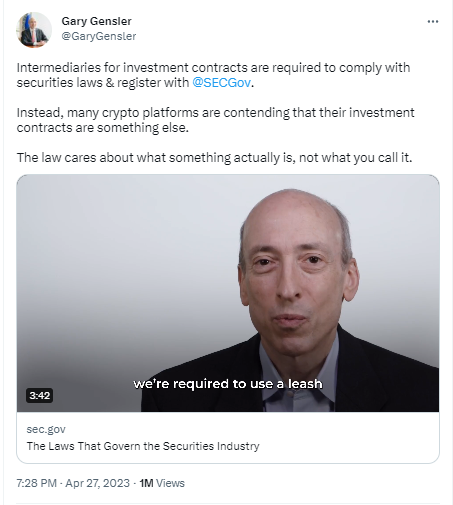

Coinbase and other cryptocurrency exchanges should take note, according to Gary Gensler, chairman of the SEC, since the regulations are unambiguous and it is imperative that they be followed.The statement was made by Gensler in a video that was uploaded to Twitter on Thursday. In the video, he stated that cryptocurrency exchanges should treat cryptocurrencies like securities and cease behaving as if the rules are vague.

Gensler said that the law was quite clear and If anyone takes part in securities exchange, clearinghouse, broker, or dealer,they are required to come into compliance, register with them, resolve any conflicts of interest that may arise, and submit any relevant information. These rules have been helping to safeguard investors for the last ninety years.

US’s regulatory state

The statements made by the regulator came only a few days after the cryptocurrency exchange Coinbase filed a lawsuit against the SEC. The lawsuit demanded that the agency be compelled to publicly reveal its response to a petition that had been pending for many months.

The petition asked whether or not the SEC would enable the cryptocurrency business to be regulated using current SEC frameworks.Coinbase has been claiming that the SEC has been inconsistent in how it regards cryptocurrencies and that the sector needs regulatory certainty. Coinbase got a Wells notice in March suggesting that an enforcement action might be forthcoming.

Since the beginning of the year, the Securities and Exchange Commission (SEC) has taken legal action against the cryptocurrency exchanges Bittrex and Gemini, the cryptocurrency lender Genesis, and a number of individual actors who are accused of manipulating cryptocurrency assets. These individuals include the cryptocurrency entrepreneur Justin Sun and the disgraced founder of Terraform Labs, Do Kwon.

Even if the argument on the subject has been buried, Gensler named the video he posted on Thursday "Office Hours," and he attempted to make the point that what cryptocurrency exchanges are doing is very blatantly promoting and selling securities. He said this in his video.

Gensler says that when one invests money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others, investment contract exists and internediaries for investment contract,whether they’re exchanges,brokers,dealers or clearing houses,they need to comply with the securities laws and register with the securities and exchange commission.

He went on and added that because the platforms do not have investor protection and do not comply with the regulations of the SEC,customers are unable to access their funds when there are issues like bankruptcy.

cryptonews.net

cryptonews.net