The digital asset economy is facing an unprecedented crisis of trust. In the first half of 2025 alone, malicious actors siphoned more than $2.17 billion from the ecosystem, putting 2025 on track to be the most devastating on record for financial theft.

Most of this money was lost to hacks, exchange breaches, and stolen wallets. But experts say a growing share now comes from crypto presale scams, rug pulls, and fake token launches that take advantage of renewed hype.

Today, Telegram, Discord, and X are filled with flashy promotions for “next-gen tokens” and “100X returns,” often backed by supposed celebrities. In reality, many of these projects offer no transparency, no audits, and no liquidity protection.

Driven by FOMO, many investors buy in without checking smart-contract ownership, liquidity locks, or whether the team is real. That leaves them vulnerable when liquidity suddenly disappears or the project vanishes.

Security firms also say scams are becoming more polished. AI-generated whitepapers, fake audits, and staged developer profiles make fraudulent projects look legitimate. For everyday investors, telling a real pre-sale from a well-designed scam is getting harder.

This article examines the rise of pre-sale crypto fraud, how these scams work, the red flags to watch for, and practical ways investors can protect themselves.

How Pre-Sale Scams Operate

Pre-sale crypto scams usually follow a familiar pattern built on hype and FOMO. Scammers create fake token contracts, claim liquidity will be locked, or set up developer wallets that quietly drain funds after launch.

They use the excitement around early token sales to raise money fast, then disappear leaving investors with worthless tokens. To look legitimate, these projects often use polished websites, whitepapers, and active social media accounts.

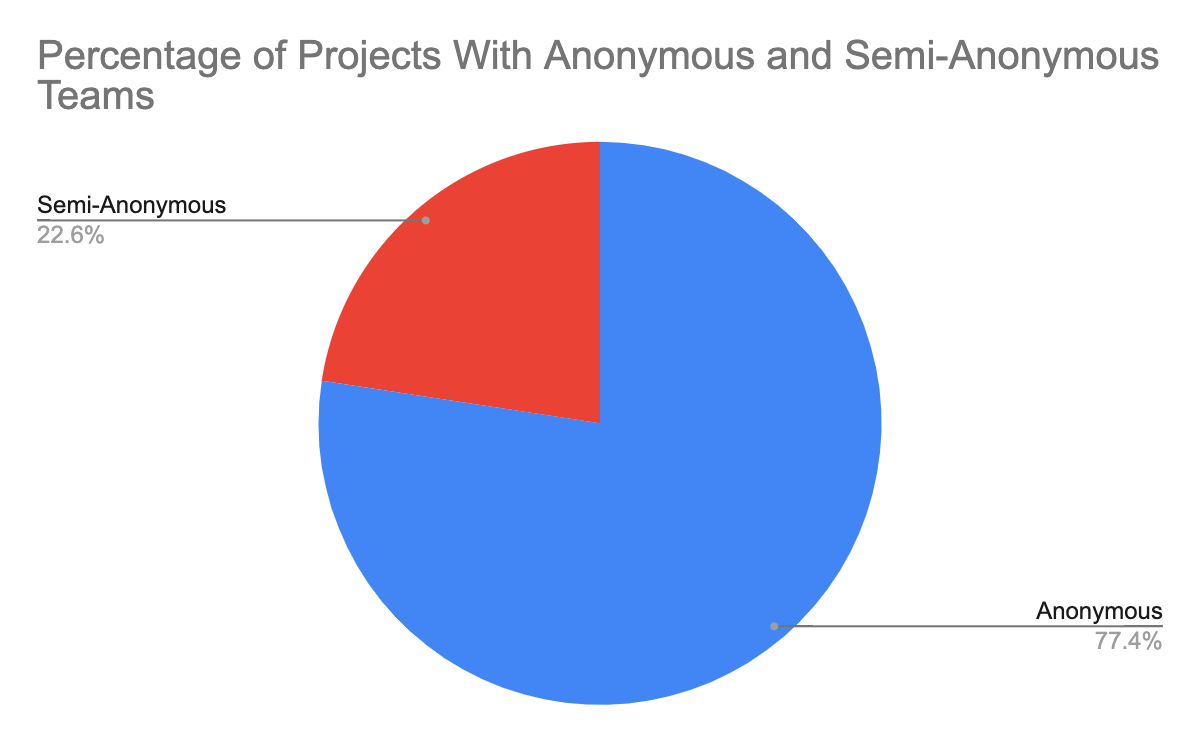

Investors can spot danger by watching for clear red flags: anonymous teams with no KYC, no LinkedIn presence, or no verifiable track record; promises of huge returns like “100X gains”; and projects driven by influencer promotion instead of real code, a roadmap, or utility. Missing audits, vesting schedules, or transparent contract details are also major warning signs.

