Early Friday, the US Treasury Department convened an unscheduled and closed meeting of the Financial Stability Oversight Council. Established in the aftermath of the 2008 Great Financial Crisis, the FSOC’s impromptu gathering again fuels the fire of banking contagion.

What is the monetary framework available to these institutions?

A Brewing Financial Crisis

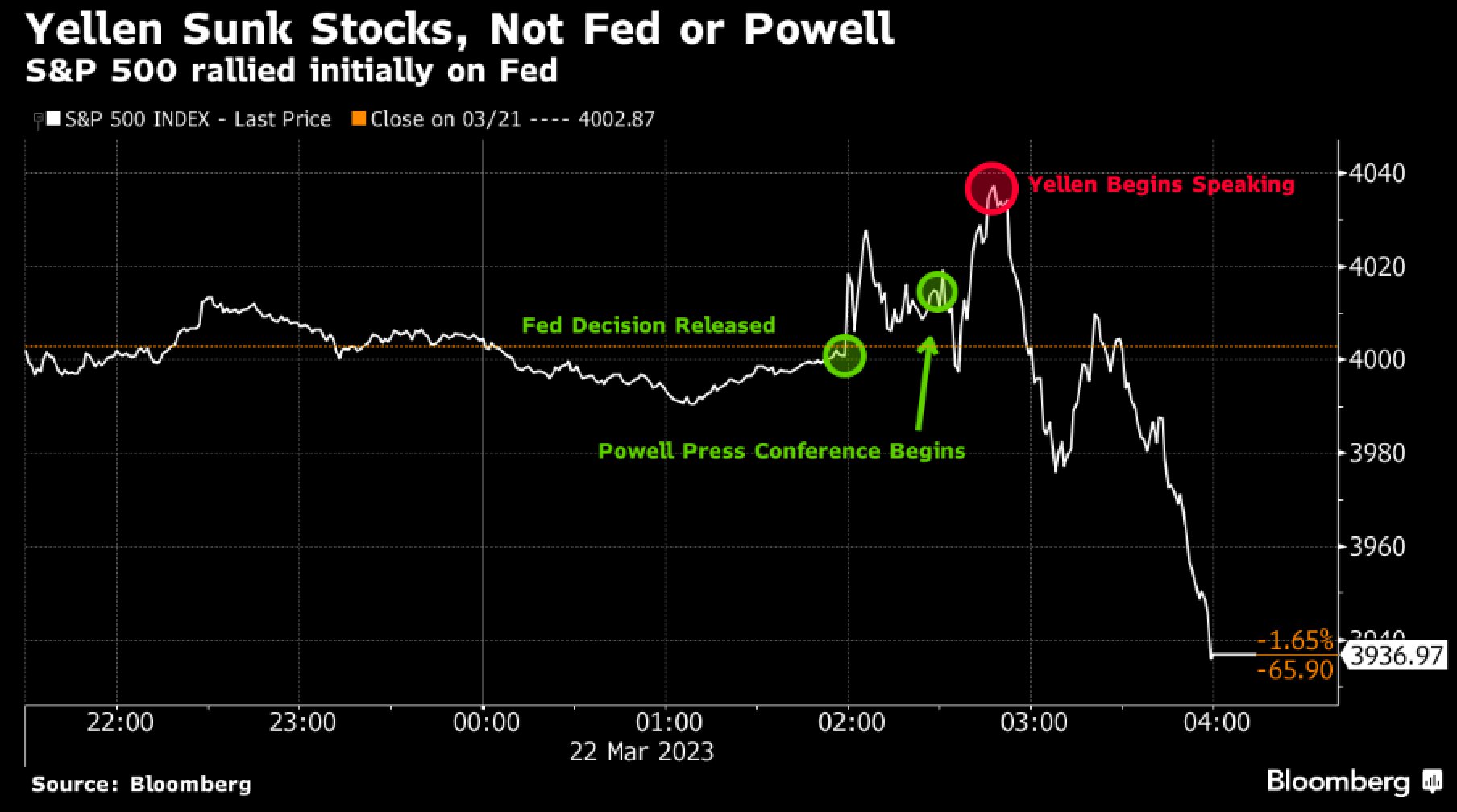

US Treasury Secretary Janet Yellen has been on a media tour this week. On Wednesday, before the Senate Appropriations Committee, Yellen committed a big blunder. She stated, “I have not considered or discussed anything having to do with blanket insurance or guarantees of deposits.”

