Initial Coin Offerings (ICOs) were once touted as a groundbreaking method for blockchain and crypto startups to raise capital. However, as history unfolds, many of these ICO giants now languish in the shadows, underscoring the volatile nature of this innovative fundraising mechanism.

ICOs, essentially crowdfunding campaigns for new digital currencies, have attracted immense attention and investment. Yet, the journey post-ICO has been turbulent for many, even for the highest-grossers in history. This article delves into the fates of the top five ICOs, evaluating their initial promise against their current realities.

The Top Crypto ICOs

EOS (EOS)

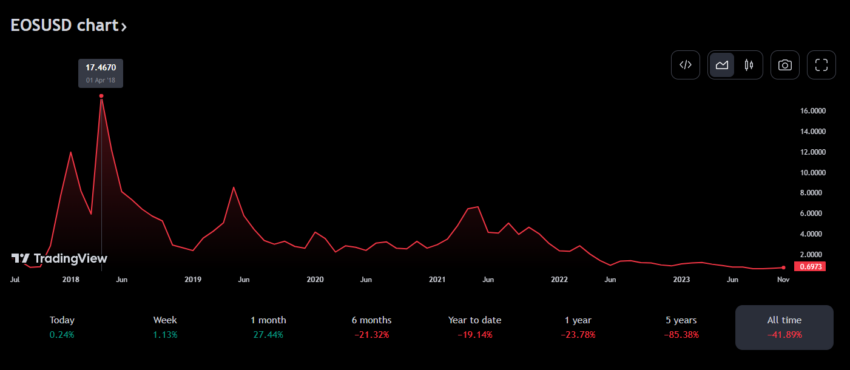

Leading the pack is EOS. It raised a staggering $4.1 billion in its year-long ICO ending in 2018. This blockchain platform, designed for decentralized applications, promised revolutionary scalability and user-friendliness.

Despite its ambitious start, EOS has faced criticism over governance issues and has not maintained the prominence it initially gained.

TradingView data reveals that EOS reached an all-time high of $17.46 after the completion of the ICO in 2018. However, it briefly peaked above $23 at its pinnacle. As of press time, EOS is languishing below $0.70—a loss of 97% for those who bought the top.

Telegram Open Network ($TON)

The Telegram Open Network ($TON) was a highly anticipated project by the famed messaging app Telegram. $TON’s ICO, concluding in 2018, amassed an impressive $1.7 billion.

However, the SEC deemed the ICO token to be a security. This led to its abrupt discontinuation, leaving investors and the crypto community in disarray. Telegram was forced to pay back the majority of investor funds alongside an $18.5 million penalty.

Venezuelan Petro

The Petro, launched by the Venezuelan government in 2018, allegedly raised $735 million on its first day.

Touted as an oil-backed cryptocurrency, Petro’s transparency and legitimacy have been subjects of intense debate, casting a shadow over its proclaimed success.

Read more: Top 7 Upcoming ICOs To Watch Out for in 2023

Filecoin ($FIL)

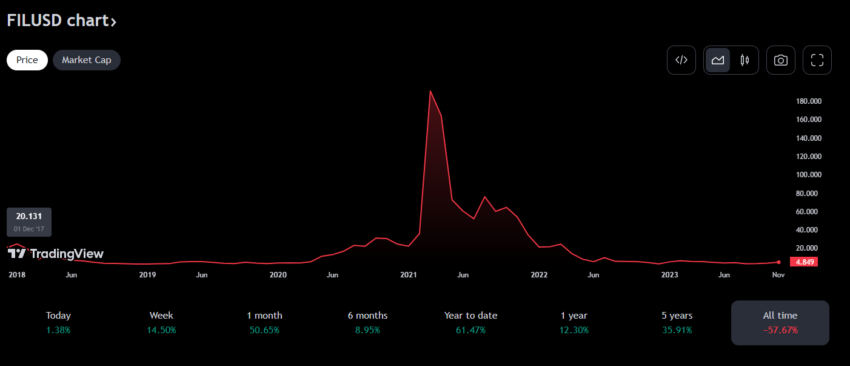

Filecoin, raising about $257 million in 2017, sought to revolutionize data storage through decentralization.

While it made significant strides initially, Filecoin has since grappled with technical challenges and market competition, raising questions about its long-term viability.

Similar to EOS, Filecoin saw a massive appreciation in the value of its $FIL tokens, which peaked at over $237 in the crypto bull run of 2021. Since then, the project has failed to live up to the hype and potential that investors once saw. $FIL is currently trading at $4.89—a 98% loss from the top.

Tezos ($XTZ)

Tezos, with a $232 million ICO in 2017, aimed to offer a more secure and democratic blockchain infrastructure.

Post-ICO, Tezos has experienced legal battles and internal conflicts, though it remains a noteworthy player in the blockchain space.

Added Regulatory Red Tape

These stories highlight the inherent risks and uncertainties of ICOs, especially as regulatory landscapes evolve. Recent regulatory developments have intensified scrutiny on ICOs, with authorities worldwide implementing stricter guidelines to protect investors from fraud and ensure transparency in these offerings.

This regulatory tightening aims to bring stability to the ICO market, yet it also raises questions about the future of this once-booming crypto fundraising avenue.

The ICO narrative, brimming with early triumphs and subsequent struggles, is a cautionary tale. It underscores the need for investor diligence and regulatory oversight in the volatile and unpredictable crypto sector.

beincrypto.com

beincrypto.com