Celsius, a crypto lending platform that went bankrupt in July 2022, began the process of liquidating its assets yesterday, selling $60 million in LINK, MATIC, SNX and AAVE.

All funds were sent to an institutional exchange, and sales are expected to continue in the coming days until the bankrupt company has totally liquidated all cryptocurrencies remaining on its balance sheet, worth about $100 million.

Let’s see below the details of the news.

Crypto platform Celsius begins liquidating its assets

As anticipated, the crypto platform Celsius has begun the process of liquidating its assets after it filed for bankruptcy in July last year by applying Chapter 11 insolvency proceedings, dedicated to US-based companies.

In reality, as early as 1 July 2023, Celsius had been allowed to convert all the altcoins it held on its balance sheet into BTC and ETH, but until Thursday 13 July, we did not see any on-chain movement.

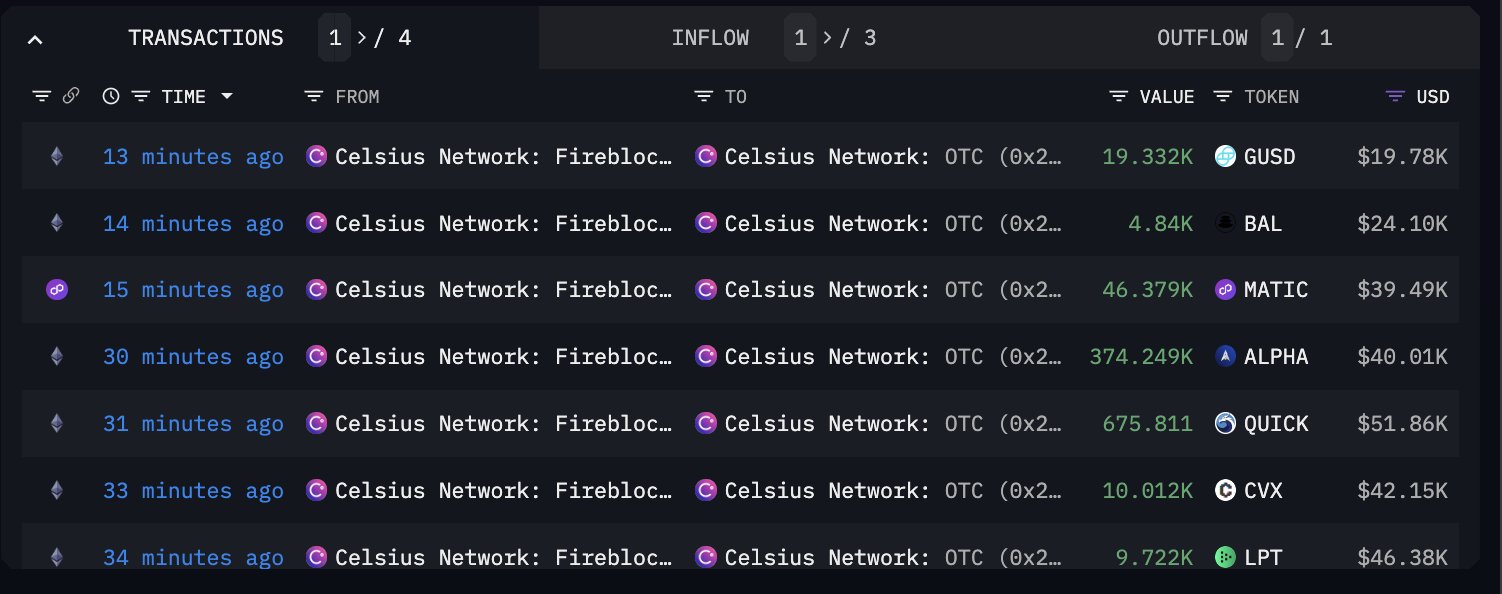

Then, on that day, around $64 million in LINK, MATIC and AAVE and other crypto assets were sent from Fireblocks to an OTC wallet controlled by the company, according to Arkham Intelligence data.