This contradicted Yellen’s statement on Tuesday before the American Bankers Association, saying that “similar actions could be warranted if smaller institutions suffer deposit runs that pose the risk of contagion.”

A week prior, Yellen said Americans “can feel confident” about their deposits. As one would expect, this messaging clash caused stock market turmoil.

On Thursday, Yellen’s modified remark reverted to the previous stance: “we would be prepared to take additional actions if warranted.” One example would be the coordinated effort to inject up to $70 billion in liquidity into the First Republic Bank.

Following the gaffe-correcting measure, Yellen summoned an unscheduled and closed-doors Financial Stability Oversight Council (FSOC) meeting on Friday. Established in 2010 as a part of the Dodd-Frank Wall Street Reform and Consumer Protection Act, FSOC consists of 10 voting members hailing from these governmental bodies:

- Chair of the Council (Treasury Secretary)

- Chairman of the Federal Reserve System

- Comptroller of the Currency

- Director of the Consumer Financial Protection Bureau

- Chairman of the Securities and Exchange Commission

- Chairperson of the Federal Deposit Insurance Corporation

- Director of the Federal Housing Finance Agency

- Chairman of the National Credit Union Administration Board

- Independent member with insurance expertise appointed by the President and confirmed by the Senate

- Independent member with financial market expertise appointed by the President and confirmed by the Senate.

Although the FSOC meeting was closed, as it addressed the delicate nature of fractional reserve banking, what framework can contain the banking contagion?

Why Did the Banking Crisis Begin?

In 2012, the current Fed Chair, Jerome Powell, was just a member of the Fed Board of Governors. At that time, he wrote this:

“Meanwhile, we look like we are blowing a fixed-income duration bubble right across the credit spectrum that will result in big losses when rates come up down the road. You can almost say that that is our strategy.”

This is one of the underlying reasons why Silicon Valley Bank went under. As the Fed started raising interest rates, the value of fixed-income securities, such as bonds (government debt), decreased. After all, the bond’s coupon rate becomes less attractive than the newly issued ones in a higher interest rate regime.

In turn, the bond’s yield decreases as a return on investment. Concurrently, this leads to the bank’s overall asset value decline. Unfortunately, Silicon Valley Bank lacked a hedge against this exposure risk, such as interest rate swaps and a more diversified portfolio.

This could be because SVB lacked a Chief Risk Officer (CRO) for eight months following the departure of Laura Izurieta last April.

But regardless of this fact, the Federal Reserve seems to expect something to break as a mechanism “to result in tighter credit conditions for households and businesses,” as noted by Powell at Wednesday’s press conference.

What is the FDIC’s Capacity to Contain Contagion?

The US banking system holds around $17 trillion in deposits, according to the latest academic paper on banking fragility. Of that amount, $7 trillion remains uninsured by the FDIC’s $250k threshold standard or 41.18%.

“Even if only half of uninsured depositors decide to withdraw, almost 190 banks are at a potential risk of impairment to insured depositors, with potentially $300 billion of insured deposits at risk.”

Due to the fastest hiking cycle in recent history, to combat inflation resulting from the Fed’s +39% M2 money supply increase, US banks’ assets declined by ~10% in value. As of December 31, 2022, FDIC reported having just $128.2 billion. This means that FDIC can only ensure 1.28% of $10 trillion in insured deposits.

This is the essence of the ‘fiat’ system, running on the concept of trust. If that trust is eroded, such a system becomes exceedingly fragile. In the aforementioned paper, researchers point to even small turbulence as sufficient kindling.

“If uninsured deposit withdrawals cause even small fire sales, substantially more banks are at risk.”

Seeing the encroaching danger, hedge fund billionaires like Bill Ackman are urging the authorities to go to unprecedented measures to make all deposits implicitly guaranteed, which Yellen implicitly hinted at.

Yesterday, @SecYellen made reassuring comments that led the market and depositors to believe that all deposits were now implicitly guaranteed. That coupled with a leak suggesting that @USTreasury, @FDICgov and @SecYellen were looking for a way to guarantee all deposits reassured… https://t.co/GqaP5LYpza

— Bill Ackman (@BillAckman) March 22, 2023

This is also why Yellen’s fumbling, through incoherent position reversals, has such a high volatility potential. Even if the US Treasury does not intend to provide “blanket insurance,” as Yellen noted on Wednesday, saying so would be powerful in a system run on governed trust.

Of course, when push comes to shove, the Federal Reserve can digitally print infinite amounts of money to backstop everything, but that would only lead to hyperinflation.

tokenist.com

tokenist.com