In recent months, former President Donald Trump has made a surprising pivot from calling cryptocurrency a "scam" to announcing his own crypto platform, World Liberty Financial ($WLFI). With the 2024 presidential election looming, this move raises serious ethical questions about the blending of political power, financial interests, and the fast-growing world of digital assets.

While Trump has long been associated with controversial business ventures, this foray into the cryptocurrency market could have far-reaching consequences. $WLFI is being positioned as a revolutionary platform, but the scant details provided during its launch—and the involvement of controversial figures—have already sparked criticism from both crypto experts and political analysts. And with Trump running for president once again, the stakes are even higher.

From Crypto Skeptic to Crypto Entrepreneur

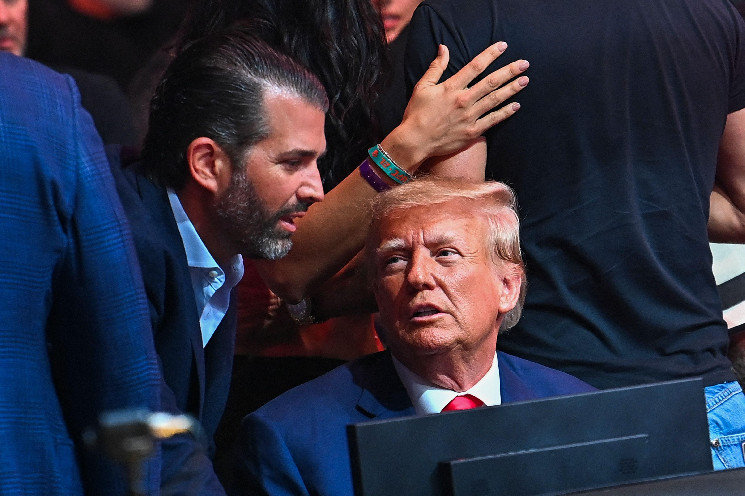

Former President and GOP 2024 presidential nominee Trump famously denounced bitcoin and other cryptos as a "scam" just a few years ago, claiming it was based on "thin air." Yet, in recent months, his tone has changed significantly. During a Twitter Spaces interview, Trump explained how his sons, particularly Eric and Don Jr., got him interested in digital currency. Even his youngest son, Barron, has been given the title of Chief DeFi Visionary for $WLFI, despite being just 18 years old. This generational endorsement mirrors statistics that younger people, even within Trump's family, are driving interest in crypto, further complicating the narrative around the former president’s sudden embrace of decentralized finance.

Yet, the details surrounding $WLFI remain murky. As Bloomberg’s Zeke Fox pointed out during a recent segment on MSNBC's Stephanie Ruhle, one of Trump’s business partners for $WLFI is Chase Herro, a self-described “dirtbag of the internet” known for selling dubious financial products. Herro’s involvement raises significant concerns about the legitimacy of $WLFI. His questionable history, including his role in selling get-rich-quick schemes, colon cleanses, and an online marketing business, casts doubt on the ethical foundation of this new crypto venture.

Moreover, the timing of this launch is critical. Coming just 50 days before the 2024 election, it raises significant conflict-of-interest concerns. Trump, who has vowed to remove SEC Chair Gary Gensler "on day one" if elected, would have enormous power to influence crypto regulation if he were to win. This timing places Trump in a precarious position, where political ambitions and financial ventures appear inextricably linked.

Is $WLFI Just Another Trump Business Gamble?

Tim O’Brien, a senior executive editor at Bloomberg and Trump biographer, noted during the MSNBC segment that Trump’s previous ventures often aimed to “part fools from their money.” From Trump University to his failed casino empire, Trump’s business record is littered with examples of ventures that ultimately benefited him at the expense of others.

$WLFI seems to follow this same ethos. Its governance token is restricted to accredited investors, effectively excluding everyday Americans from participating in this financial experiment. Accredited investors are individuals who meet specific financial criteria, including a net worth of over $1 million (excluding their primary residence), or an annual income of over $200,000 individually (or $300,000 with a spouse or partner) for each of the last two years, with the expectation of earning the same in the current year. By limiting access to those who already hold significant wealth or financial sophistication, $WLFI reinforces the exclusivity that many critics of traditional finance have long argued against.

