Spot crypto exchange-traded funds recorded broad inflows on Wednesday, led by a sharp pickup in demand for U.S. bitcoin ETFs as institutional investors returned after a choppy start to the year.

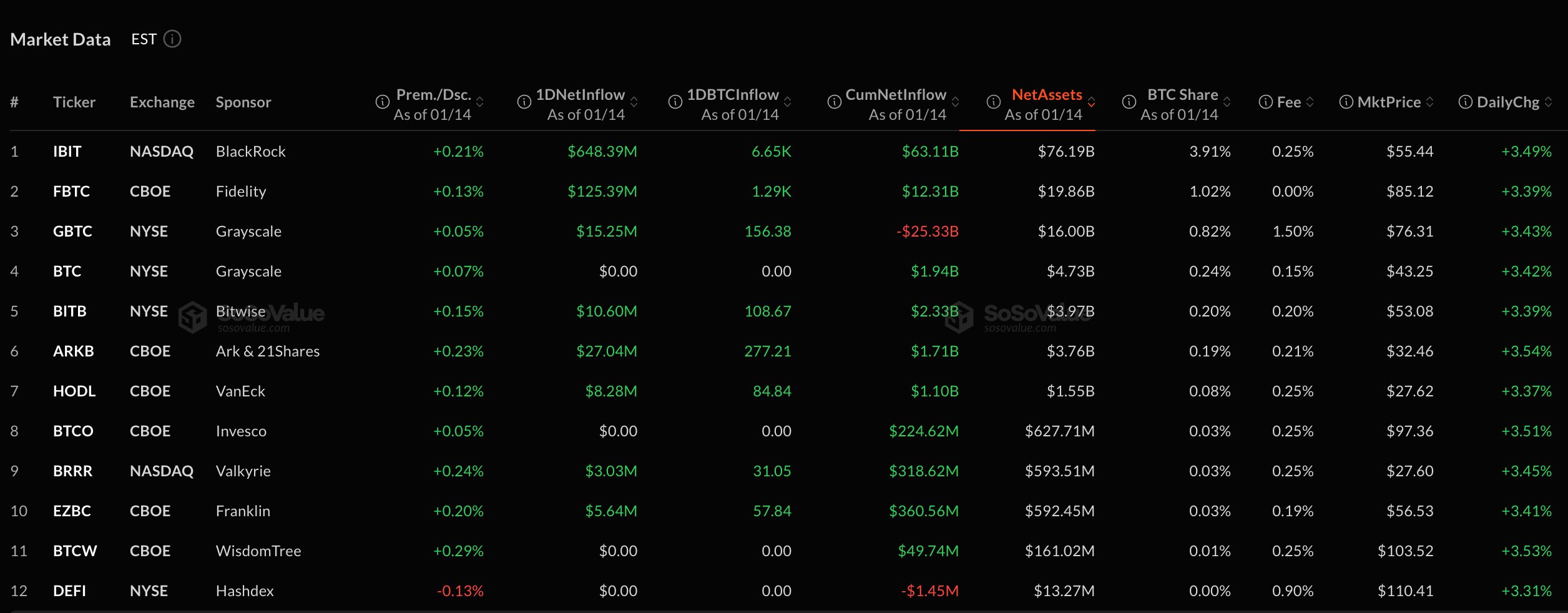

Data from SoSoValue shows spot bitcoin ETFs pulled in $843.6 million on Jan. 14, their largest daily inflow in several months. The move followed a volatile stretch earlier in January that saw multiple days of net outflows as traders reduced exposure.

BlackRock’s IBIT dominated the session, drawing about $648 million, while Fidelity’s FBTC added roughly $125 million. Smaller inflows were spread across other issuers, lifting total net assets held by U.S. spot bitcoin ETFs to about $128 billion.

