TL;DR Breakdown

- $TUSD, or TrueUSD, is a stablecoin pegged to the value of the US dollar. Staking $TUSD tokens allows you to earn rewards while holding them in support of the network.

- Choose a wallet that supports $TUSD tokens and staking. Options include hardware wallets, desktop wallets, and web-based wallets.

- Look for a reliable staking platform that supports $TUSD staking. After staking, regularly monitor your staked $TUSD tokens and track your rewards.

TrueUSD ($TUSD) has made a name for itself as a solid stablecoin by providing users with an easy and secure way to transfer money. $TUSD strives to ease the worries about stablecoins. It is backed by USD cash in escrow accounts and boasts a straightforward collateralization procedure. TrueUSD enables users to stake their tokens and generate passive revenue, increasing its appeal.

TrustUSD: What is it?

TrueUSD debuted at the beginning of 2018. It was intended to be a straightforward, trustworthy stablecoin. Because of this, it doesn’t employ any unique algorithms or hidden bank accounts.

The US dollars held by TrueUSD are split among several bank accounts held by several trust corporations. The parties involved have a contract requiring them to publicize the collateralized holdings daily and hold monthly audits. The token uses several escrow accounts to reduce counterparty risk and give holders legal protection from theft.

TrueUSD was developed to:

1. Exchanges and traders. TrueUSD is a fantastic instrument for market entry without first purchasing BTC or ETH and as a hedge against market volatility.

2. Mainstream business. Businesses and regular people can benefit from blockchain technologies’ advantages without being subjected to significant price volatility.

3. Developing nations. Stable currencies can be used in developing markets for commerce.

4. Long-term financial agreements, such as loans, contracts for employment, or futures markets.

$TUSD – How it works

Asset-backed stablecoins and algorithmic stablecoins are the two main categories of stablecoins. The most popular stablecoins in the past have been fiat-backed stablecoins like USDC and USDT.

Many people have lost faith in these stablecoins due to the catastrophic collapses of other stablecoins, such as the algorithmically backed UST stablecoin. All $TUSD tokens are backed by the same amount of collateral, making the $TUSD stablecoin a part of the asset-backed stablecoin family. All $TUSD tokens held in multiple escrow accounts are secured by USD cash.

The TrustToken platform will always allow for the direct creation and redemption of $TUSD tokens. When you exchange $TUSD tokens for US dollars, the exchange rate is always 1:1. The production of $TUSD tokens is relatively straightforward and may be accomplished in one of two ways:

Tokens for the $TUSD currency can be created on any market that lists the token. $TUSD coins are on some of the most well-known exchanges, including Binance, KuCoin, and Huobi.

Directly from the TrueUSD website, Mint – Users must first provide identity details to validate their accounts. Following that, consumers must enter their BEP-2 or ERC-20 wallet address and send money from their bank account to the address listed in the app. TrueUSD tokens will be delivered to the users’ appropriate wallet addresses once the money has been wired.

What purpose does TrueUS serve?

Like other stablecoins, TrueUSD is frequently used as a transferable value medium. The idea behind stablecoins is to offer a straightforward and reliable method of transferring value to others.

The specific asset behaves similarly to a US dollar coin, effectively a digital dollar. A program called TrustToken allows users to create tokenized crypto assets. The company’s website provides examples of its desire to tokenize many types of assets, including small enterprises, timeshares, rental properties, oil, movies, music, and patents.

TrustToken is a motivated and skilled team of experienced individuals from Stanford, UC Berkeley, PwC, Google, and Palantir. Four co-founders make up the basis of the business: product strategist Tory Reiss, CEO Danny An, CTO Rafael Cosman, and COO Stephen Kade.

How to stake TrueUSD

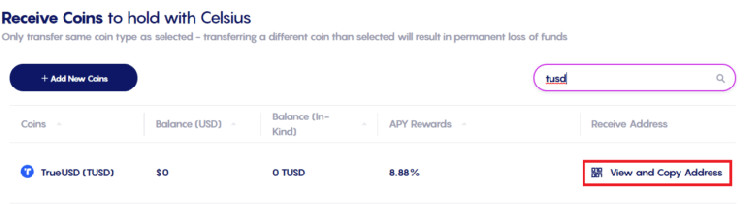

1. Create a new account

You must transfer the necessary sum to qualify for the Celsius sign-up bonus.

2. Your dashboard will be visible once your account is set up.

3. Select “Add New Coins” from the “Receive” menu. TrueUSD will appear on your coins list after you add it. Go to “View and Copy Address” and click.

4. Submit your TrueUSD to the address given.

5. You’re done after getting your TrueUSD! Interest will start building up immediately, and awards will be given weekly.

Where to Buy $TUSD

$TUSD tokens are frequently traded on the majority of centralized crypto exchanges. You must first deposit fiat currency onto an exchange to buy TrueUSD; your exchange-based digital wallet will be credited with $TUSD tokens.

