American Senators Kirsten Gillibrand and Cynthia Lummis have formally introduced a new legislative proposal aimed at regulating stablecoin operations. After several months of anticipation, the details of their collaborative effort, known as the Lummis-Gillibrand Payment Stablecoin Act, were disclosed.

Introduced on April 17, the proposed legislation aims to implement strict guidelines for the issuance and use of stablecoins. Specifically, the act targets “unbacked, algorithmic stablecoins,” likely referring to incidents like the TerraUSD (UST) crash in 2022. The legislation mandates that stablecoin issuers maintain one-to-one reserves and establishes comprehensive regulatory frameworks at both state and federal levels. Moreover, it seeks to prevent the misuse of stablecoins for illicit activities.

Senator Gillibrand emphasized the regulatory framework’s importance in maintaining the US dollar’s dominance, fostering responsible innovation, protecting consumers, and deterring financial crimes. She expressed confidence in the bill’s bipartisan support in both the Senate and the House of Representatives.

The

The bill responds to the increased scrutiny of stablecoin issuers in the backdrop of the FTX collapse and concerns regarding adequate custody practices. It comes after the Clarity for Payment Stablecoins Act was removed from the committee by the House of Representatives in July 2023, with expectations for a floor vote that has yet to materialize.

Furthermore, on April 16, Senator Sherrod Brown, chair of the Senate Banking Committee, indicated his intention to prioritize stablecoin legislation during the legislative session, provided his concerns were adequately addressed. However, he did not specifically mention the Lummis-Gillibrand efforts.

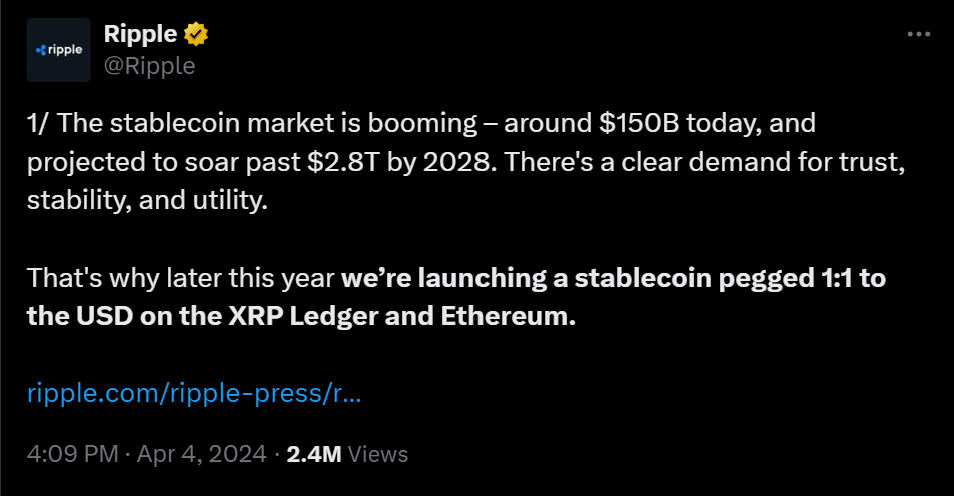

Ripple’s Stablecoin Ambitions

Amid the legislation introduction, Ripple also introduced a new digital currency pegged to the U.S. dollar, marking its entry into this competitive market space. Ripple’s new stablecoin guarantees a 1:1 backing with assets the company reserves, including U.S. dollar holdings, government securities, and cash equivalents. The firm has committed to transparency by planning monthly public reports on its funds, although the auditor remains unnamed.

Initially launching in the United States, Ripple has not dismissed the possibility of expanding its offerings to other regions such as Europe and Asia. This strategic move places Ripple in direct competition with major stablecoin issuers like Tether, with its USDT token, and Circle’s USDC. This comes on the heels of PayPal’s introduction of its own U.S. dollar stablecoin, PayPal USD, developed in collaboration with crypto firm Paxos.

Ripple’s CEO, Brad Garlinghouse, expressed indifference to the competition, emphasizing that market dynamics are bound to evolve and will hinge on the scale of operations. He noted that Ripple decided to launch a stablecoin following the instability seen in competitors’ offerings last year, citing the de-pegging incidents involving Tether’s USDT and Circle’s USDC during market upheavals.

Garlinghouse raised concerns about the current market leader, hinting at regulatory uncertainties and highlighting Ripple’s status as a licensed entity with global operations, including offices in New York, Ireland, and Singapore. Despite not naming specifics, he suggested that U.S. officials are skeptical about the incumbent’s market dominance. A Tether representative, responding to Ripple’s entry into the market, expressed hopes for Ripple’s success, albeit with a hint of skepticism based on Ripple’s past performance.

Ripple’s Ongoing Commitment to XRP

Ripple continues to advocate for the utility of its XRP token, particularly through its On-Demand Liquidity service, which facilitates real-time transactions between financial institutions using XRP as a bridge currency. Despite challenges in gaining traction among banks and payment companies, Ripple remains committed to integrating XRP with its stablecoin strategy, envisioning a more robust community engagement around its ledger.

Garlinghouse highlighted the role of stablecoins in modern payment systems and noted the positive impact other blockchain networks have seen by integrating stablecoins with their operations. He emphasized community requests for a USD-backed stablecoin on the XRP Ledger as a testament to the demand and support within the XRP community. Recent data from CoinGecko indicates a 13% increase in XRP’s value over the past year, reflecting growing market confidence.

Upcoming UK Cryptocurrency Regulation

The British government is poised to introduce new regulatory measures for stablecoins and cryptocurrency activities, including staking, exchanges, and custody services. Economic Secretary Bim Afolami announced these plans during his address at the Innovate Finance Global Summit this Monday. He indicated that the legislation could be presented as early as June or July of this year.

Afolami emphasized the government’s commitment to accelerating the legislative process to establish a comprehensive regulatory framework. “We are advancing swiftly to finalize and enact our proposed regulatory scheme,” he remarked. This new legislation will encompass a wide range of cryptocurrency operations, such as managing exchanges and safeguarding customer assets, bringing them under regulatory oversight for the first time.

In 2023, the UK enacted a significant financial markets bill, creating a baseline for treating stablecoins and broader crypto activities as regulated financial endeavors within the nation. Early last year, both the Financial Conduct Authority (FCA) and the Bank of England (BoE) provided insights into their envisioned regulatory approach for stablecoins. The BoE announced it would supervise major stablecoin handlers potentially impacting the financial system, whereas the FCA would oversee the broader cryptocurrency market.

Afolami had previously hinted at additional stablecoin-focused legislation in February, with ambitions to implement it within six months. The current administration, led by the Conservative Party, has expressed a desire to establish the UK as a hub for cryptocurrency, actively exploring regulatory frameworks. However, with an anticipated election this year, political shifts could place these cryptocurrency initiatives in uncertainty, especially if the Conservative Party does not retain power. The Labour Party is currently leading in public favor, potentially impacting the continuity of the crypto regulatory agenda.

cryptonews.net

cryptonews.net