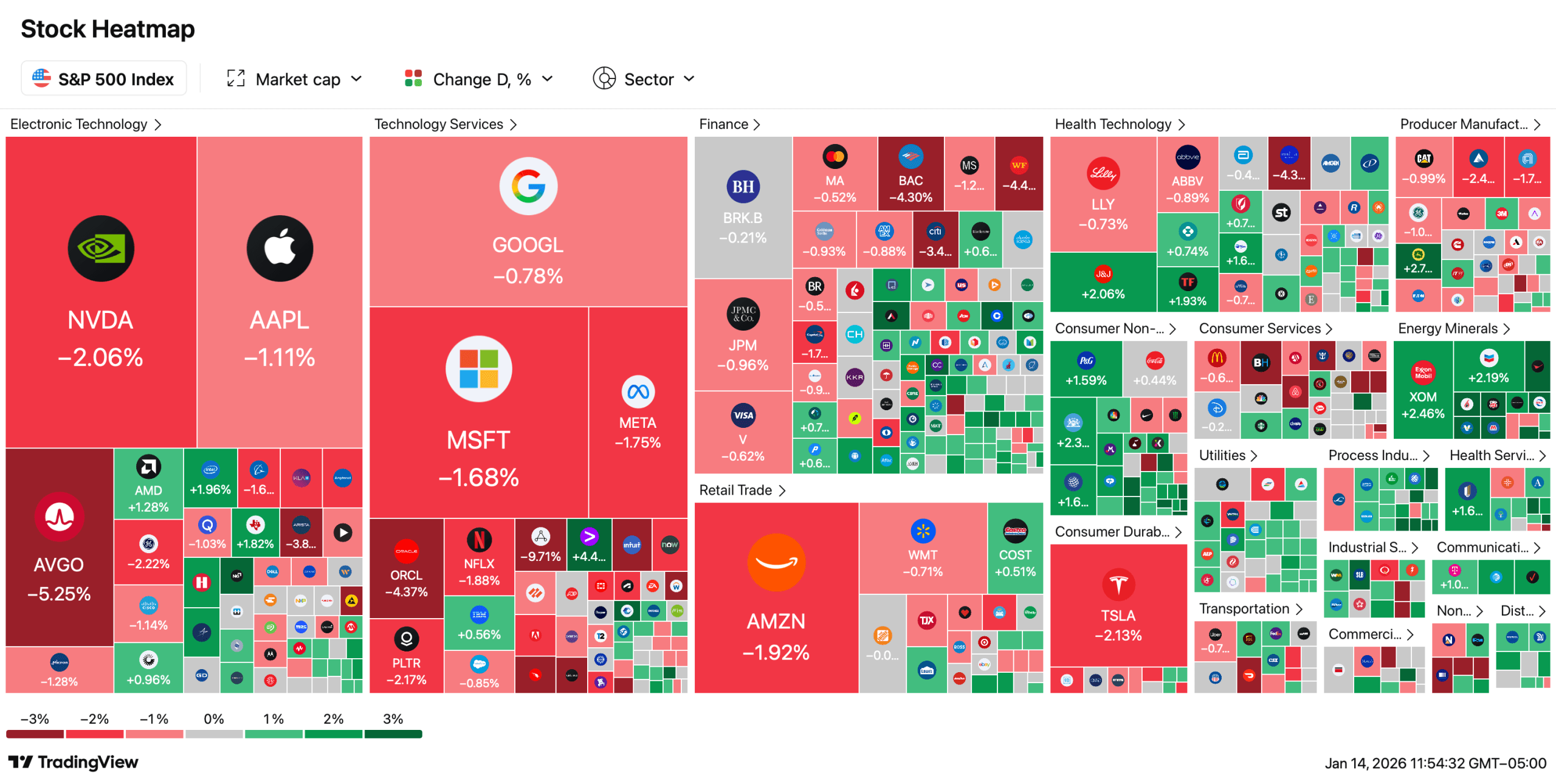

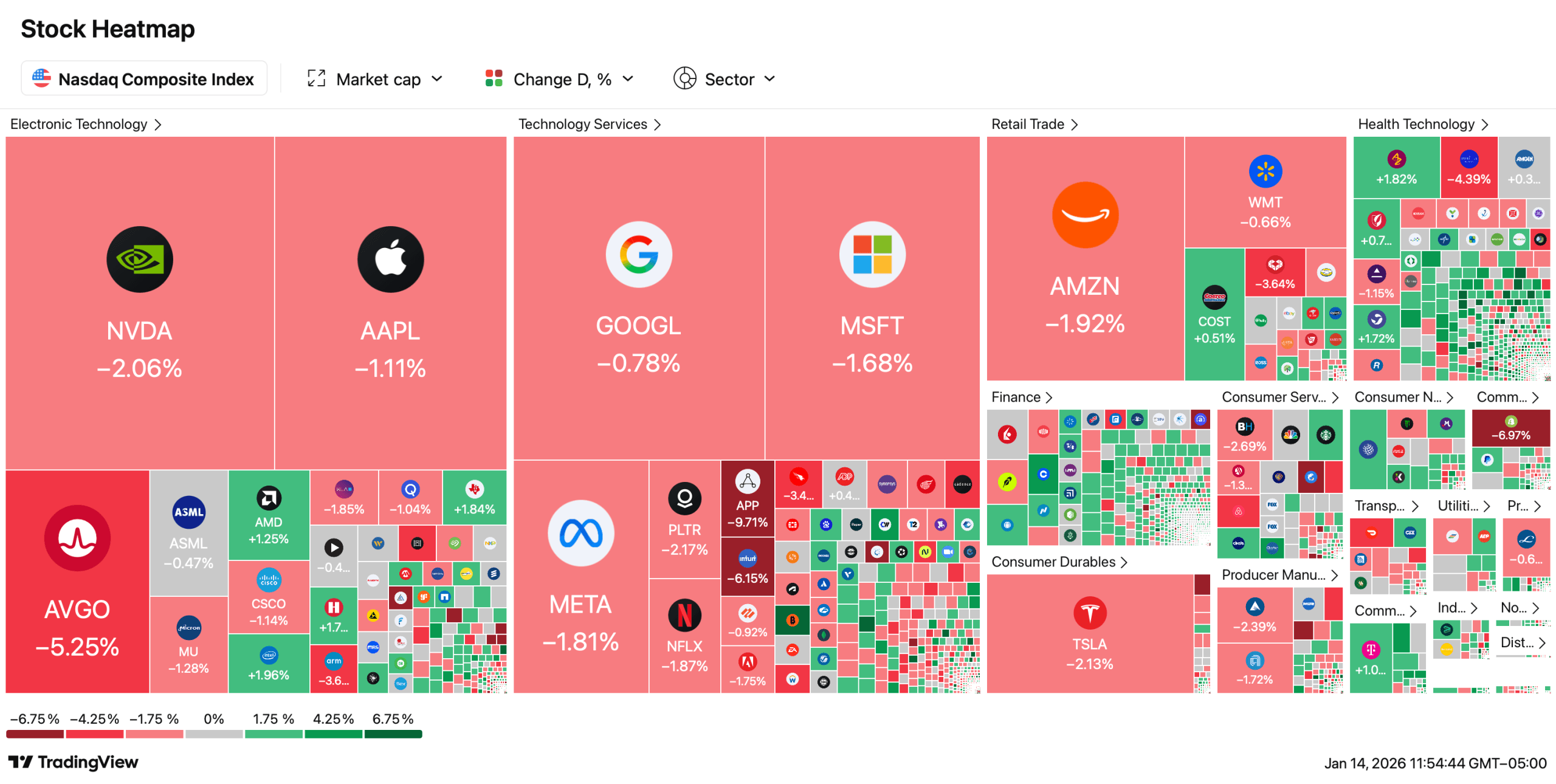

On Wednesday, after Tuesday’s pullback, U.S. stocks are moving lower across the board, with red ink splashed over every major index. Equities aren’t keeping pace with precious metals— gold and silver are still on a tear—while the crypto economy added 3.66% in the past day, climbing to $3.29 trillion.

Red Ink for Stocks as Crypto Markets and Precious Metals Shine

Equities aren’t catching the rhythm that crypto markets and precious metals are dancing to, with the Nasdaq Composite setting the tone by tumbling 344.05 points in morning trading.

The Dow Jones Industrial Average gave up 224 points. The S&P 500 slipped 63 points, while the NYSE Composite ticked down 15.39 points, capping off a morning session painted head to toe in red. All four began to show signs of life as the afternoon wore on, with the NYSE clawing back into the green by 11:50 a.m. Eastern. The stock stumble comes as markets attempt to factor in the ongoing clash between the Trump administration and the U.S. Federal Reserve.

After Chair Jerome Powell’s video message, Trump dialed up the pressure, declaring that “jerk will be gone soon.” Attention has also drifted toward earnings from Bank of America and Wells Fargo. Bank of America posted its Q4 2025 results on Wednesday, delivering a mixed yet mostly upbeat report that ultimately failed to win over investors.

Wells Fargo also rolled out its Q4 2025 results the same day, offering a bumpier readout that pointed to lingering challenges, even as signs of recovery peeked through. The bank logged net income of $5.36 billion, up 6% year over year, with earnings per share of $1.62—or $1.76 when adjusted for severance costs—topping adjusted estimates of $1.66.