Holders of tokens can move their tokens to appropriate wallets, but this isn’t financial advice. However, users can use various decentralized services to generate interest in their tokens. TrueUSD coins can be purchased, sold, and stored on several exchanges, including:

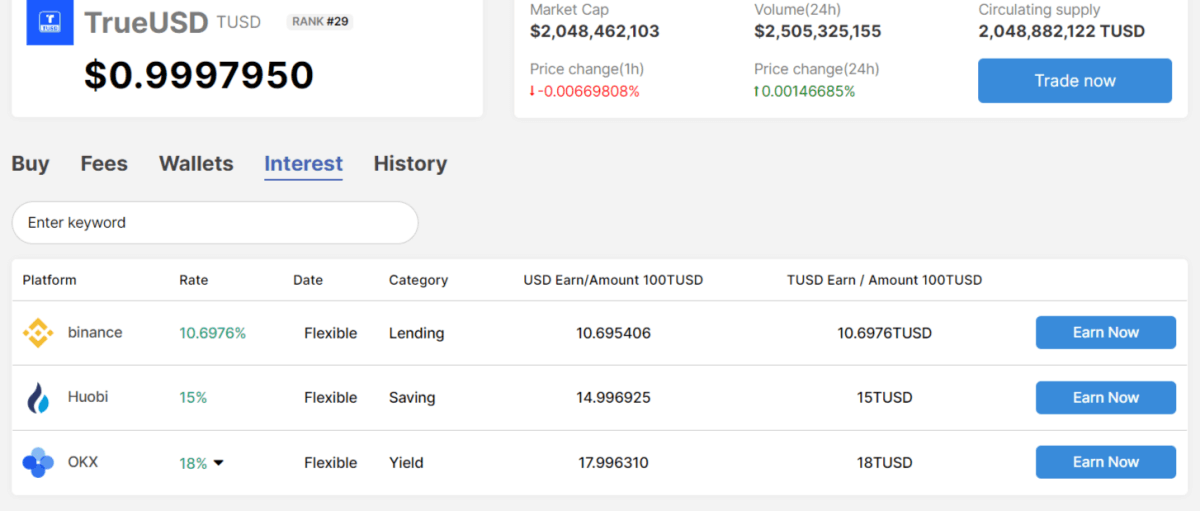

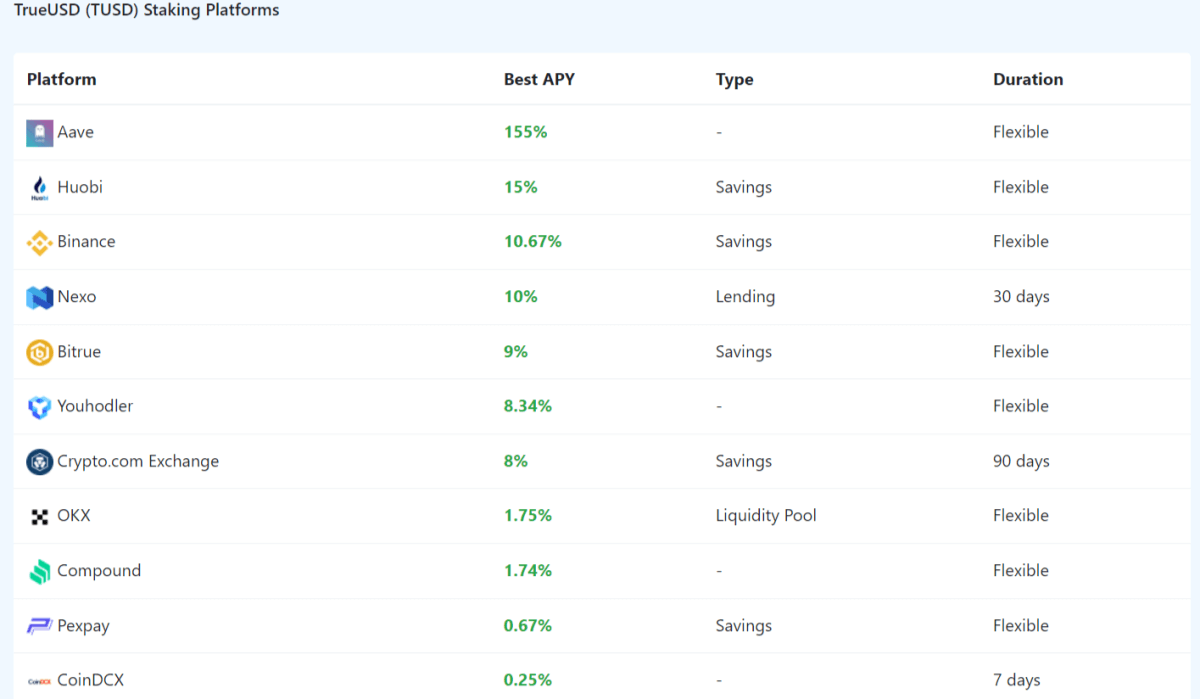

You can earn TrueUSD by staking on the following exchanges:Aave, Binance, Bitrue, CoinDCX, Compound, Crypto.com Exchange, Huobi, Nexo, OKX, Pexpay.

cryptopolitan.com

cryptopolitan.com