We have finally seen the end of catastrophic 2022 when the whole crypto market saw multiple massive crashes. At the end of 2022, things stabilized a bit and the market started to see some growth, but there were still some bad periods mixed as well. Continuing into 2023, this has not changed and things are still up and down.

While big cryptocurrencies such as Bitcoin and Ethereum don’t have huge spikes in value and have been on a constant but slow rise after falling drastically in early 2022, other cryptocurrencies inside the top 30 all have their highs and lows, with prices having high volatility for most of these tokens. If we ignore stablecoins and pegged tokens, this was a perfectly even month, with 12 cryptocurrencies inside the top 30 seeing positive gains, while 12 have managed to lose some value. Most of these tokens are close to 1% - 3% changes and they can jump ship at any time. But today we are not interested in these tokens, today we will be taking a look at the top 5 gainers and losers of February to see which cryptocurrencies have performed the best and which have disappointed the investors the most.

Top 5 Gainers

As we mentioned earlier, 12 cryptocurrencies, excluding stablecoins, inside the top 30 have managed to gain value in February. Almost half of these tokens have seen very small gains in the range of 1% - 3%, while there were a few tokens that have seen double-digit increases. So which of them have performed the best?

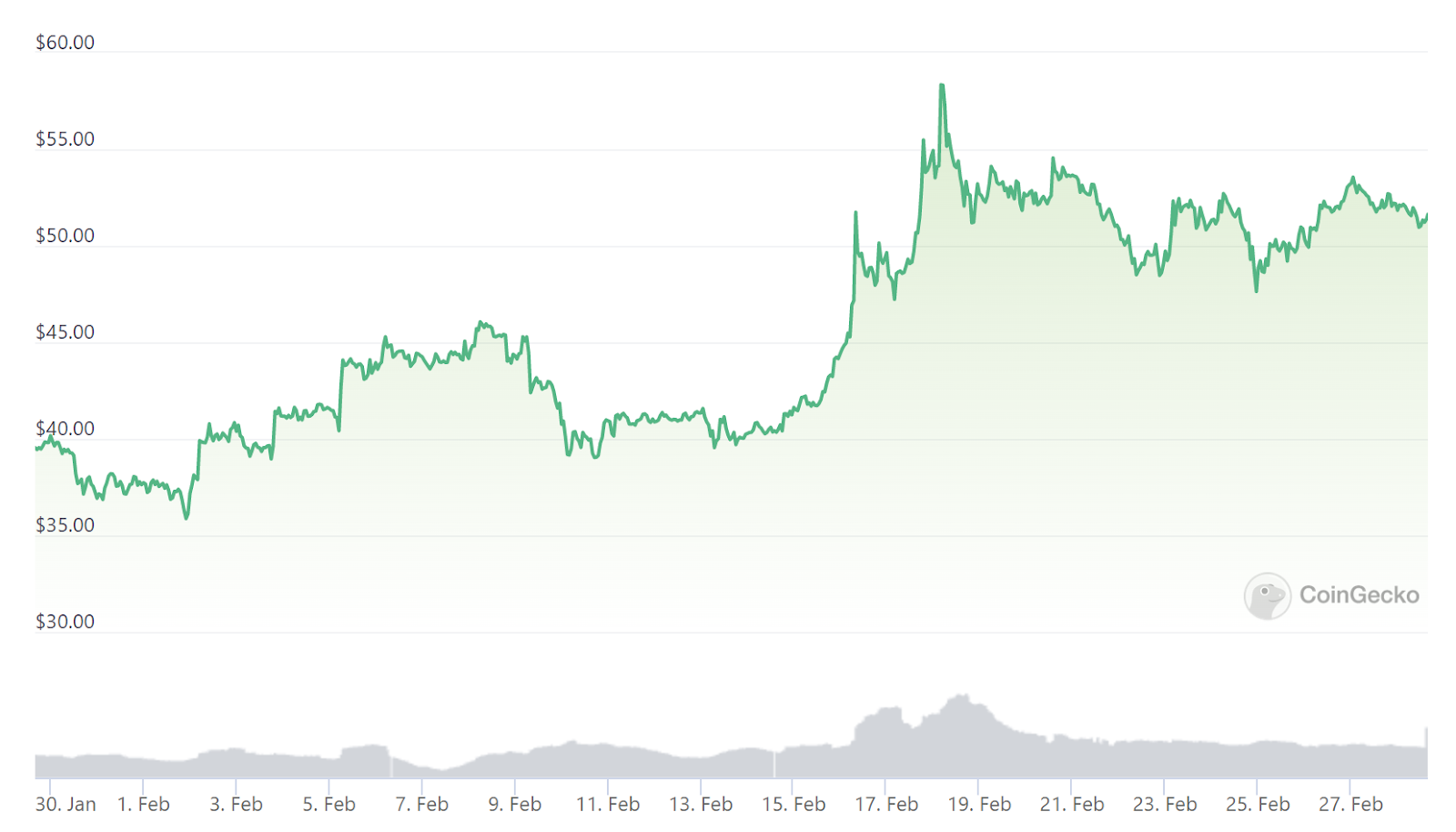

OKB +46.3%

For the past few months, OKB has constantly been one of the fastest-growing cryptocurrencies on the market. OKB is the native currency of the crypto exchange OKX which has been growing in popularity, especially after the FTX collapse. When it comes to why OKB has risen so much in value, there is no single factor we can associate with it and it has simply been following the success of OKX. Just last month OKB went from $27 to $38 and this rise continued into February as well, with token going all the way to the $51 mark. But people still look at this token with skepticism as what happened with FTX is still in everyone's mind, but this worry was removed when OKX made their reserves public and anyone can see how much exchange holds.

