After the United States Securities and Exchange Commission (SEC) decided to defer decisions on several spot Bitcoin exchange-traded funds, former commission head Jay Clayton said that he still anticipated clearance would be granted at some time in the future.

In an interview on September 1 with CNBC, Clayton said that the support of spot Bitcoin investment vehicles by giant financial institutions indicated a change in how regular investors may obtain exposure to cryptocurrency.

The Securities and Exchange Commission (SEC) extended the period during which it will consider applications for spot Bitcoin exchange-traded funds (ETFs) submitted by BlackRock, WisdomTree, VanEck, Invesco Galaxy, Bitwise, Valkyrie, and Fidelity on August 31.

After the notice has been published in the Federal Register, the commission will have another 45 days to decide whether the ETF applications from these seven significant companies will be approved, denied, or again delayed. In his statement, Clayton said he anticipates "progress on this going forward." The SEC can continue extending the deadlines for the application submissions until March 2024.

Clayton stated, "An approval is unavoidable," and I agree. As the saying goes, the contrast between a futures product and a cash product can't be maintained indefinitely.

More Optimism around ETF approvals

Clayton's argument was similar to the one made by Circuit Judge Neomi Rao of the United States Court of Appeals. Rao was one of three judges who ordered the Securities and Exchange Commission to investigate an application made by asset management Grayscale to convert its Bitcoin Trust (GBTC) into a spot Bitcoin ETF. Rao said that the SEC had previously approved $BTC futures ETFs, and he felt that Grayscale's offering was "materially similar."

The ETF application delays occurred in rapid succession on August 31, just before the holiday weekend in the United States that is associated with Labor Day. The next deadline for significant spot Bitcoin applications being reviewed is October 7, the day the commission is anticipated to announce the offering from fund manager Global X.

Another EX-SEC official speaks on the ETF effect

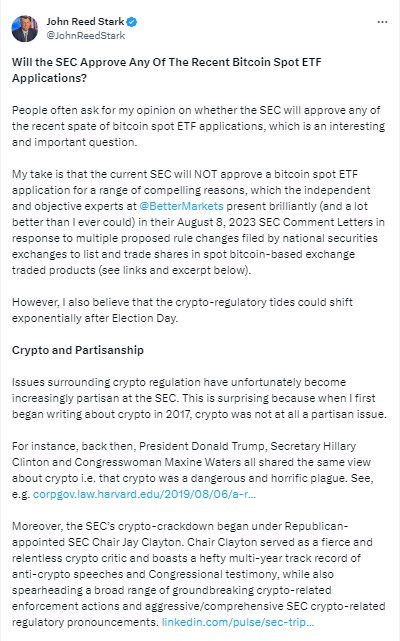

John Reed Stark, a former officer with the United States Securities and Exchange Commission (SEC), has shared his thoughts on the present standstill in the Bitcoin Spot Exchange Traded Funds (ETFs) certification process.

Because of the politicised nature of the regulators' office, he thinks the current regulatory team will not accept any submissions. His remarks came after the banking authority placed Cathie Wood's application for Ark Invest on hold, delaying the judgment until later, perhaps in 2024.

A former Securities and Exchange Commission (SEC) member speculates that a government led by Republicans would approve Bitcoin spot ETFs.

John Reed Stark, previously employed as an official with the SEC's Internet office, thinks the present enforcement team will only accept applications for a Bitcoin spot ETF. He provides arguments in favour of his position and backs up his assumption with statements made by "independent and objective experts at Better Markets."

John Reed Stack’s Snap | Source: X (Formerly Twitter)

John Reed Stack’s Snap | Source: X (Formerly Twitter)

According to Stark, the regulatory waves on the crypto beaches might alter drastically following the US presidential elections. He observed that if a Republican president (and, therefore, the government) were to assume office, $BTC spot ETFs would have a greater chance of being approved.

Stark also brings up the partisanship concerns that are now surrounding (or defining) the commission, which, in his view, is an undesirable shift that has occurred since he began serving on the board in 2017. According to Stark, this political split has now expanded into cryptocurrency.

Accordingly, Stark thinks electing a Republican to the presidency in 2024 would usher in several benefits. First, it would limit the SEC's ability to enforce laws of cryptocurrencies, perhaps allowing it to concentrate more on cases involving fraud and less on instances involving registration breaches "such as the failure of a crypto-trading platform to register as an exchange, broker-dealer, and clearing firm."

Second, according to Stark, a Republican government would be more receptive to authorising a Bitcoin spot exchange-traded fund (ETF) and much more receptive to taking other significant regulatory moves favourable to cryptocurrencies.

cryptonews.net

cryptonews.net