As the market attempts to recover from the FTX cryptocurrency exchange liquidity crunch, several assets are standing out, defying the general downturn. In this line, interoperability-based crypto project Quant ($QNT) appears to be building momentum aiming to reclaim previous highs.

Indeed, by press time, the token was trading at $124.19, gaining over 20% in the last 24 hours while attracting a buying pressure that saw the market cap hit $1.5 billion as of November 15. Over the 24 hours, the token has added about $0.24 billion, according to CoinMarketCap data.

Notably, the latest gains come after Quant hit a yearly peak of $225 on October 17 but has since been impacted by macroeconomic factors and the FTX crisis. At the same time, Quant has not been affected by any preceding negative news amid the ongoing market conditions.

$QNT technical analysis

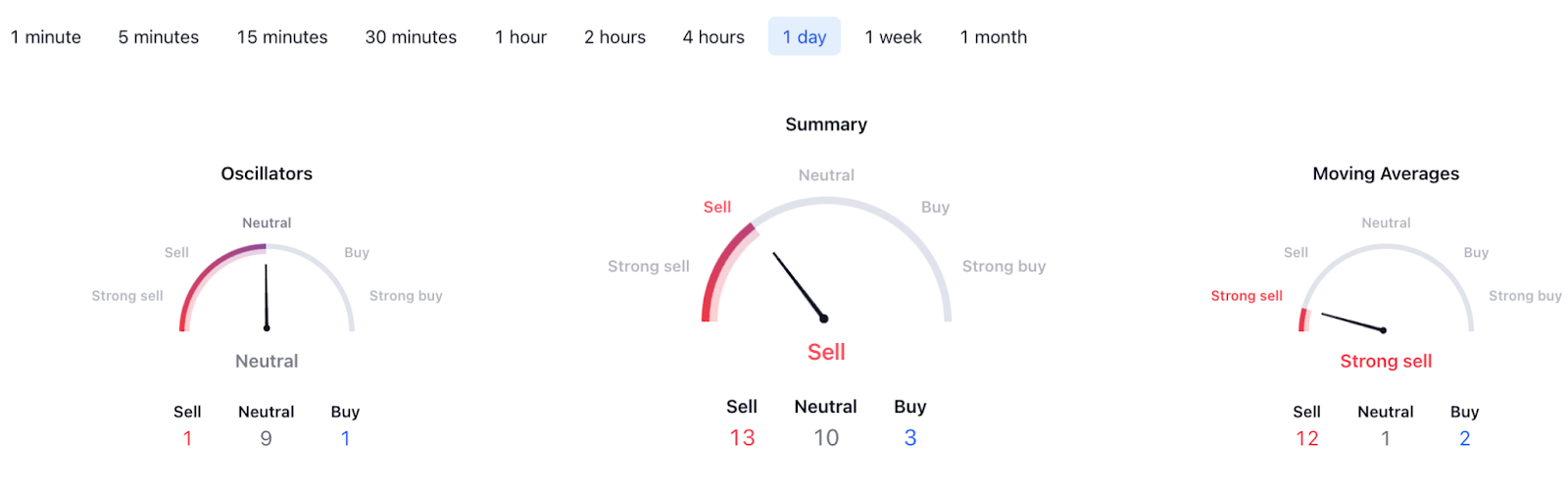

Despite $QNT’s short-term gains, the token’s technical analysis remains bearish. In particular, a summary of the technical aligns with ‘sell’ at 13, while the daily gauges for moving averages are for ‘strong sell’ at 12. Elsewhere, oscillators are dominated by ‘neutral’ at nine.

What next for Quant?

It is worth noting that the Quant network remains vibrant, as highlighted by elements such as increased social activity. For instance, $QNT’s social dominance has risen significantly with data from blockchain analysis firm Lunar Crash, indicating that as of October 14, $QNT’s six-month social engagements had spiked over 130%. However, for the token to sustain its rally, it needs more than social activity.

Notably, the gains come after $QNT appeared to face exhaustion, with the selling pressure accelerating as early investors opted to take profits. Although Quant has rallied in the last 24 hours, the gains can be viewed as a relief rally that can attract more profit-taking.

The previous selling pressure saw Quant find support at $150 as investors continued to take profits. For the asset to sustain the gains, it will need increased buying pressure to regain the $150 support level and target $200.

If selling pressure kicks in, $QNT faces a threat of plunging further and potentially breaching the $100 support level. Notably, the buying pressure is crucial, considering the general market has minimal bullish activities happening.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com