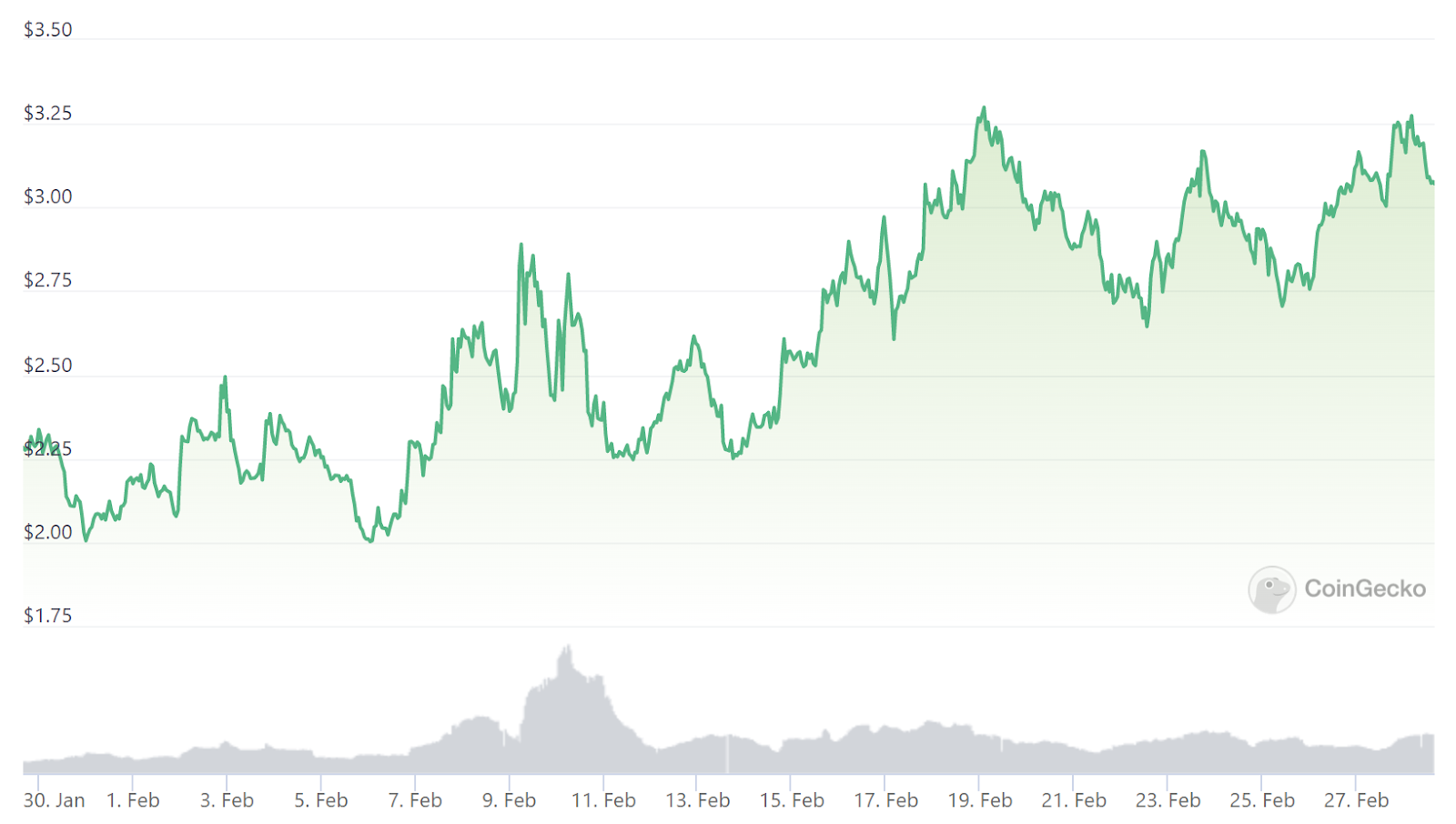

Lido DAO +36.3%

This is a cryptocurrency that not many will know, and it should not be surprising. Occupying the 28th spot by market capitalization this is the cryptocurrency of the Decentralized crypto-staking platform Lido. When it comes to reasons why this token has seen such growth in February can be attributed to a few things. This is one of the largest Ethereum staking platforms, with over $9 billion worth of Ethereum staked on the platform. Ethereum is having a relatively quiet month, but things will change soon as a much anticipated Shanghai update is coming up soon, which prompted more people to stake their crypto on Lido and the price of their native currency has seen positive effects. This rise in value was also helped by recent crackdowns on centralized exchanges, as more and more regulations are being placed on these exchanges, some people started to migrate to decentralized platforms and Lido has benefited from it as well.

