The court has finally issued the consent order in the FTX and Alameda cases, ending a longstanding lawsuit filed by the Commodities Futures Trading Commission (CFTC).

FTX filed for bankruptcy in November 2022, destroying billions of dollars worth of investor funds.

Judge Ends 20-Month FTX Case

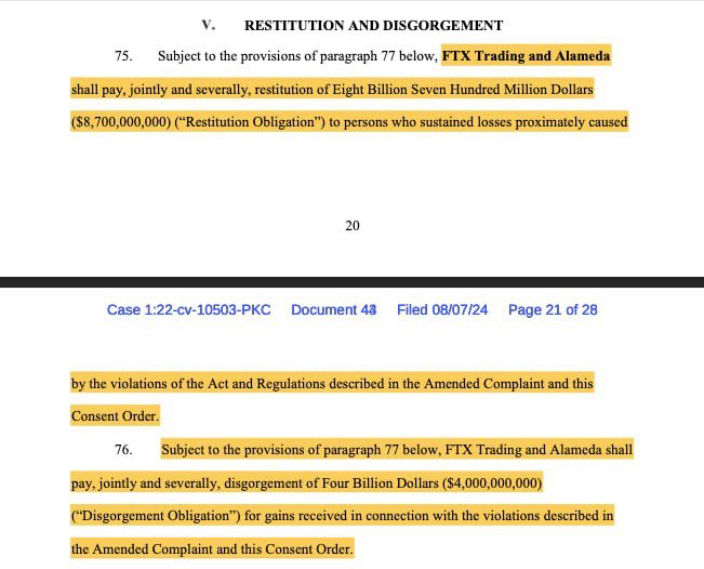

US District Judge Peter Castel officially approved the consent order on Wednesday, determining that FTX and Alameda will pay creditors $12.7 billion. Notably, the New York court does not pursue a civil monetary penalty. However, it prohibits the two firms from trading digital assets and acting as intermediaries in the market.

This development ends a 20-month-long lawsuit filed by the CFTC after FTX exchange’s Chapter 11 bankruptcy filing in 2022. Nevertheless, it does not limit or impair the ability of any other pursuit for a legal or equitable remedy against the exchange’s defendants in any other proceeding.

The regulator alleged that FTX and Alameda Research committed fraud and misrepresentations when publicizing the now-defunct exchange as the digital commodity asset platform. FTX creditor activist @Sunil_trades on X did not immediately respond to BeInCrypto’s request for comment.

Read more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

As this development breaks, FTX founder Sam Bankman-Fried (SBF) is serving a 25-year sentence. The court found him guilty of seven counts of fraud, conspiracy, and money laundering and compelled him to forfeit $11 billion earlier this year. An unreleased interview showed SBF is not a pushover in prison, having adopted a crew and sharing hot crypto tips with prison guards.

The FTX token, FTT, has been down 1.4% since the Thursday session opened, following the broader market trend.

beincrypto.com

beincrypto.com