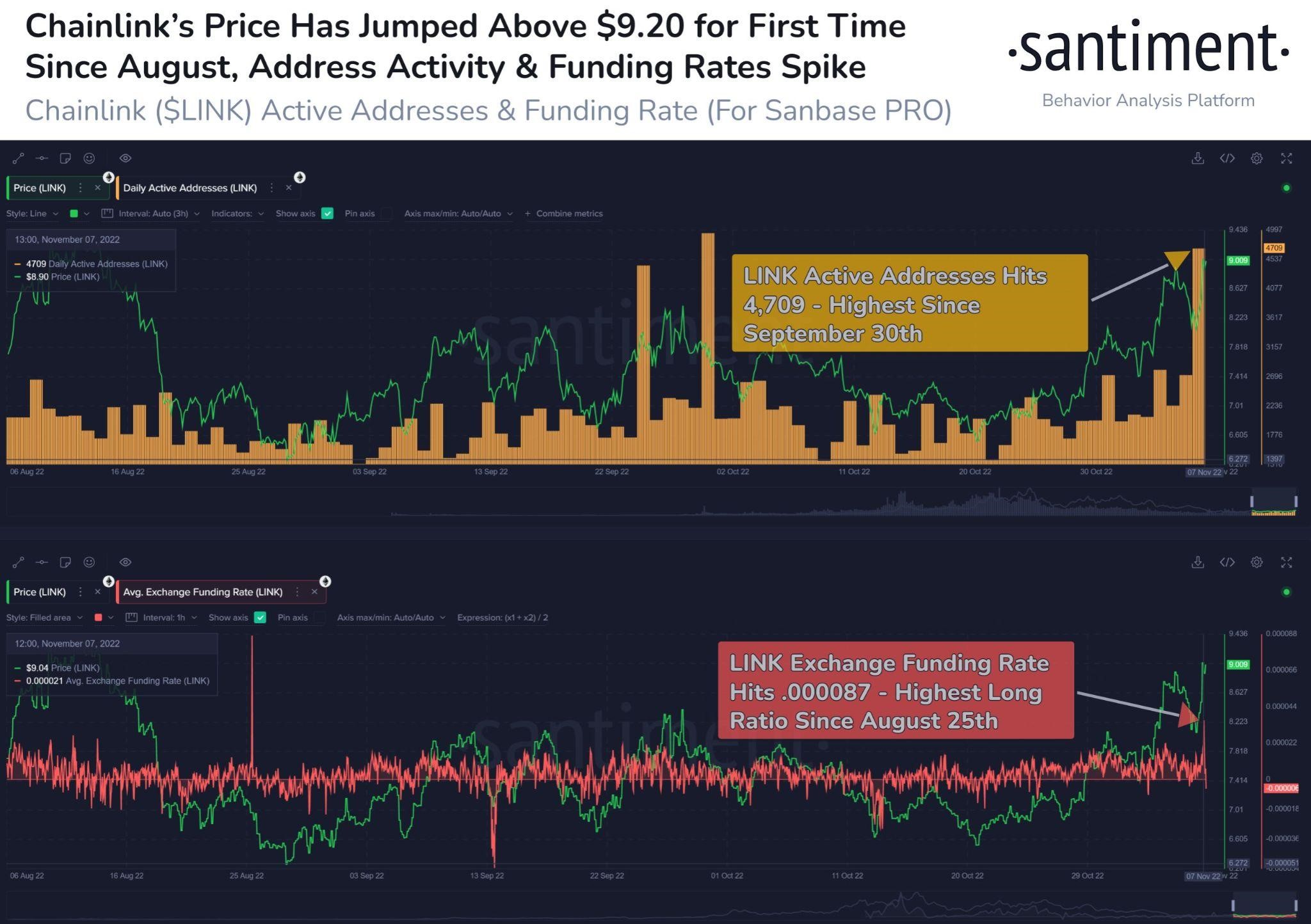

Data posted by the blockchain intelligence firm, Santiment, today shows that on-chain activity for Chainlink (LINK) has picked up significantly. This increase in on-chain activity has also boosted LINK’s price to a 3-month high despite highly volatile market conditions.

🔗 #Chainlink spiked all the way above $9.20 for the first time since August 13th, a ~3 month high despite very volatile markets. This rise has been supported by the largest amount of active $LINK addresses in 5 weeks, and traders are longing aggressively. https://t.co/ZxsZnveURm pic.twitter.com/lia6XAgSar

— Santiment (@santimentfeed) November 8, 2022

According to the data, LINK’s price has spiked above $9.20 for the first time since August 13 of this year. This rise has been supported by the largest amount of active LINK addresses in 5 weeks. Furthermore, traders are also aggressively entering into long positions for LINK as exchange funding rates have reached .000087 – the highest ratio since August 25.

LINK is currently trading at $8.17 following a 0.44% drop in price over the last 24 hours, according to CoinMarketCap. The price of LINK was able to establish a daily high at $9.20, with its low at around $7.94. Trading volume for LINK has also surged by 147.10% over the last day, taking the total to $1,196,047,212 at press time.

LINK’s price is currently being held up by the support level between $8.00 and $8.19 after traders took profit from the recent spike in price. The daily chart for LINK still favors bulls as the 20 EMA line has crossed bullishly above the 50 EMA line and remains above the longer EMA line.

This suggests that traders looking to enter a long swing position can do so as the tides seem to be turning for LINK. A confirmation of this will be if today’s trading session closes with LINK’s price above the aforementioned support level. Should it fail to do so, the bullish thesis will be invalidated and LINK’s price will look to rest on the daily 20 EMA line.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

coinedition.com

coinedition.com