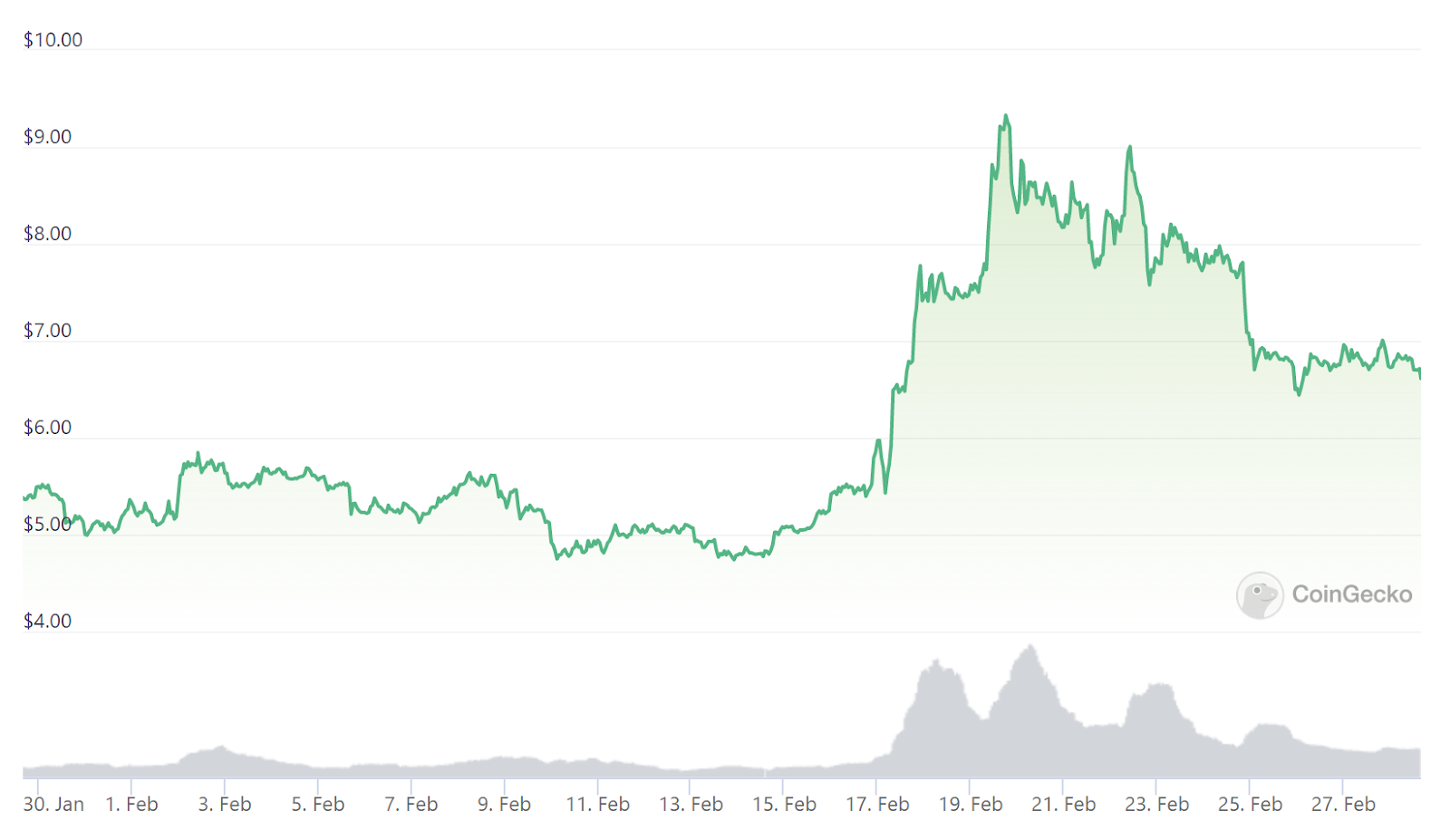

Filecoin +33.7%

Another lesser-known cryptocurrency that has managed to see big gains in February is Filecoin. This is an open-source cryptocurrency used as a digital payment method and the rise of this token is associated with recent developments. Filecoin has announced the launch of new software that will introduce smart contracts on the network. Because of this, the price of this token has gone from $5 to just above $7, and in between, it hit the peak value of $9.25, which was the highest valuation of the token after it crashed in May of 2022. No one knows if this growth will continue, but as things stand, Filecoin has seen a good rise in value.

