In March 2023, the U.S. Commodity Futures Trading Commission (CFTC) initiated legal proceedings against Binance, its CEO Changpeng Zhao (CZ), and former Chief Compliance Officer Samuel Lim. The CFTC alleged that Binance operated an “illegal” exchange and maintained a “sham” compliance program, citing violations of the Commodity Exchange Act and other federal regulations. This marked the beginning of a legal battle that would shape the future of the world’s largest cryptocurrency exchange.

Binance responded by seeking the dismissal of the CFTC lawsuit. One key argument put forth by Binance was its jurisdictional claim. Despite CZ being a Canadian citizen, Binance’s parent company is in the Cayman Islands. Binance contended that since its primary clientele were non-U.S. residents and businesses, the CFTC lacked jurisdiction over their operations. To support this claim, Binance cited a precedent from 2007 stating that “United States law governs domestically but does not rule the world.”

SEC’s Allegations and Escalation

The legal troubles for Binance did not end with the CFTC lawsuit. In June, the U.S. Securities and Exchange Commission (SEC) escalated the situation by lodging thirteen allegations against Binance, CZ, and the operator of its U.S. exchange. These allegations accused them of being involved in a “web of deception.” This marked a significant escalation in the legal challenges facing Binance and its leadership, with the SEC adding further weight to the allegations.

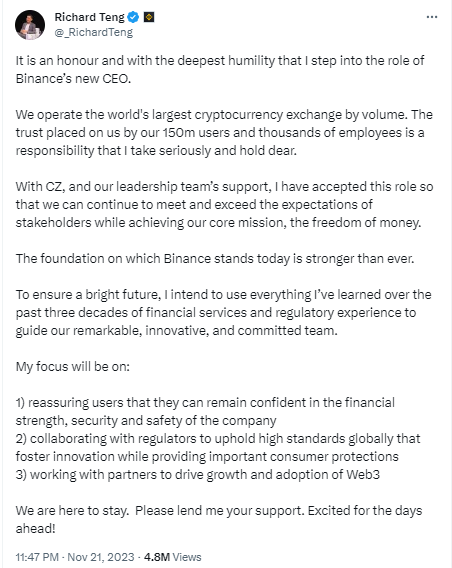

Amidst the mounting legal pressures, CZ, the CEO of Binance, took a surprising step by resigning. He publicly stated that this decision was made to accept responsibility for past errors, benefiting the broader community, Binance itself, and his own future. CZ introduced Richard Teng as his successor, elevating him from his previous Global Head of Regional Markets role.

CZ snap | Source: X (Formerly Twitter)

Teng’s Commitments and Future Direction

The newly appointed CEO, Richard Teng, assumed the mantle immediately. He pledged to lead Binance into its next development phase while prioritizing security, transparency, compliance, and expansion. Teng’s extensive thirty years of experience in financial services and regulation positioned him as a figure with the expertise to navigate the challenges facing Binance.

Despite stepping down as CEO, CZ assured stakeholders of his continued involvement. He expressed readiness to provide consultations when needed, leveraging his stakeholder status and deep understanding of the company’s history. Additionally, he outlined his plans for sabbatical and passive investments in blockchain, AI, biotech, and DeFi startups, signalling a shift in focus while denying allegations of financial misconduct.

Richard Teng’s vision as CEO emphasized the importance of maintaining financial stability, security, and safety at Binance. He highlighted the need for regulatory compliance with global regulations and collaboration with authorities. Notably, he underlined the necessity of adhering to U.S. laws when serving U.S. customers, aligning with the position of the U.S. government.

In summary, the Binance case encompasses a series of legal actions by regulatory bodies, the attempted dismissal of the CFTC lawsuit based on jurisdictional claims, the SEC’s additional allegations, CZ’s unexpected resignation, the appointment of Richard Teng as CEO, and the new leadership’s commitment to compliance and collaboration.

These developments have far-reaching implications for the world’s largest cryptocurrency exchange and the broader crypto industry. The market reacted with several sharp downfalls, but recovered almost fully. It seems that the bullish trend is gaining momentum despite a lot of negative regulation-related cases.

cryptonews.net

cryptonews.net