On Friday, the Wall Street Journal broke news of another US government investigation into Tether. Anonymous sources familiar with the Manhattan US attorney’s office say that senior law enforcement officials are “looking at whether the cryptocurrency has been used by third parties to fund illegal activities.”

This announcement is yet another chapter in Tether’s legal saga. As early as 2012, lawsuits began against Bitcoinica — whose source code was used by Tether’s sister company, Bitfinex.

Legal issues would affect Tether every year since.

As the world’s largest stablecoin, tether (USDT) attracts criminals who find its properties of pseudonymity, chargeback resistance, and widespread acceptance to be useful. Although most uses of USDT are innocuous, its illegitimate uses are pernicious.

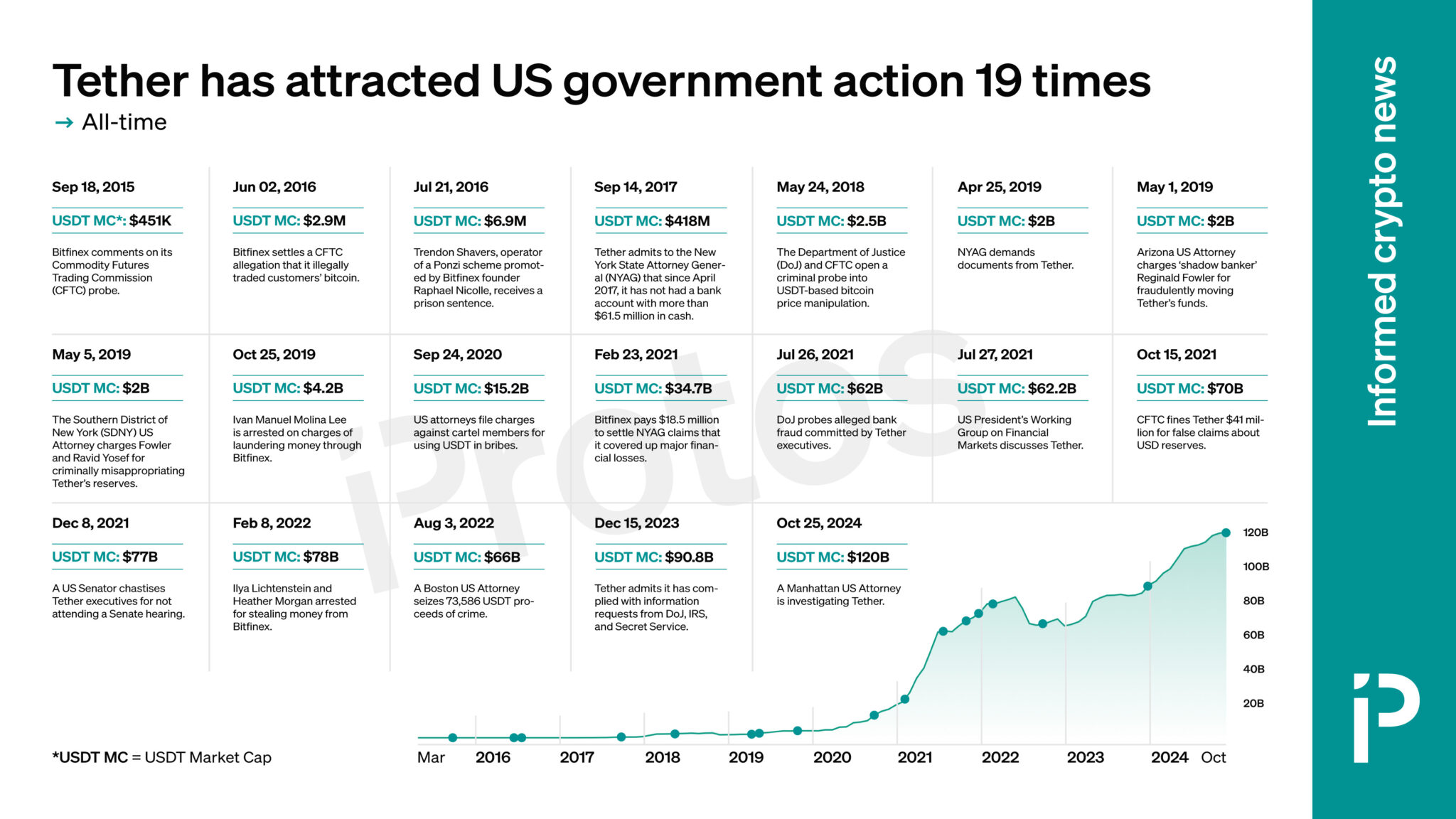

To track Tether’s run-ins with the US government across time, Protos has created a chart of some major US government actions involving the stablecoin giant. Note that this chart includes only US governmental actions and excludes numerous civil lawsuits and criminal investigations around the world.

Read more: FBI details how USDT is laundered through Binance

US government actions involving Tether

- September 18, 2015

- Bitfinex comments on its Commodity Futures Trading Commission (CFTC) probe.

- USDT market cap: $451,000.

- June 2, 2016

- Bitfinex settles a CFTC allegation that it illegally traded customers’ bitcoin.

- USDT market cap: $2.9 million.

- July 21, 2016

- Trendon Shavers, operator of a Ponzi scheme promoted by Bitfinex founder Raphael Nicolle, receives a prison sentence.

- USDT market cap: $6.9 million.

- September 14, 2017

- Tether admits to the New York State Attorney General (NYAG) that since April 2017, it has not had a bank account with more than $61.5 million in cash.

- USDT market cap: $418 million.

- May 24, 2018