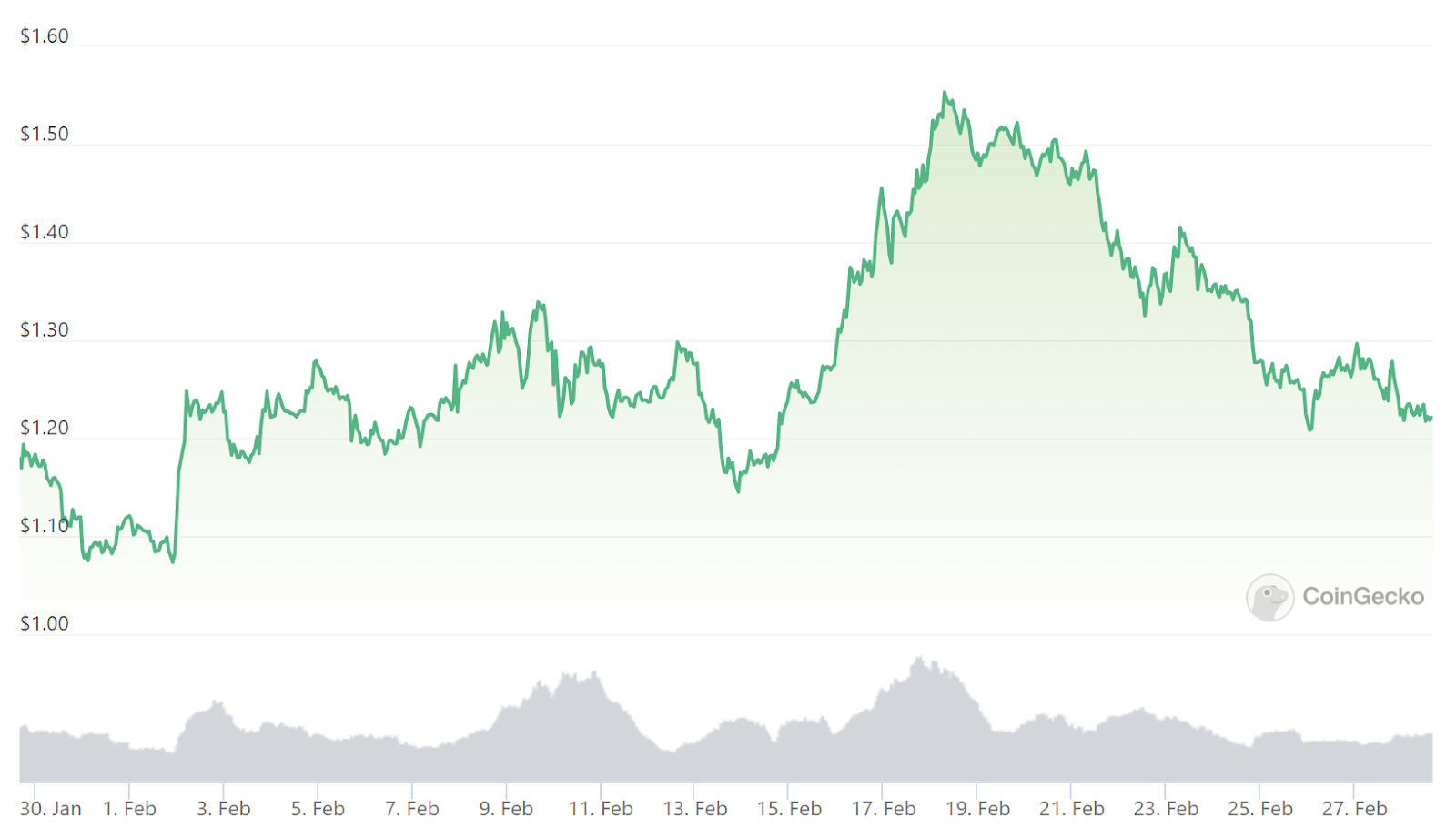

MATIC + 11%

For the last few months, we have been seeing the resurgence of MATIC, after it lost quite a bit of value last year. This month was another good month for MATIC with the price going up by around 11% but the reason for this happening is not associated with anything special or significant. Looking at technical indicators, the signs show that there is a bullish run and we should expect this run to continue. At the start of February MATIC was trading for around $1.08 and it closed the month with a value of $1.24, it also managed to reach $1.55 in mid-February and it was MATIC's highest valuation since April 2022.

