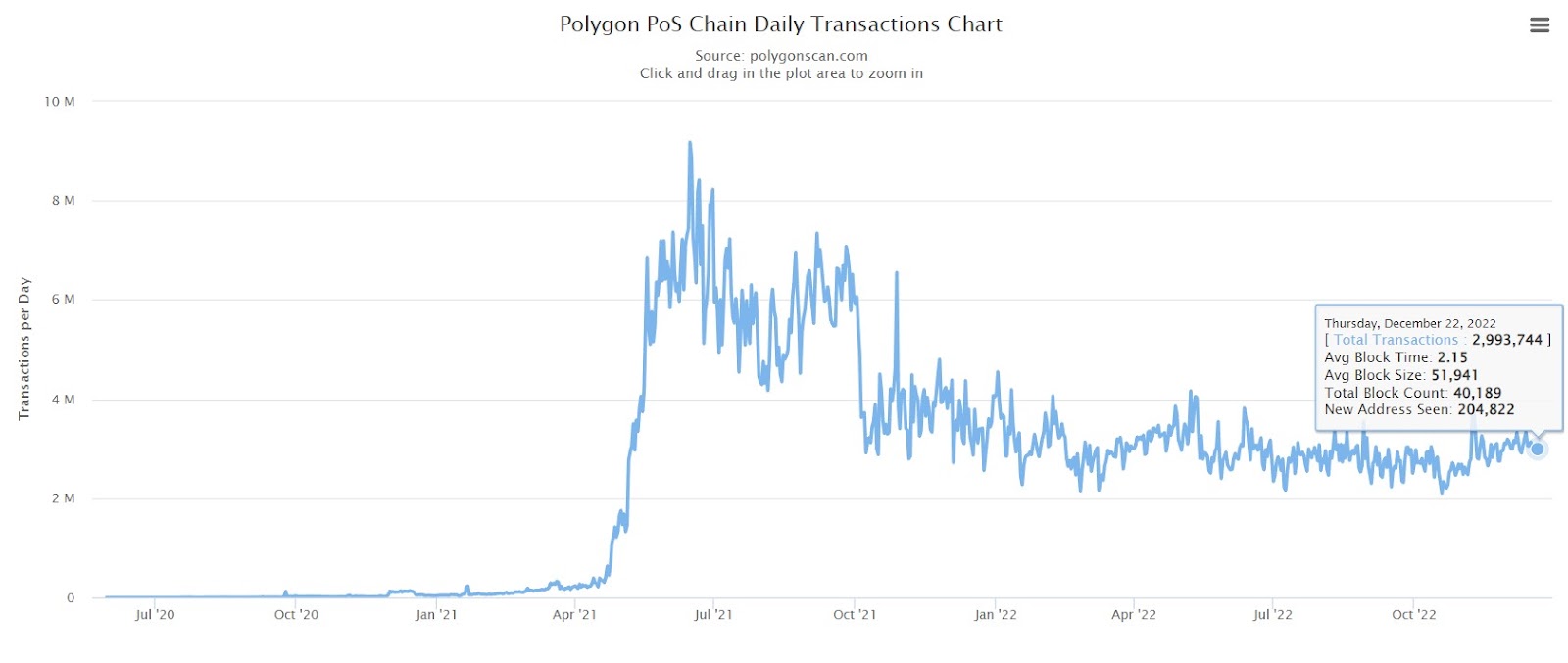

Daily transactions near three million as final testnet launches

At the same time, Polygon’s transaction history demonstrates that the number of transactions using MATIC currently stands at close to three million, or 2,993,744 as of December 22, although it is still a lot lower than its ATH of 9,177,310 recorded on June 16, 2021.

On top of that, the PoS blockchain has recently launched its final testnet for an upgraded version of its zkEVM (short for ‘zero-knowledge Ethereum Virtual Machine’) solution, with an aim to seamlessly run any smart contract from the underlying network on it.

As the developers specified:

“Researchers at Polygon are introducing the pioneering use of recursion in a zkEVM, resulting in batch aggregation. In addition, an optimized prover now generates proofs for a batch in under 4 minutes (down from 10).”

Along with the additional optimizations planned for the future, the final testnet will allow the Polygon zkEVM to “flex its muscles and deliver faster throughput at a low cost for users of Ethereum,” the Polygon team said.

