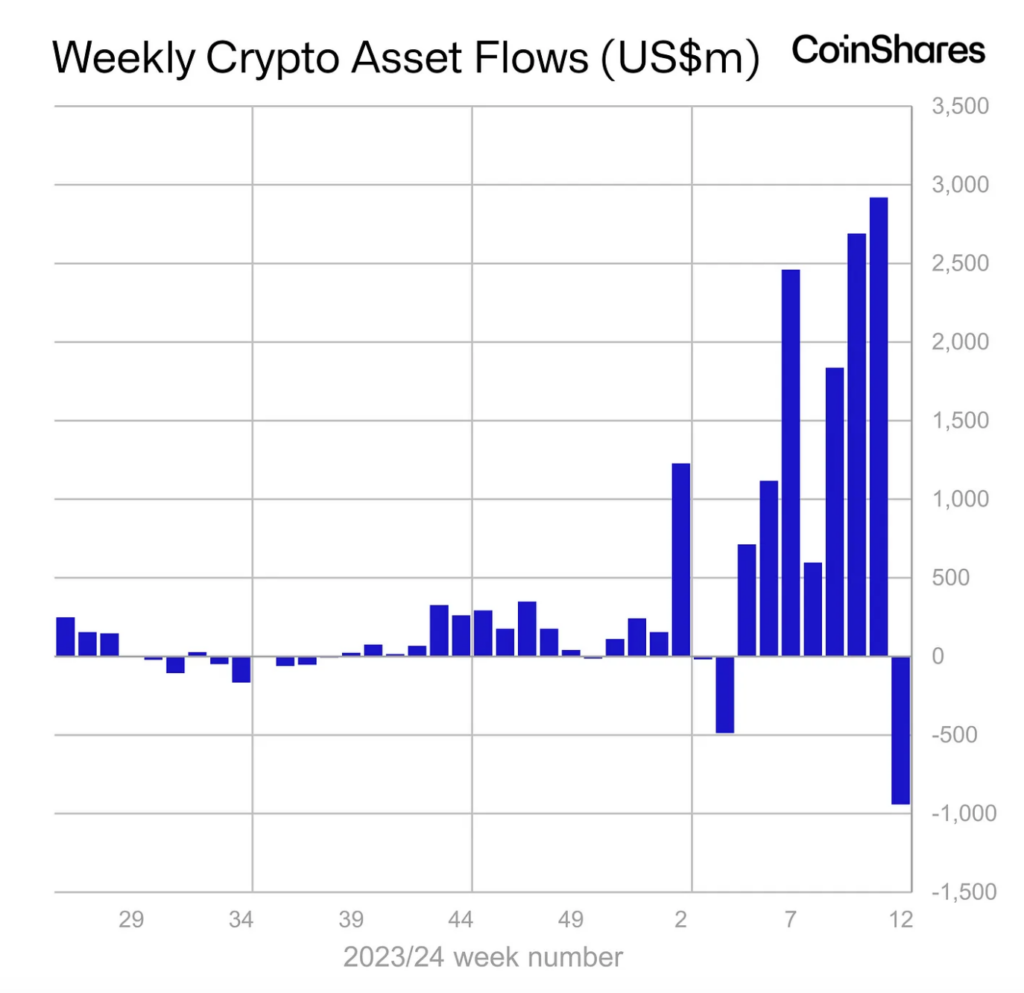

The outflow from crypto investment products from March 16 to 22 reached $942 million after the maximum historical inflow of $2.92 billion.

CoinShares experts note that previously, positive dynamics were observed for seven weeks. During this period, inflows into instruments amounted to $12.3 billion. Trade turnover amounted to $28 billion after a record $43 billion the previous week.

The main driver of the negative dynamics was outflows from GBTC from Grayscale for $2 billion. They exceeded net inflows to its competitors ($1.1 billion). As a result, market participants withdrew a record $904 million from Bitcoin (BTC) related instruments after the highest-ever receipts of $2.86 billion a week earlier.

Combined with a rollback in quotes, the volume of digital assets under management decreased by $10 billion to $88.2 billion. A week earlier, the metric immediately exceeded $100 billion. From structures that allow opening short positions on BTC, clients took $3.7 million after the maximum investment since the beginning of the year of $26 million in the previous seven days.

In Ethereum (ETH) funds, the outflow increased from $13.9 million to $34.2 million. Investors withdrew $5.6 million and $3.7 million from instruments based on Solana (SOL) and Cardano (ADA), respectively. Products based on Polkadot (DOT), Avalanche (AVA), and Litecoin (LTC) recorded inflows of $5 million, $2.9 million, and $2 million, respectively.

Noteworthy, a week earlier, inflows in cryptocurrency investment products amounted to $2.92 billion after $2.69 billion in the previous reporting period. Thus, the inflow since the beginning of the year reached $13.2 billion. For comparison, for the entire 2021 the figure was $10.6 billion.

You might also like: Crypto market outlook for 2024: insights and predictions