- The Department of Justice (DoJ) and CFTC open a criminal probe into USDT-based bitcoin price manipulation.

- USDT market cap: $2.5 billion.

- April 25, 2019

- NYAG demands documents from Tether.

- USDT market cap: $2 billion.

- May 1, 2019

- Arizona US Attorney charges ‘shadow banker’ Reginald Fowler for fraudulently moving Tether’s funds.

- USDT market cap: $2 billion.

- May 5, 2019

- The Southern District of New York (SDNY) US Attorney charges Fowler and Ravid Yosef for criminally misappropriating Tether’s reserves.

- USDT market cap: $2 billion.

- October 25, 2019

- Ivan Manuel Molina Lee is arrested on charges of laundering money through Bitfinex.

- USDT market cap: $4.2 billion.

- September 24, 2020

- US attorneys file charges against cartel members for using USDT in bribes.

- USDT market cap: $15.2 billion.

- February 23, 2021

- Bitfinex pays $18.5 million to settle NYAG claims that it covered up major financial losses.

- USDT market cap: $34.7 billion.

- July 26, 2021

- DoJ probes alleged bank fraud committed by Tether executives.

- USDT market cap: $62 billion.

- July 27, 2021

- US President’s Working Group on Financial Markets discusses Tether.

- USDT market cap: $62.2 billion.

- October 15, 2021

- CFTC fines Tether $41 million for false claims about USD reserves.

- USDT market cap: $70 billion.

- December 8, 2021

- A US Senator chastises Tether executives for not attending a Senate hearing.

- USDT market cap: $77 billion.

- February 8, 2022

- Ilya Lichtenstein and Heather Morgan arrested for stealing money from Bitfinex.

- USDT market cap: $78 billion.

- August 3, 2022

- A Boston US Attorney seizes 73,586 USDT proceeds of crime.

- USDT market cap: $66 billion.

- December 15, 2023

- Tether admits it has complied with information requests from DoJ, IRS, and Secret Service.

- USDT market cap: $90.8 billion.

- October 25, 2024

- A Manhattan US Attorney is investigating Tether.

- USDT market cap: $120 billion.

protos.com

protos.com