In the 2025 market, where scams are more sophisticated than ever, recognizing these patterns is essential. Vigilance remains the strongest protection against pre-sale fraud.

Regulatory Attention

Global financial watchdogs have increasingly sounded the alarm on pre-sale crypto scams. Agencies such as the U.S. Securities and Exchange Commission (SEC), the UK’s Financial Conduct Authority (FCA), the European Securities and Markets Authority (ESMA), and Singapore’s Monetary Authority (MAS) are warning investors to exercise extreme caution when participating in early-stage token sales.

Many pre-sales operate in a legal gray zone, as decentralized issuance often falls outside traditional regulatory frameworks, leaving buyers with limited protection in the event of fraud.

Regulators are also turning their attention to key opinion leaders (KOLs) and influencers who promote unregistered token pre-sales. Promotions without proper disclosure or licensing often trigger enforcement actions, fines, and reputational consequences.

Investor Impact

Retail investors are the main victims of pre-sale scams, often drawn in by promises of quick profits and social-media hype. Many join token pre-sales without real research, trusting influencers or viral marketing instead.

This usually leads to sudden liquidity pulls, project disappearances, and tokens that end up worthless. Psychologically, these losses create a cycle of fear and frustration.

Across the crypto space, the result is lower confidence in pre-sales, tougher investor scrutiny, and a slowdown in fundraising for genuine early-stage projects.

Security Experts’ Commentary

Security auditors warn that crypto scammers are becoming more advanced and more dangerous. CertiK’s January 2025 analysis found that nearly half of all Ethereum-based token launches promoted in Telegram groups between late 2023 and mid-2024 were rug-pull schemes.

Specifically, of 93,930 promoted tokens, about 46,526 (49.5%) were flagged as fraudulent, draining hundreds of thousands of ETH. CertiK said these points to “organized rug-pull groups” using fake liquidity, unverified developers, and ghost audits to appear legitimate.

In its earlier Rug Pull Report, CertiK reviewed 40 “hard rug pull” cases from 2020–2023 and highlighted recurring risk factors: anonymous developers, no audits, vague or meaningless utility, and heavy marketing instead of transparency.

PeckShield’s 2024 report, released in January 2025, adds further concern. It recorded about $834.5 million stolen through scams (on top of $2.15 billion lost to hacks), with scam-related losses continuing to grow year over year.

Many losses came from deceptive token launches and suspicious contracts, not just technical exploits, making pre-sales one of the riskiest areas in crypto.

Together, these findings show that pre-sale scams now mix social-engineering tricks, AI-powered impersonation, and on-chain deception, making them harder to spot. As such, old red-flag checklists aren’t enough anymore.

Related: PeckShield Alerts Web3 Community About Smart Contract Vulnerability

Market Reaction and Reputation Damage

The rise in pre-sale scams has made both retail and institutional investors more skeptical, creating major challenges for legitimate early-stage token projects. Even strong projects now face tougher questions about tokenomics, team credibility, and overall transparency.

Hype tactics that once worked, such as influencer promotions and flashy social media campaigns, are now viewed with suspicion. This makes it harder for real projects to build community trust.

Venture capital firms and institutional investors are also tightening their standards, asking more profound questions before offering any funding. As a result, legitimate teams must work far harder to prove their credibility and earn investor trust.

Prevention & Due Diligence

Investors can take concrete steps to protect themselves from pre-sale scams in 2025’s high-risk crypto market. First, always verify smart contracts and independent audits to ensure the code behaves as promised.

Confirm that liquidity is locked and review the vesting schedule to avoid scenarios where developers can drain funds immediately after launch. Avoid projects driven solely by influencer hype, as these often prioritize marketing over technical legitimacy.

Other key practices include verifying team identities and activity through LinkedIn, GitHub commits, or other traceable contributions. Scrutinize domain registration age and ensure the whitepaper is original and coherent, rather than AI-generated or plagiarized.

Cross-check all claims across multiple sources and use on-chain explorers to track token flows. By combining these due diligence steps, investors can significantly reduce exposure to fraudulent pre-sales while supporting credible early-stage projects.

Conclusion

As pre-sale scams continue to evolve in sophistication, investor vigilance has never been more critical. While early-stage token launches offer high-reward potential, they also carry significant risks, particularly in an environment rife with AI-assisted fraud, anonymous teams, and hype-driven promotions.

Education, transparency, and careful due diligence remain the most effective defenses. Investors are urged to verify contracts, audit reports, liquidity locks, and team credentials, and to remain skeptical of influencer-only promotions or unrealistic returns.

By staying informed and recognizing red flags, the crypto community can navigate pre-sales more safely, support legitimate projects, and help foster a more trustworthy early-stage token ecosystem.

Related: Interpol Declares Global Emergency Over Transnational Crypto Scam Networks

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com