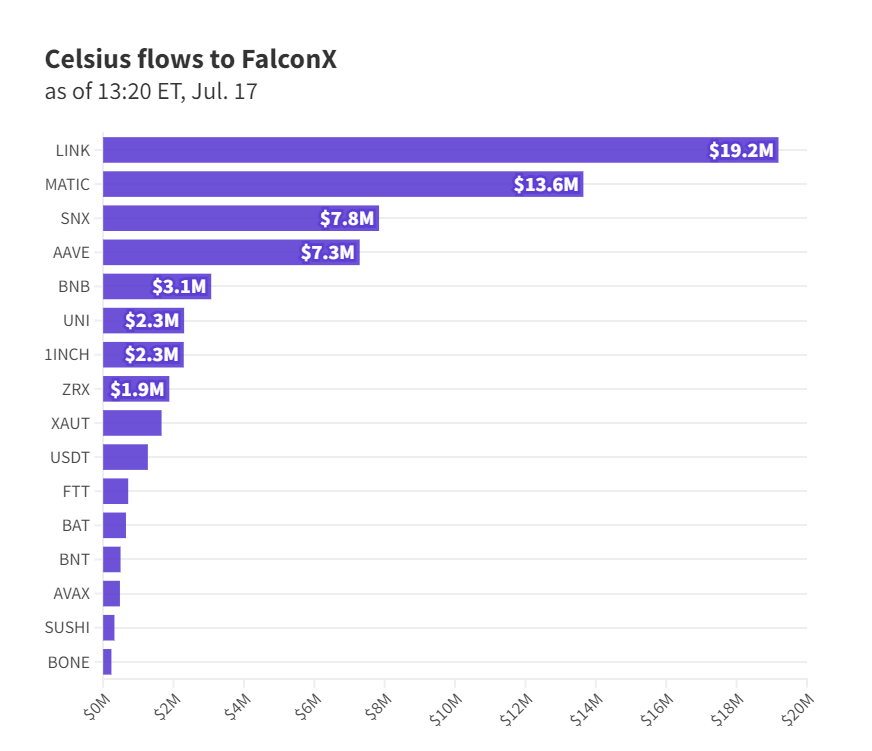

Yesterday morning, these funds were transferred to FalconX, an institutional exchange where Celsius allegedly began selling off cryptocurrencies.

Specifically, $19.2 million was sent in LINK, $13.6 million in MATIC, $7.8 million in SNX, $7.3 million in AAVE and smaller amounts in BNB, UNI, 1INCH, ZRX and other tokens.

All cryptocurrencies declined slightly on the price front, although in itself the amount of sales does not represent a high value.

Fear and the spread of FUD regarding the Celsius liquidation issue played its role in this affair leading many users to sell their altcoins.

The only tokens that were not affected by this news were 1INCH and LINK: the former experienced a strong pump that was absorbed soon after, while the latter is benefiting from the launch of the long-awaited Cross Chain Interoperability Protocol (CCIP), which could have a strong positive impact on Chainlink‘s infrastructure.

It is also interesting to note that Celsius holds certain stablecoins on its balance sheet, and by converting them to BTC or ETH, it could produce positive effects on the market.

While it remains true that in terms of numbers, the amounts held by the bankrupt platform are decidedly small, the fact remains that such a narrative could spark a small rally for the industry’s top two crypto assets by capitalization.