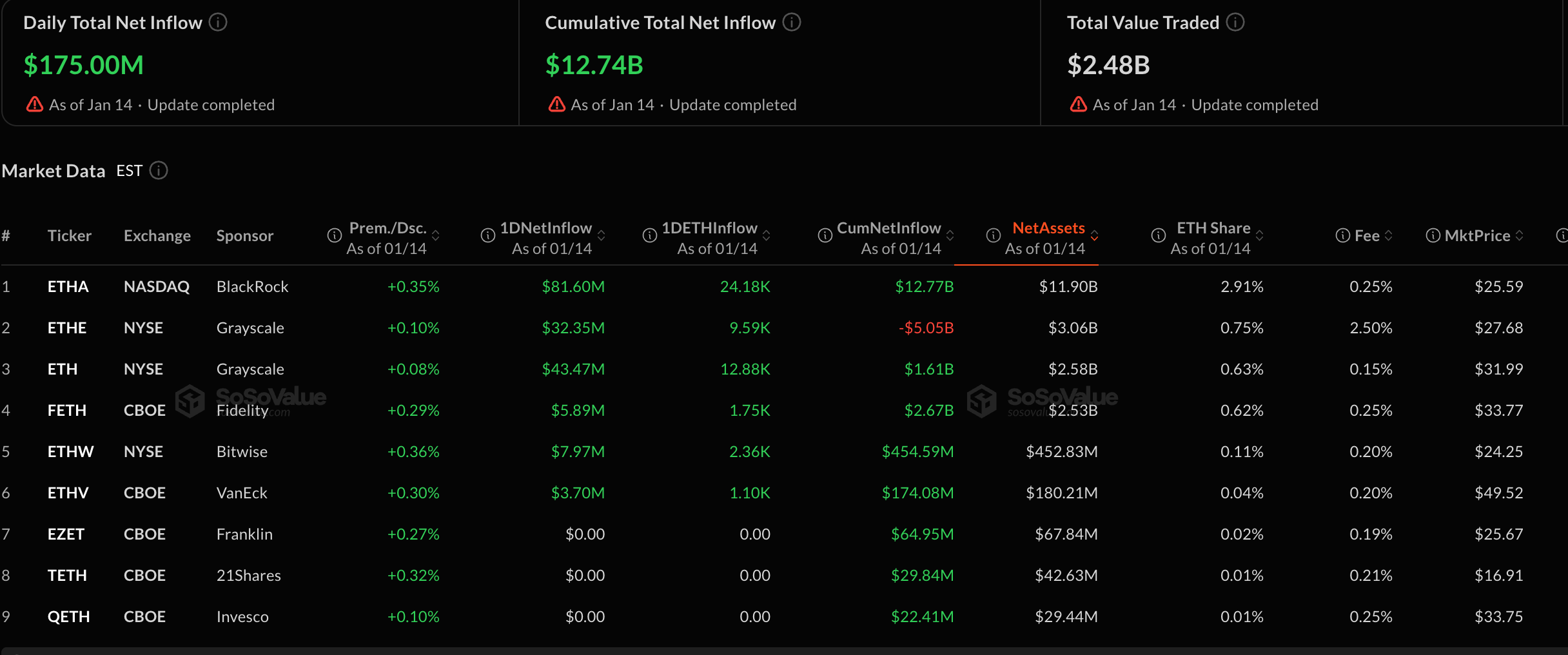

Ether-linked funds also saw steady demand. Spot ether ETFs recorded $175 million in net inflows on the day, led by BlackRock’s ETHA and Grayscale products, extending a gradual recovery in flows after a quiet December.

Smaller spot ETFs tracking solana and XRP posted gains as well. Solana funds saw about $23.6 million in net inflows, while XRP-linked ETFs added $10.6 million, according to the data.

The return of inflows coincided with bitcoin trading near recent highs, hovering just above the $96,000 level after climbing steadily over the past week. Ether held above $3,300, while performance across altcoins remained mixed.

The breadth of inflows across major tokens suggests institutional demand is stabilizing after early-year volatility, wherein ETF buying could help support prices if broader market conditions remain steady.

coindesk.com

coindesk.com