Meanwhile, gold and silver are printing lifetime price highs, and analysts expect appetite for precious metals to stick around. Digital assets also pushed higher on Wednesday, with the sector gaining 3.66% against the greenback. Bitcoin climbed 4% versus the U.S. dollar and is now trading north of the $97,000 range. Real estate joined the winning column as the National Association of Realtors said existing-home sales in the U.S. rose more than 5%.

Wednesday is painting a familiar split-screen for investors: equities wrestling with policy tension and uneven earnings, while capital continues to leak into much harder assets. Stocks are attempting a modest afternoon rebound, but the broader mood suggested hesitation rather than conviction, as traders weighed political pressure, central bank messaging, and corporate results that struggled to inspire.

Also read: Bitcoin ETFs Surge With $754 Million Inflow as Crypto ETFs Register Broad Gains

Outside equities, the tone was far more confident. Precious metals keep rewriting the record books, digital assets continue to extend their advance, and housing data added another pocket of strength to the mix. The divergence left markets looking less like a unified trade and more like a rotating cast of winners, with money clearly favoring assets perceived as steadier—or simply more exciting—than stocks for now.

FAQ ❓

- Why were U.S. stocks down today? Markets pulled back as investors weighed political tension between the Trump administration and the U.S. Federal Reserve alongside mixed bank earnings.

- Why is the crypto sector rising while stocks fall? Digital assets moved higher as traders rotated into crypto, lifting the overall sector more than 3% on the day.

- What is driving record highs in gold and silver? Strong demand for precious metals continues as investors look for alternatives outside equities.

- What does the latest housing data show? Existing-home sales in the U.S. climbed more than 5%, according to the National Association of Realtors.

news.bitcoin.com

news.bitcoin.com