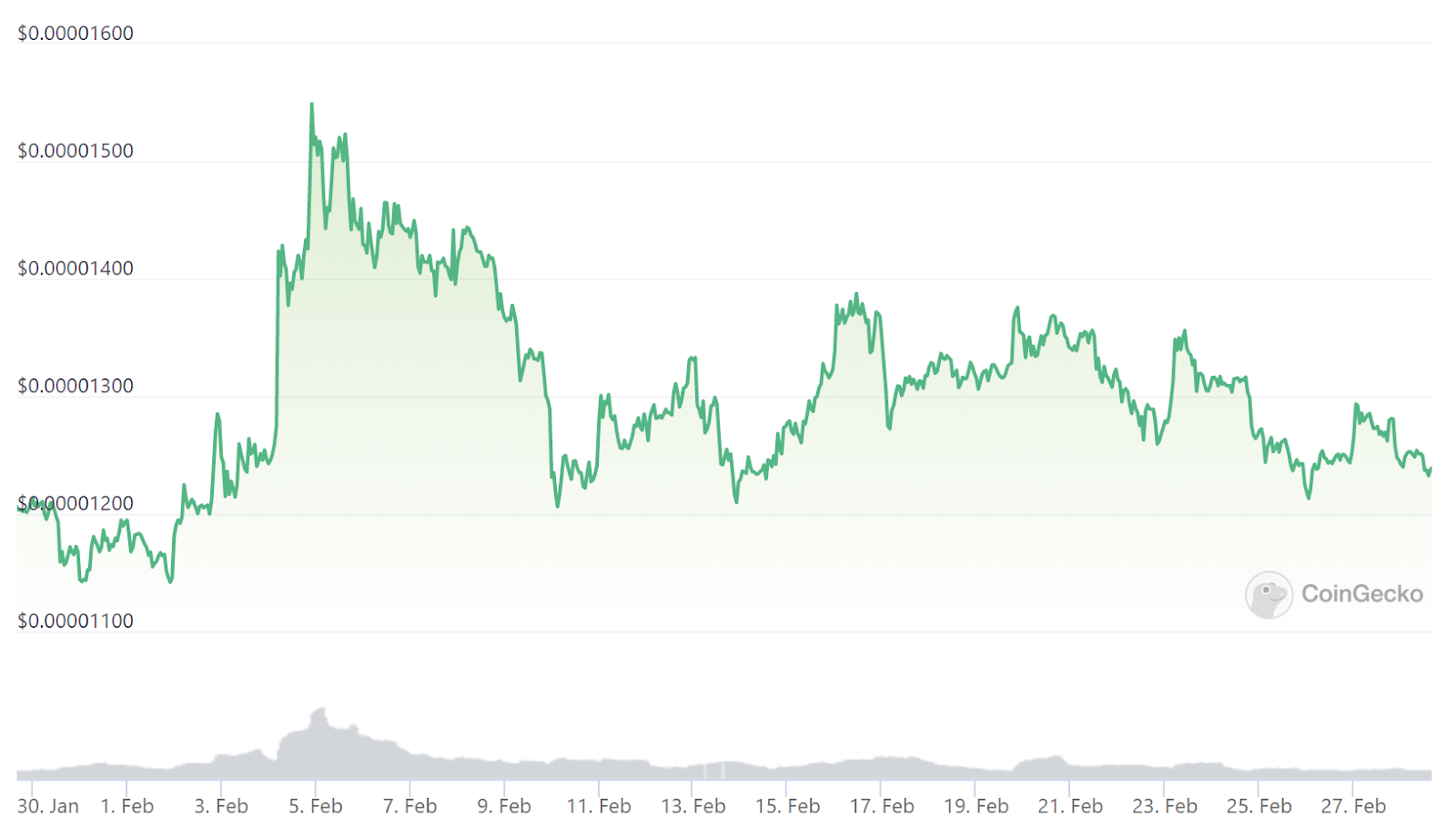

Shiba Inu +9%

The 5th token that managed to gain the most value in February is Shiba Inu. The reason Shiba Inu grew this month can not be attributed to one specific thing and it was just a simple bullish run. Looking at the charts, the price of Shiba grew significantly at the start of February, when on 5th February it reached its highest value ever since August of last year. But soon after prices started to fall and entered a volatile state. At the end of February price was significantly down from the peak but it still managed to close the month with a 9% increase in price.

Top 5 losers

Just like gainers, we had 12 cryptocurrencies inside the top 30 that managed to close the month lower than they started. Most of these changes were in 4% - 5%, but we also had tokens that lost more than 15%. But all in all, it was a relatively good month and the losses suffered were not significant, especially if we compare them to what was happening last year. Now let’s take a look at the top 5 tokens that lost the most in February.