The legal structure of $WLFI raises even more red flags. By utilizing SEC Regulation D exemptions, the platform can avoid full registration with the SEC, which would otherwise require greater transparency and consumer protections. This legal loophole allows Trump and his team to bypass traditional regulatory scrutiny while potentially positioning themselves for massive financial gains if the platform takes off.

Ethical Concerns And Political Conflicts of Interest

Perhaps the most troubling aspect of $WLFI is how it highlights the ethical dilemmas political figures face when they engage in private financial ventures—particularly in an industry as volatile and speculative as cryptocurrency. As O’Brien emphasized, Trump’s involvement in $WLFI is especially concerning given his political aspirations. If he wins the election, he will have the power to shape the regulatory environment for cryptocurrency, potentially benefiting his own platform.

This creates a stark ethical conflict. Can a sitting president regulate an industry in which he has a direct financial interest? Trump has already stated his disdain for SEC Chair Gary Gensler, and his campaign has promised to take a more lenient approach to crypto regulation. The fact that Trump’s sons, who are actively promoting $WLFI, are also central figures in his campaign only deepens concerns about the potential for self-dealing.

The Trump family's $WLFI launch, coinciding with his presidential campaign, draws parallels to past ethical controversies during his first term, including Jared Kushner’s financial ties to Saudi Arabia and Ivanka Trump’s Chinese patents. These examples highlight a troubling pattern of using political influence to advance personal business interests.

Crypto Regulation: An Election Battleground Issue

As the 2024 election draws nearer, cryptocurrency is quickly becoming a hot-button issue, as noted in a recent DCG/Harris Poll of crypto holders in six key swings states. On one side, Trump is promoting a hands-off approach, encouraging innovation with minimal oversight. On the other side, Vice President Kamala Harris, through senior advisers and strategic meetings with crypto industry leaders, has expressed a willingness to engage with the crypto industry but is also focused on ensuring that regulatory frameworks protect consumers and promote financial inclusion.

According to the 2022 Ariel/Schwab Black Investor Survey, Black investors are more likely to own cryptocurrency compared to their white counterparts. This demographic represents a significant portion of the voter base, particularly in key swing states. Harris could position DeFi as a tool for empowering these investors and innovators by breaking down barriers to capital and fostering generational wealth. Her platform could focus on using blockchain technology to create equitable financial systems that offer underserved communities access to essential financial services.

Restoring Public Trust In Crypto

$WLFI’s launch also coincides with a pivotal moment for cryptocurrency. After high-profile scandals like the collapse of FTX, public trust in the crypto industry has eroded significantly. The rise of “pump-and-dump” schemes, fraudulent token offerings, and Ponzi-like platforms has left many wary of the promises of decentralized finance. The crypto industry’s reputation and impact depend on good faith actors exercising best practices—those who prioritize transparency, ethical responsibility, and consumer protection.

Trump’s involvement in $WLFI, particularly alongside a figure like Chase Herro, raises concerns about whether this platform will further damage the industry’s credibility. While Trump has promised that $WLFI will revolutionize the crypto world, the lack of transparency and the questionable backgrounds of those involved suggest that $WLFI could be yet another project designed to benefit the few at the expense of the many.

Crypto, Politics, And The Future of Financial Innovation

As World Liberty Financial enters the decentralized finance market, it highlights the ethical, legal, and political challenges that arise when political figures engage in private financial ventures. Trump’s $WLFI, with its exclusionary structure and ties to controversial figures, raises significant concerns about the intersection of politics and finance.

In contrast, Kamala Harris’ Opportunity Economy offers a vision for a more inclusive and transparent crypto future. By focusing on consumer protection, financial inclusion, and regulatory clarity, Harris could lead the Democratic Party toward a more equitable approach to cryptocurrency. As the 2024 election approaches, voters must decide which path they believe will lead to a more fair and just financial future.

Will crypto projects like $WLFI continue to serve the interests of the wealthy elite, or can it become a tool for economic empowerment and equity as originally envisioned by Satoshi Nakamoto, bitcoin’s inventor?

The answers to these questions will shape the future of cryptocurrency—and, more broadly, the American economy—for years to come.

forbes.com

forbes.com