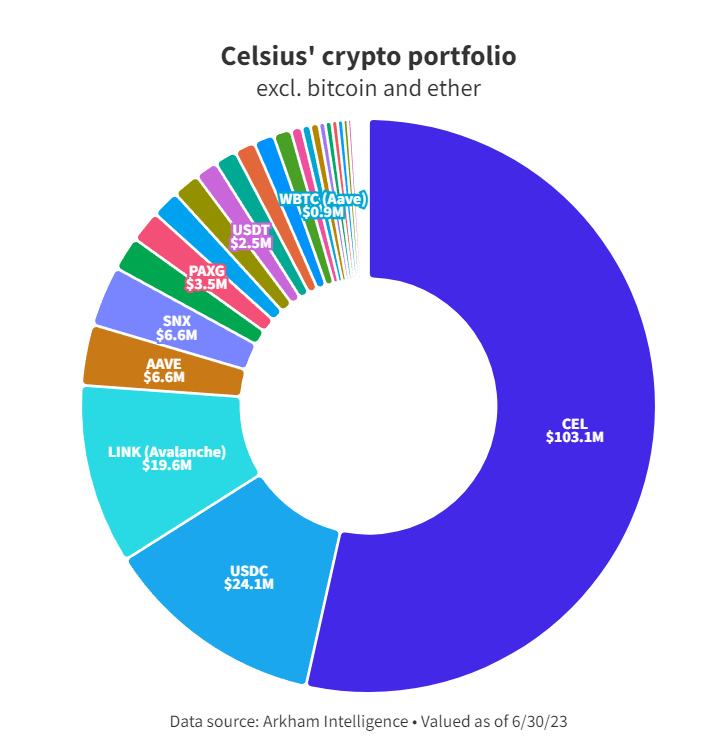

Celsius still holds 24.1 million USDC, and 2.5 million USDT ready to be converted into the speculative currencies par excellence.

Those who should be seriously concerned are the holders of the CEL token, which appears to be worth $103.1 million in Celsius’ wallets.

A sale of all these tokens could easily cause a dump for CEL, whose price is already experiencing disastrous price action.

The bankruptcy and arrest of CEO Alex Mashinksy

On 13 July 2022, the crypto lending platform Celsius formally filed what is known as Chapter 11 with the Federal District of New York, permanently entering bankruptcy.

The affair came as a shock to the entire cryptocurrency industry, as the colossus’ bankruptcy came after the downfall of other major institutions in the industry such as Voyager and Three Arrows Capital.

After a year-long investigation, several US federal agencies such as the Department of Justice (DOJ), the Commodity Futures Trading Commission (CFTC), the Federal Trading Commission (FTC), and the Securities and Exchange Commission (SEC) launched coordinated legal action against Celsius and its CEO.

However, while the platform was prosecuted civilly under a non-prosecution agreement given the willingness of the organization’s members to cooperate with US authorities, CEO Alex Mashinksy was arrested and criminally charged.

The latter has been charged with market manipulation, wire fraud, securities fraud and commodity fraud, pending a judge’s ruling.

Most of the crypto community was happy that a person like Mashinksy, who was responsible for mismanaging their clients’ funds, was arrested.

Such situations, with the CEO of a company using customer deposits for personal gain or to gamble in the cryptocurrency market, should no longer exist: the arrest of Mashinksy is a warning to all abusive players in the industry.

Among those who rejoiced loudly over the arrest of the former Celsius CEO is a very enigmatic figure known to be a crypto detractor, namely Peter Schiff.

Almost two years after I publicly accused Alex #Mashinsky of committing crimes, the U.S. government finally indicted him for the very crimes I accused him of committing. What took them so long?https://t.co/ARUGrBqtrm

— Peter Schiff (@PeterSchiff) July 13, 2023

The bankrupt company will now have to compensate creditors for an estimated $4.7 billion, according to a recent settlement with the Federal Trading Commission.

The creditor compensation company is rumored to have partially recovered these funds, thanks to the liquidation of companies previously acquired by Celsius, and thanks to income generated by certain factors such as the staked MEV on Ethereum, which produced $10 million in 10 months.

The self-custody platform GK8, acquired in 2021 for $115 million, was also divested these days.

The proceeds from this transaction, about $25 million, will be used 96% to pay all legal fees, according to an agreement reached between the debtors, the creditors’ committee and the initial consenting Series B preferreds.

en.cryptonomist.ch

en.cryptonomist.ch