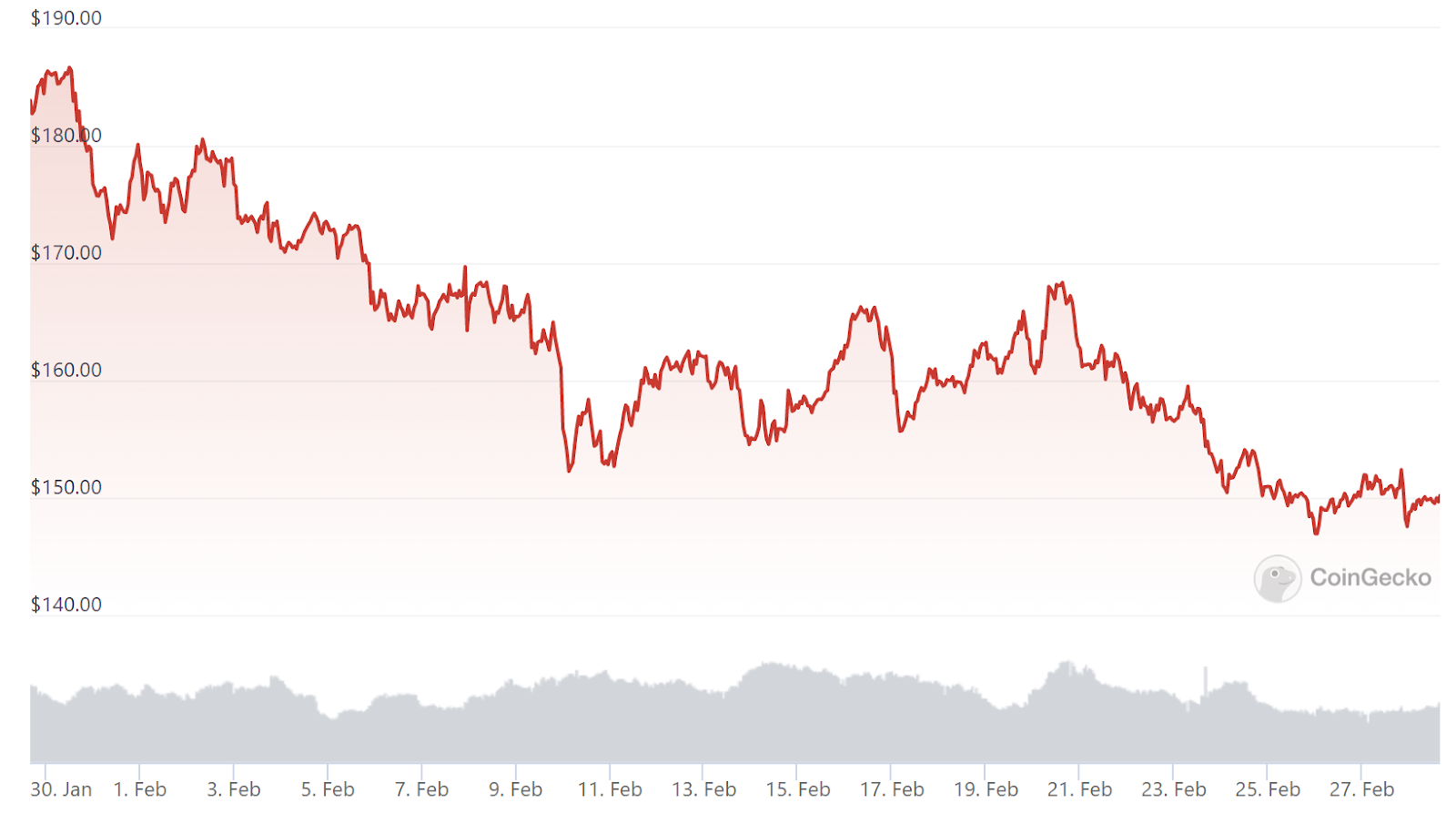

Monero -19.4%

Monero is the biggest loser inside the top 30 cryptocurrencies by market capitalization, managing to lose more than 19% of its value in February. It has been a rough up-and-down period for Monero ever since the crypto crash that happened early last year. Coming into this year, Monero had a relatively good start, going from $147 to $186, but once February rolled around everything changed. Prices started to drop from the start of February and entered high volatility, and in the end, the price had a significant drop, finishing the month exactly where it started the year with a valuation of around $147. There is no reason that can be pointed out for this drop, and it was a simple bearish run after investors started to sell to take out profits made in January.

LEO Token -13.6%

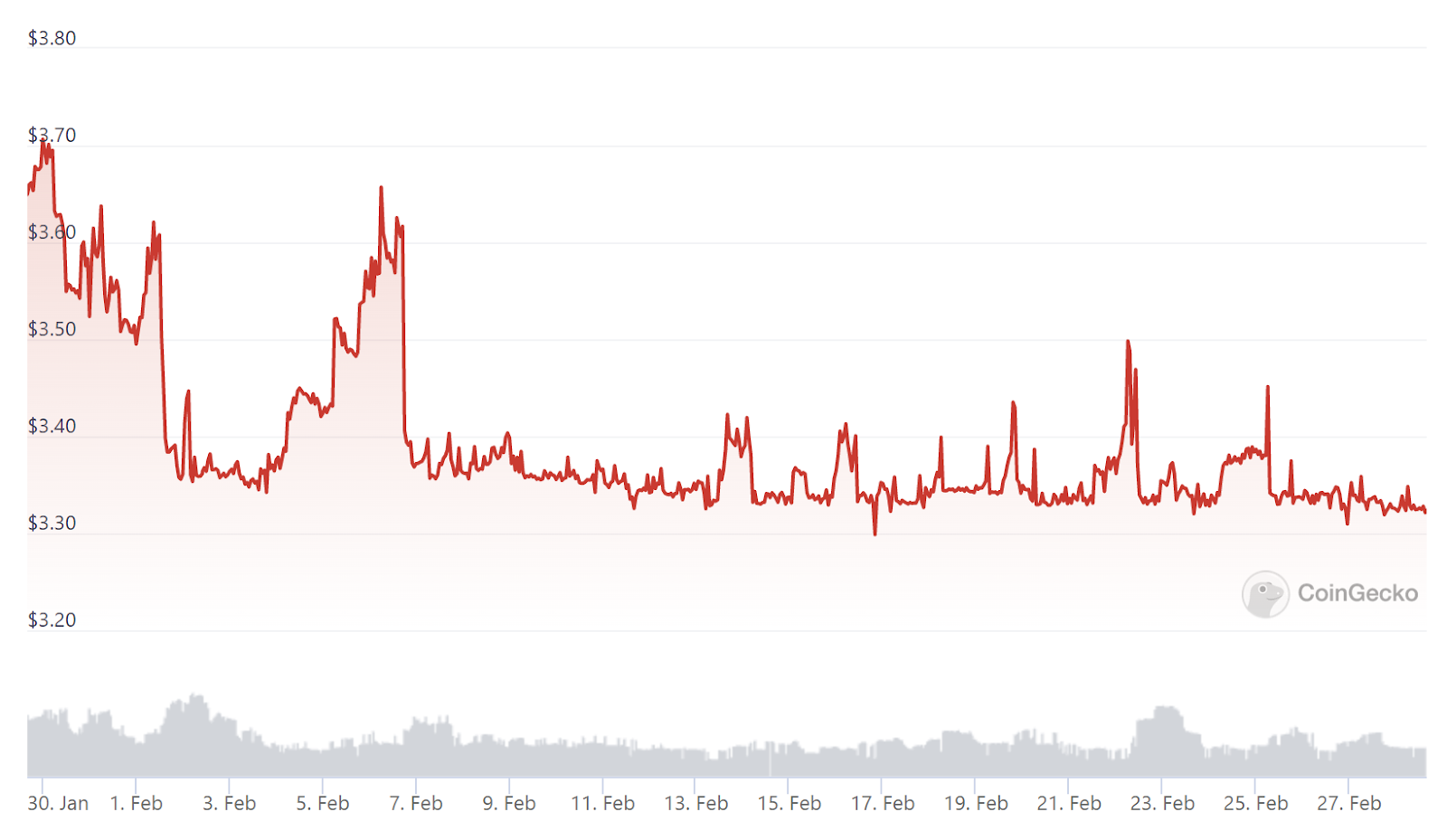

When talking about volatility, LEO Token should come to most people's minds. This is a utility token that is being used in the iFinex ecosystem, most commonly on the Bitfinex exchange. In January LEO was also in a volatile state, but at the end of the month it managed to spike in value and some thought a bullish run was coming. But coming into February prices suddenly started to drop, before showing one more spike. But just like before, the value of the token started to drop again and entered a volatile state. When looking at the chart, you might think it is someone's heartbeat reading rather than a cryptocurrency chart. But while being volatile, the volatility is not massive, meaning that the price goes up and down each day but the changes are not that significant. This is a cryptocurrency that can be very beneficial for traders who are looking for volatile assets, while investors should look elsewhere for investment opportunities.

