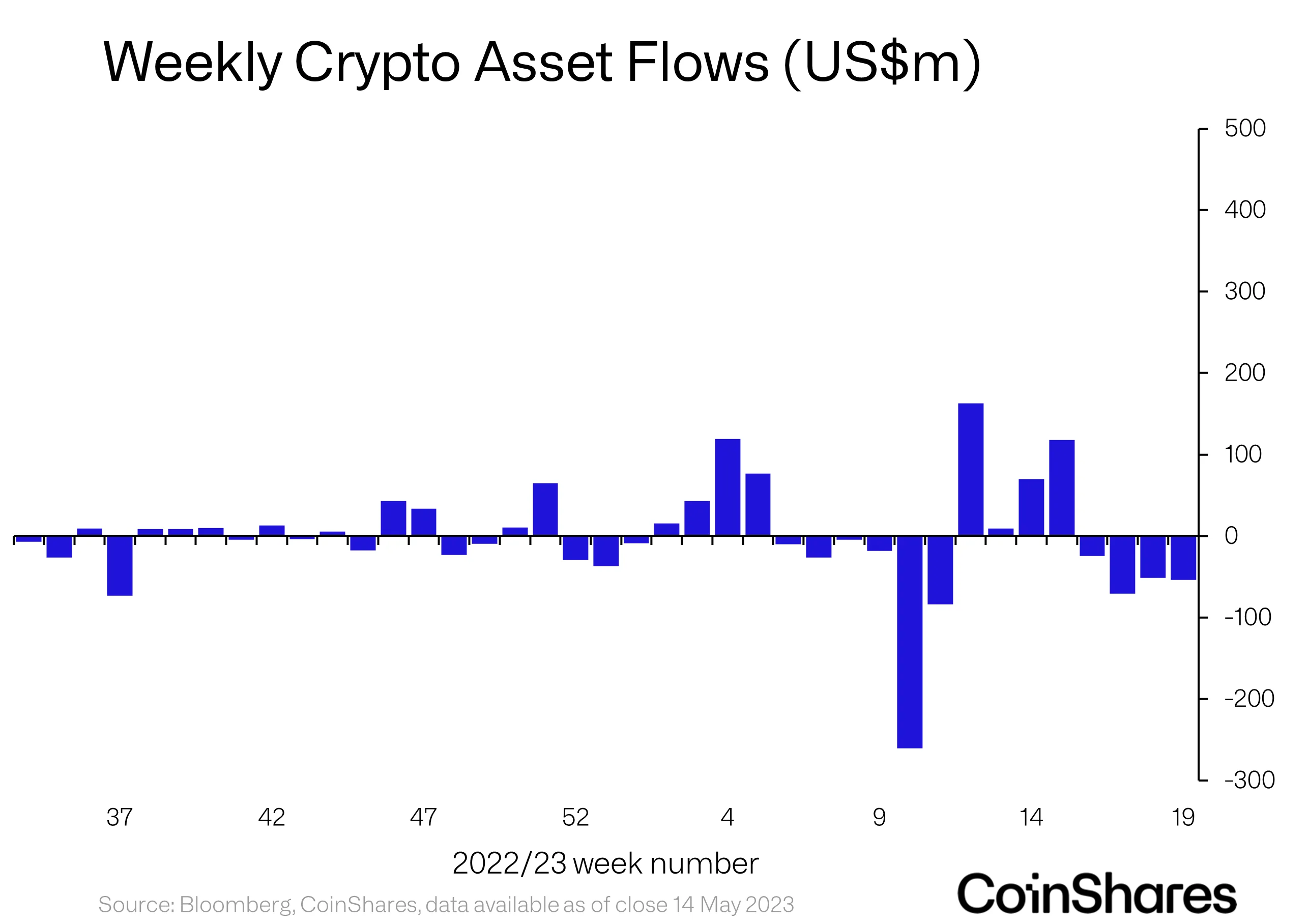

Digital assets manager CoinShares says institutional investors continue to have a bearish sentiment about the market as crypto suffers major outflows for the fourth week in a row.

In its latest Digital Asset Fund Flows Weekly Report, CoinShares finds that institutional investors sold off $54 million in crypto holdings last week for a fourth consecutive week of outflows.

“Digital asset investment products saw a 4th consecutive week of outflows totaling US $54 million, bringing the total outflow to US $200 million, representing 0.6% of total assets under management (AuM). The recent price declines have seen total AuM fall by 13% since their mid-April peak.”

King crypto Bitcoin (BTC) suffered the brunt of the outflows, totaling $38 million, according to CoinShares.

“Bitcoin saw outflows totaling US$38 million, with the last four weeks of outflows now totaling US $160 million. This represents 80% of all outflows over the period, when combined with short-bitcoin outflows they represent US $201 million highlighting that the recent investor activity has almost solely been focussed on the asset.”

While multi-asset investment products, those investing in more than one digital asset, suffered outflows of $7 million last week, Cardano (ADA), Tron (TRX) and The Sandbox (SAND) products raked in inflows of $0.5 million, $0.23 million and $0.2 million respectively.

“Unusually, inflows were seen across 8 different altcoin assets, suggesting investors are becoming more adventurous, and selective.”

Ethereum (ETH) products also took in $0.1 million in inflows.

dailyhodl.com

dailyhodl.com