Following the collapse of Grayscale Ether Trust, prominent fund manager popular for his non-adherence to Bitcoin, Peter Schiff, in a recent statement explained that the Grayscale Bitcoin’s Trust may be the next to collapse based on some reasons.

According to Schiff, Grayscale Ether Trust had experienced a 65% crash below high since the beginning of June, and since May 12 halving. At that time, the prominent fund manager noted that the Ether Trust also collapsed by 56% within 5 days.

Despite the fact that Grayscale have been buying Bitcoin more than miners produce, the Grayscale Bitcoin Trust is likely going to be the next to collapse, Schiff noted.

Peter Schiff said the institutional vehicle that exposes investors to Bitcoin and other cryptocurrencies will soon lose its trust in Bitcoin.

Grayscale through its GBTC and other products fuels the trading of BTC on the open OTC market. Regarding Grayscale’s prospectus, one GBTC shares trades at $10 and the institution holds 0.00095996 BTC per share. Grayscale charges 2 percent of investor’s fee and manages assets of over $3 billion in total.

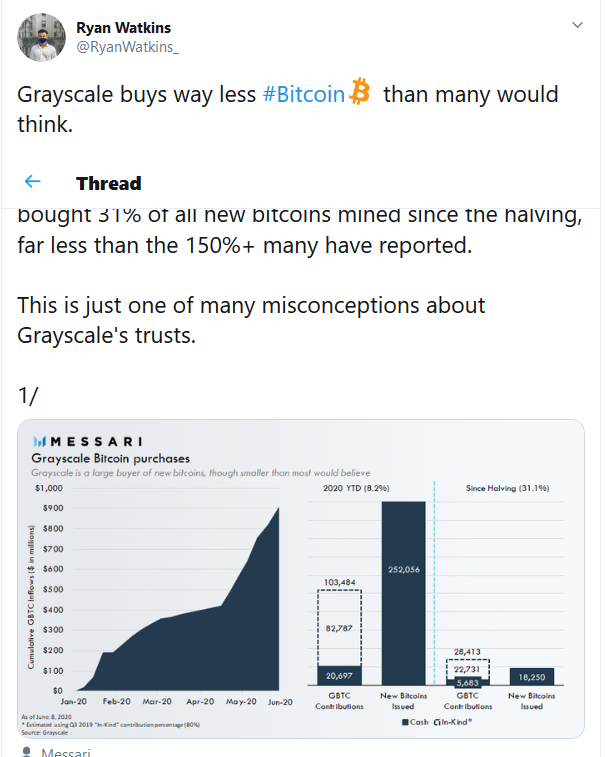

Grayscale seems to be really hungry for Bitcoin, and a report has it that the institutional company recently bought over 19,000 BTC in the last one week, and it has been buying about 80% of all Bitcoins produced per week.

Grayscale’s actions have made crypto investors believe that the institution will make a profit from BTC by selling it off to retail buyers, however, Schiff believes that the opposite is about to happen.

This time around Schiff, who has in the past considered all cryptocurrencies and the market as being worthless and predicted that the cryptocurrency giant Bitcoin will go to zero, was also of the opinion that the falling price of Bitcoin indicated whales, and Investors are dumping their Bitcoin holdings on the institutional fund in a bid to avert greater losses as Bitcoin gets very bearish.

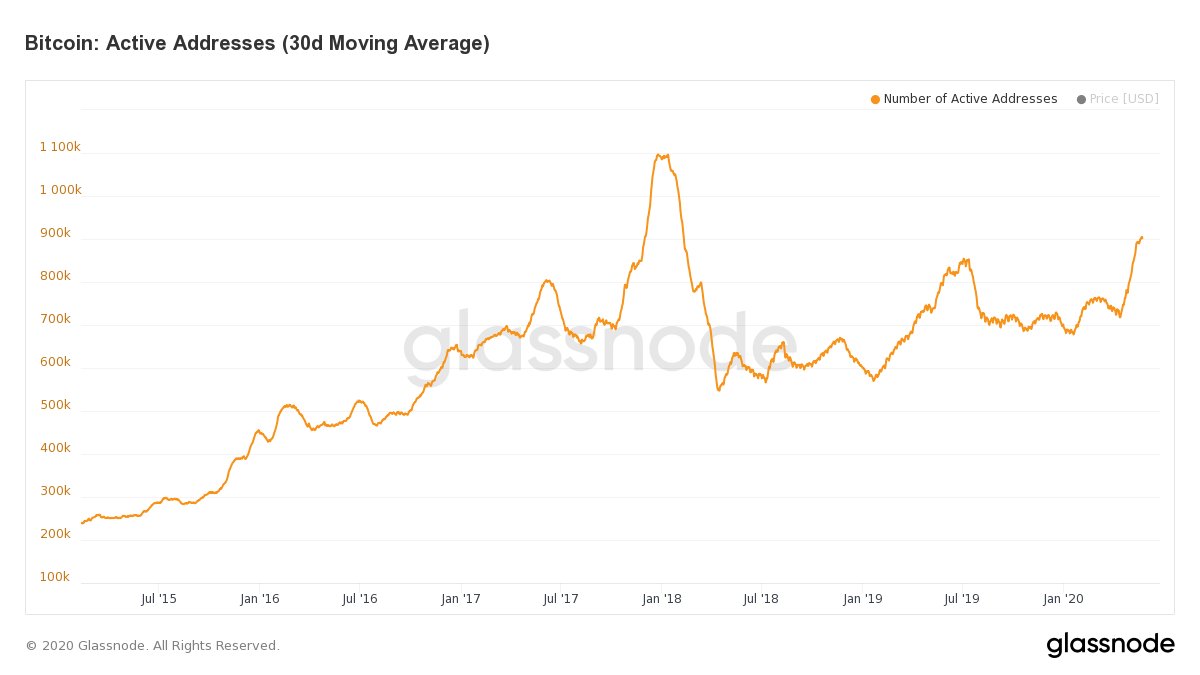

Nevertheless, data from Glassnode, an on-chain analytics firm was invariance to Schiff’s claim, as it indicated that whales’ holdings have been on the increase.

Furthermore, despite Schiff’s opinion, an analyst at Messari, an on-chain firm, Ryan Watkins, claims that people grossly overestimate the amount of BTC held by Grayscale. Watkins explained that Grayscale products do not allow investors to sell their holdings until after six months.