Avalanche - 13.4%

The third loser of the month is Avalanch as it managed to lose almost the same amount of value as did LEO Token. But saying that Avalanche lost the value without giving a good fight will be wrong. Entering February Avalanche was on a downward trend, but soon after it picked up value by going from $18 to $22.50. This peak was not long as soon after price started to drop again, going all the way down to $17. But as we mentioned Avalanche did not go down without a fight, and once again it started to gain momentum and the price rose once again, reaching $21.30 by the later stages of February. After this, it once again started to drop and ended the month with a value of $17.40. Because of the way this token behaved in February, there is no one major thing that played a role in this and traders should not be surprised to see Avalanche rise in value at the beginning of March.

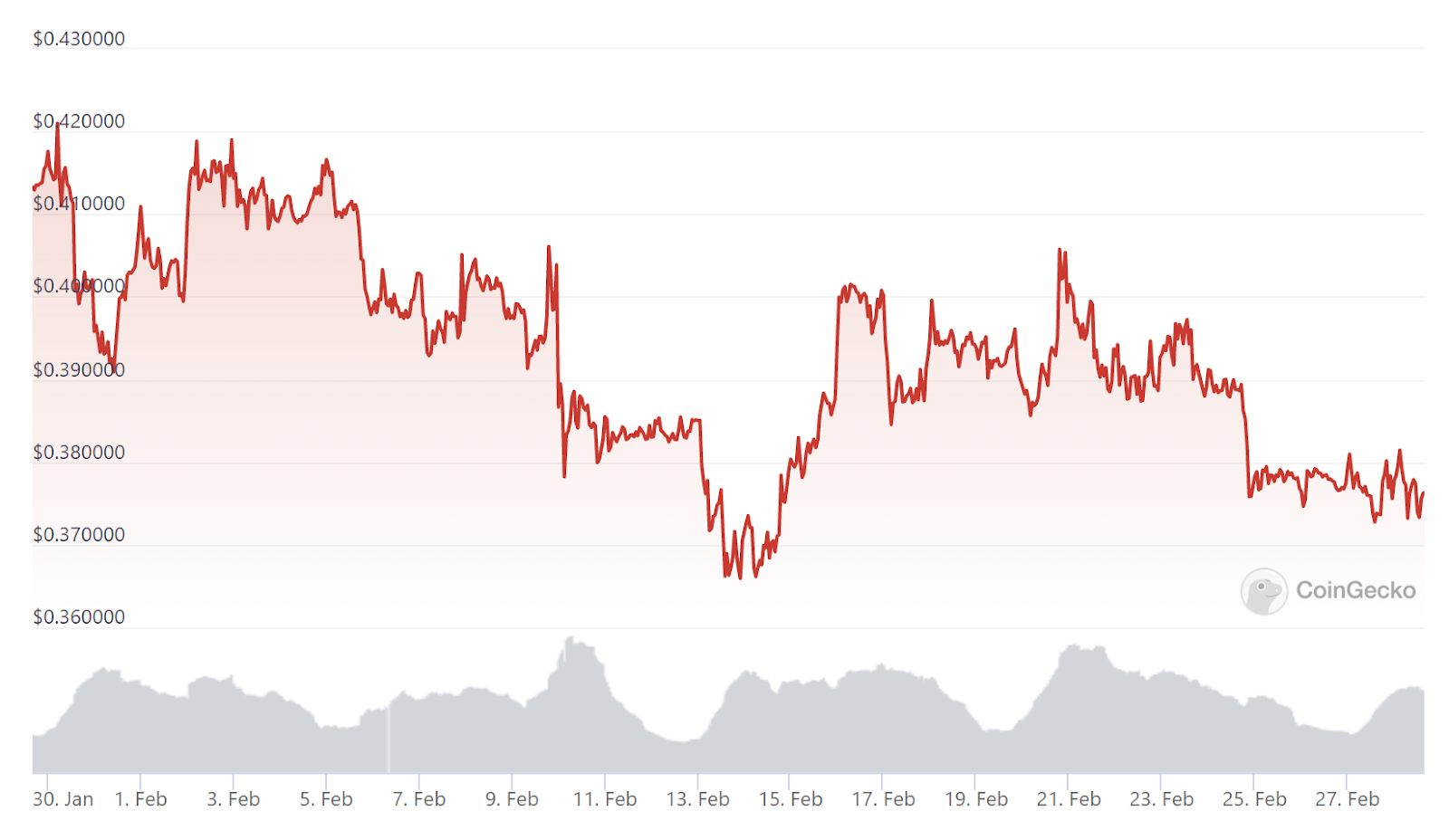

XRP -8%

When it comes to Ripple and its cryptocurrency XRP it has not been a great month but in general things are looking good for this token. At the start of the year, XRP was trading for $0.32 and has risen significantly in the first month of the year, closing January with a value of $0.42. But once February rolled around prices started to drop again and XRP went down to $0.34. From there it picked up the pace and had a small rise in value to then drop once again and it closed February with a valuation of $0.37. This was not caused by anything significant and was the product of market trends, and because of this, some people expect that XRP is going to go once again and show positive gains at the beginning of March.