MATIC price analysis

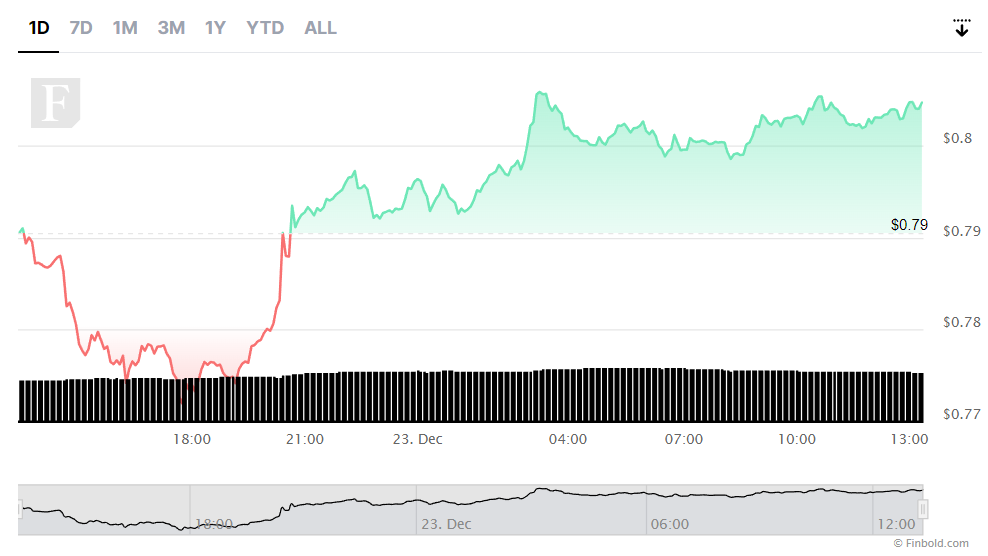

Meanwhile, the price of Polygon’s native token currently stands at $0.8039, recording a 1.66% over the previous 24 hours but still measuring the losses of 6.21% on its weekly and 5.96% on its monthly chart, as per data retrieved on December 23.

With a market capitalization of $7.02 billion, Polygon is maintaining its position as the 10th-largest cryptocurrency by this indicator, according to the latest data retrieved by Finbold from the crypto tracking platform CoinMarketCap.

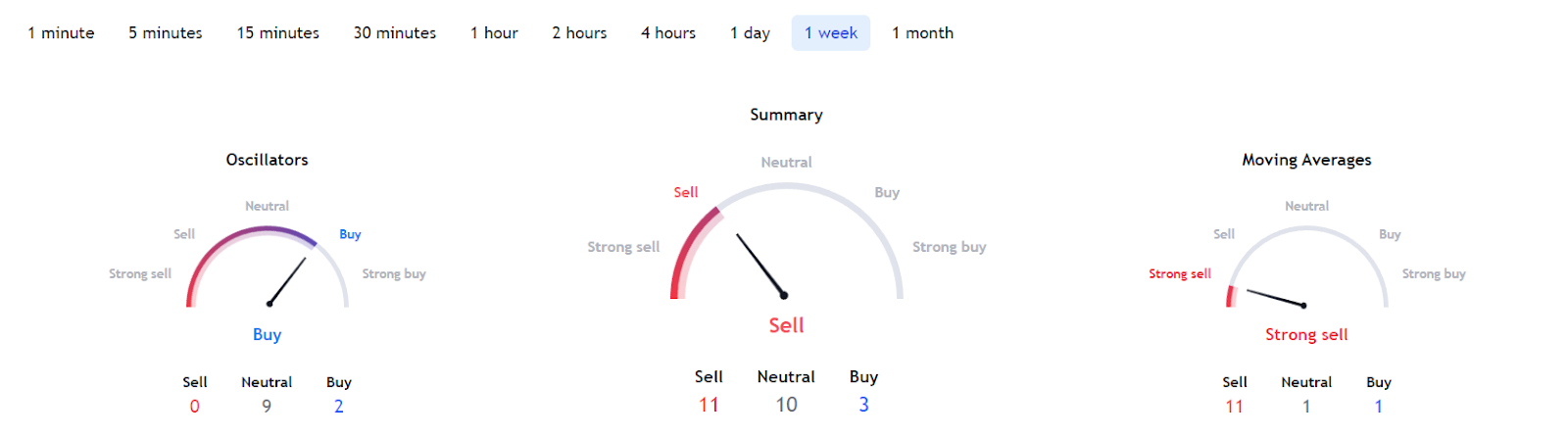

For now, the technical analysis (TA) indicators on 1-week gauges suggest a ‘sell’ sentiment for MATIC, as summarized from moving averages (MA) indicating a ‘strong sell’ at 11 but oscillators slightly in the ‘buy’ zone at 2.

In the meantime, Polygon’s recent successes, provided they are coupled with favorable crypto and macroeconomic situation, could be what the token needs to make the previously set “strong rally in 2023” or at least meet the community’s expectations of a 12.14% increase by the end of December.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com