- The Securities and Exchange Commission says crypto companies may not be complying with federal securities laws.

- The SEC also warns about Proof of Reserves reports, claiming they may not assure that entities hold adequate assets.

- USDC issuer Circle’s CEO Jeremy Allaire claimed that the aggressive regulatory actions on crypto have resulted in deep market anxiety.

The crypto market has been in the crosshairs of the Securities and Exchange Commission (SEC) for a while now. The lack of clear regulations and the recent collapse of crypto companies and tokens has increased concerns among investors. In line with these concerns, the regulatory body has issued an alert for potential crypto investors.

SEC urges caution on crypto

In a bulletin on March 23, the United States Securities and Exchange Commission stated that the crypto space lacks important protections for investors. In the words of the regulatory body, the risk of loss runs high as the market is highly volatile and speculative. The SEC also went after crypto service providers claiming the companies offering digital asset investments or services may not be complying with the existing securities laws. The SEC further added,

“Under the federal securities laws, a company may not offer or sell securities unless the offering is registered with the SEC or an exemption to registration is available…Moreover, entities and platforms involved in lending or staking crypto assets may be subject to the federal securities laws.”

The agency also took a shot at the Proof of Reserves that came into existence after the cryptocurrency exchange FTX collapsed. Starting with Binance, many other exchanges followed suit to show the reserves they hold for the deposits made by the customers. SEC stated that even such Proof of Reserves might not provide any meaningful assurance to investors about whether these entities hold adequate assets.

Last month, the SEC shut down Kraken’s crypto staking service after it was charged for being sold without being registered. The crypto exchange was also penalized with a $30 million fine.

Furthermore, this week the regulatory body charged Tron founder Justin Sun with selling unregistered assets - TRON (TRX) and BitTorrent (BTT).

Along with Sun, the Tron Foundation, BitTorrent Foundation, and Rainberry (formerly BitTorrent) also faced similar charges. Additionally, the founder was also accused of fraudulently manipulating the secondary market for TRX using wash trading.

USDC issuer Circle CEO fights back

USD Coin (USDC) issuer Circle’s Chief Executive Officer (CEO) Jeremy Allaire took to Twitter on March 23 to share his view on the effects of the Silicon Valley Bank collapse. The executive stated that the recent aggressive regulatory actions on crypto taken by the authorities had invoked deep market anxiety. He added that there also seems to be a large-scale risk-off from USD that is exposed to the banks in the country.

5/ US policy makers need to think very carefully about what happens next. Right now, market participants are shifting into platforms with no oversight, totally opaque bank and risk exposures, and histories of lax financial risk/integrity controls. This doesn't end well.

— Jeremy Allaire (@jerallaire) March 23, 2023

Allaire also attempted to shill the stability of USDC through this narrative claiming the stablecoin sustained against the dire stress from the last few weeks.

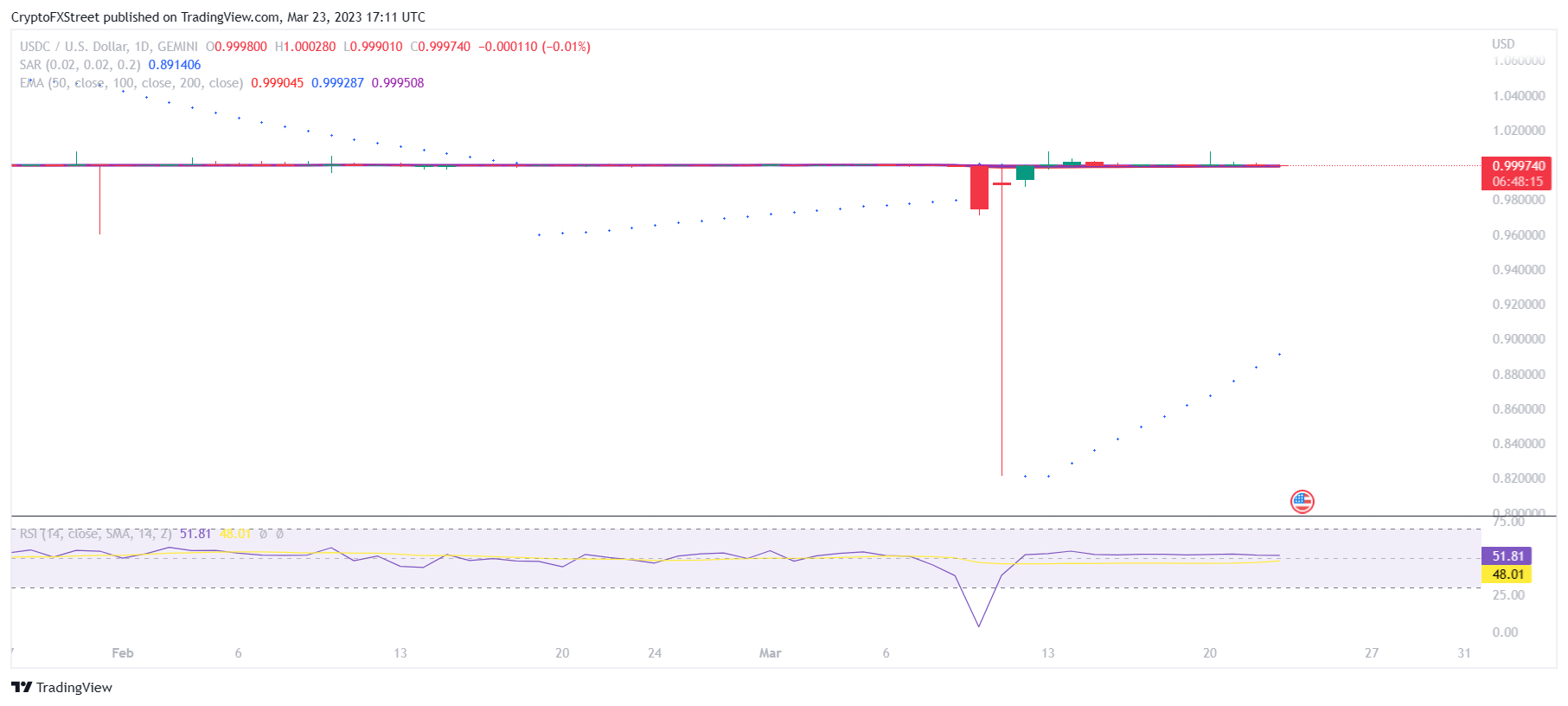

USDC/USD 1-day chart

This was in reference to the de-pegging noted on March 11, when USDC fell to trade at $0.82 during the intra-day trading hours. However, the stablecoin has since returned to its stable value of $1.

fxstreet.com

fxstreet.com