Doge -7.3%

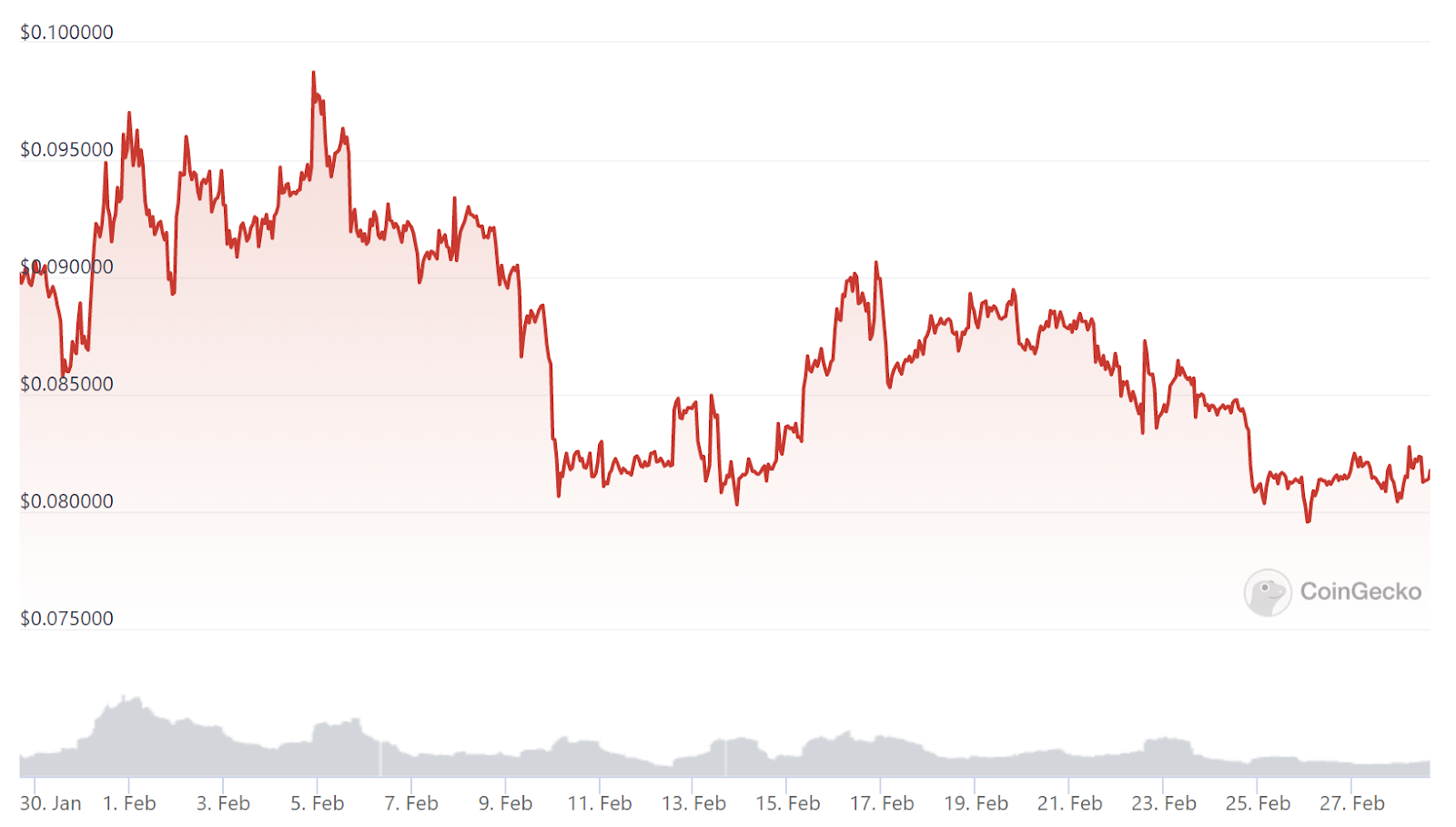

The 5th token that lost the most during February is everyones beloved meme token, Doge. Doge has been going strong during the later parts of 2022, before suffering losses in December. After this, it somewhat recovered in January when the price went from $0.069 to $0.095. But once February rolled around Doge went into a volatile state and the price has been going up and down during the first 9 days before suffering a big loss. After this token tried to recover and the price started to grow once again before crashing once more and ending the month at $0.081. Doge has somewhat lost a meme token status, but it is still a volatile token that shows constant rises and falls with no apparent reason. If we wish to see this token grow in March, we need to expect something to happen in social media that will put the spotlight on Doge and help raise the price.

Final Thoughts

February was an okay month for cryptocurrencies. Excluding stablecoins and pegged tokens 12 tokens have managed to gain value and 12 have managed to lose it inside the top 30 tokens by market cap, making it an even month. Looking back at last year, we can even say that this was a relatively good month for cryptocurrencies as no major crashes happened and Bitcoin even almost managed to break the $25,000 mark. Going into March a lot is expected to happen in the crypto space and especially with Ethereum as the Shanghai update is expected to roll out sometime in March. With this update, Ethereum staking rewards will be available for withdrawal and this will have a significant impact on the market. It can raise the price of Ethereum significantly but it can also have a negative impact as a lot of people might start selling Ethereum they earned from staking, all that is left for us to do is wait and see.

cryptonews.net

cryptonews.net