Elon Musk's aerospace powerhouse, SpaceX, has maintained an air of secrecy regarding the staggering $373 million in bitcoin it divested across 2021 and 2022. This move bears additional significance when considering Tesla Inc., where Musk also holds the reins as CEO, opted to offload around 75% of its bitcoin holdings just over a year after its initial investment in the digital currency.

Liquidations info snap | Source: Twitter

This maneuver, now dubbed the "SpaceX effect," sparked repercussions across the cryptocurrency landscape. Bitcoin's price, which had stood firm at over $29,000, plummeted to a rock-bottom low of $25,314 in an astonishing 24-hour timeframe. This rapid descent led to a massive $1 billion asset liquidation spree, starkly highlighting the profound impact of SpaceX's strategic shift on the crypto realm.

This abrupt event shattered the period of market equilibrium that had come to define the cryptocurrency sphere, casting a spotlight on the vulnerabilities that digital assets like Bitcoin are susceptible to. The root cause of this market upheaval can be traced back to the specter of heightened interest rates, which drove investors to divest riskier holdings like Bitcoin hastily. This reaction underscores the intricate interplay between external economic dynamics and the inherent volatility of the nascent cryptocurrency market.

In the wake of SpaceX's bold liquidation maneuver, a broader inquiry emerges regarding the future trajectory of cryptocurrencies as a safe-haven asset class. Amidst the backdrop of regulatory intricacies, global economic uncertainties, and the intensified scrutiny of tokens like $XRP by the SEC, investors grapple with a multifaceted landscape where clarity and certainty remain elusive.

Effect on Bitcoin

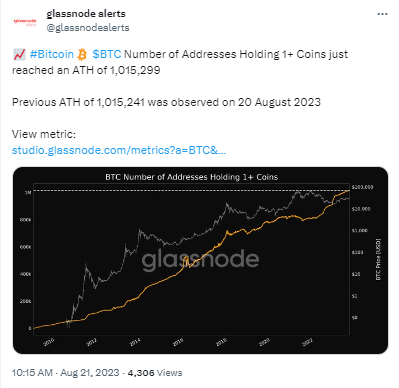

Contrary to a pessimistic narrative, data from Glassnode reveals a silver lining amidst the turbulence. An all-time high of 1,015,299 wallets now securely harbor at least 1 $BTC, illustrating a marked increase since late 2021, when Bitcoin reached its historic zenith of $68,790. This address surge hints at a persistent faith in Bitcoin's resilience even after setbacks like SpaceX's liquidation.

Glassnode market data | Source: Glassnode

Furthermore, the recent price plunge has fostered an uptick in short-term Bitcoin traders. Glassnode's data spotlight the decrease in Bitcoins in circulation within the one-week to one-month timeframe, marking a 30-day low at 680,353.028 $BTC. This shift in trading behavior coincides with SpaceX's bitcoin exit, suggesting an adjustment in investment strategies spurred by the aerospace firm's actions.

It's worth noting that shortly after news of SpaceX's bitcoin maneuver emerged, cryptocurrency liquidations surged past the billion-dollar mark, with 83% of these closures involving long-held positions.

Effects on $XRP

The Wall Street Journal (WSJ) was the publication that broke the news that Tesla was allegedly selling bitcoins for $377 million, which sent shockwaves across the cryptocurrency market. $XRP, whose market structure was already dilapidated after the adjustment from July highs of $0.93, swiftly became the greatest victim of the selling pressure and dropped below $0.42. $XRP's market structure had already been in a deteriorated state following the correction.

The selling pressure has also been exacerbated by the fact that there has been a net outflow of cash into $XRP markets. According to the Money Flow Index (MFI), the number of money leaving $XRP markets is presently at full force. This further dampens any efforts to continue the rise to $1, which would need a price increase.

As the crypto market navigates this intricate landscape, Bitcoin's market capitalization still towers over $500 billion, representing 48% of the market. While SpaceX's actions have sent shockwaves through the industry, they've also ignited discussions that underscore the ongoing evolution of the cryptocurrency realm in the face of internal and external forces.

Brad Garlinghouse adds to $XRP’s legal team

Ripple's CEO, Brad Garlinghouse, is beefing up his legal defense as the business continues to face off against the U.S. Securities and Exchange Commission (SEC) in court. Garlinghouse, now engaged in litigation in the United States District Court for the Southern District of New York, has garnered substantial support for his views.

Two high-profile attorneys from the prestigious firm Cleary Gottlieb Steen & Hamilton LLP announced their intention to vigorously represent Garlinghouse in court. Since then, Michael A. Schulman has officially requested clearance to advocate for Garlinghouse.

Caleb J. Robertson, an attorney, has also entered the fray and now represents Garlinghouse in this litigation. The fact that such well-known attorneys are involved suggests this is a difficult and important case.

Garlinghouse and Chris Larsen, two key executives of Ripple, are at the center of this legal conflict as they defend themselves against claims from the SEC. These allegations center on the circulation and distribution of the digital currency $XRP.

The court presiding over the SEC's civil complaint against Ripple Labs has set a trial date of April 1 through June 30 and will be conducting the trial in front of a jury.

Judge Analisa Torres previously ruled that $XRP did not meet the criteria for a security in the context of its exchanges.

However, Ripple and its top executives may still be liable for other alleged infractions. In light of recent events, the SEC has begun challenging the verdict, although the fate of their efforts is unclear at this time.

cryptonews.net

cryptonews.net