Ripple Labs, the blockchain company behind $XRP, has emerged triumphant in its legal battle with the U.S. Securities and Exchange Commission (SEC). In a landmark ruling on July 13, Federal District Judge Analisa Torres declared that $XRP is not an unregistered security, except when utilized for fundraising from institutional investors. This nuanced verdict sparked a surge in $XRP's price, and several centralized exchanges in the United States promptly relisted the cryptocurrency following the ruling.

$XRP's Legal Victory and Price Surge

After months of legal disputes, Judge Torres concluded that $728 million of Ripple's institutional sales could be considered investment contracts under the Howey test, which addresses the sale of securities. However, she ruled that programmatic sales to the public and distributions of $XRP to Ripple Labs employees were not unregistered securities sales. This favorable ruling, based on the Howey test, caused $XRP's price to soar by 52% within hours of the verdict, reaching 71.6 cents, its highest peak since April 2022.

Potential Implications for Crypto Classification

The ruling's significance extends beyond Ripple's case, offering potential implications for the classification of other tokens in future enforcement actions. By analyzing the economic reality of $XRP's sales, the court shed light on distinguishing between institutional and public expectations regarding profits from $XRP's value. This newfound clarity might impact how regulators view different crypto assets, potentially defining them as non-securities.

In light of the ruling, centralized exchanges in the U.S., including Coinbase and Kraken, have announced their plans to relist $XRP. Coinbase, which previously delisted $XRP in December 2022 due to low transaction volumes, is now among the exchanges expressing support for the cryptocurrency. The ruling has injected renewed investor confidence in $XRP and altcoins as a whole.

Snap | Source: Twitter

Ripple CEO's Perspective

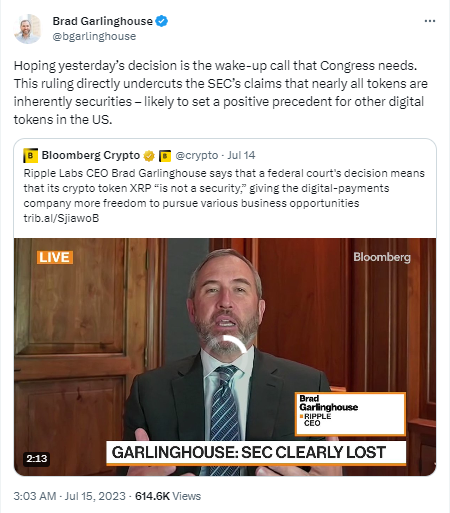

Ripple CEO Brad Garlinghouse expressed his satisfaction with the legal victory, deeming it a win for both Ripple and the entire crypto industry. He acknowledged the SEC's previous lawsuits against himself, Ripple's co-founder Chris Larsen, and the company, but highlighted that the court recognized $XRP's non-security status. While the ruling acknowledged certain institutional sales as investment contracts, Garlinghouse emphasized that this aspect represented only a fraction of their overall business.

Snap | Source: Twitter

Garlinghouse criticized the SEC's tactics during the case, accusing them of creating market uncertainty and hindering the growth of the crypto industry in the United States. He referred to the SEC's approach as regulatory enforcement rather than fostering a clear rule-based market. The legal victory and support from industry peers are seen as a significant moment, marking the first time the SEC has lost a crypto-related case.

Conclusion

Ripple's legal victory has reinvigorated $XRP and the broader crypto industry, fostering optimism among investors and crypto enthusiasts. The ruling's potential implications for token classification may pave the way for regulatory clarity and a thriving market ecosystem. As major U.S. exchanges relist $XRP and express their support, the focus now shifts to achieving regulatory certainty for sustainable growth and innovation in the crypto space.

cryptonews.net

cryptonews.net