Digital assets manager CoinShares says large institutional investors are being more selective this year, pouring money into Ethereum (ETH), Polygon (MATIC) and one ETH competitor last week.

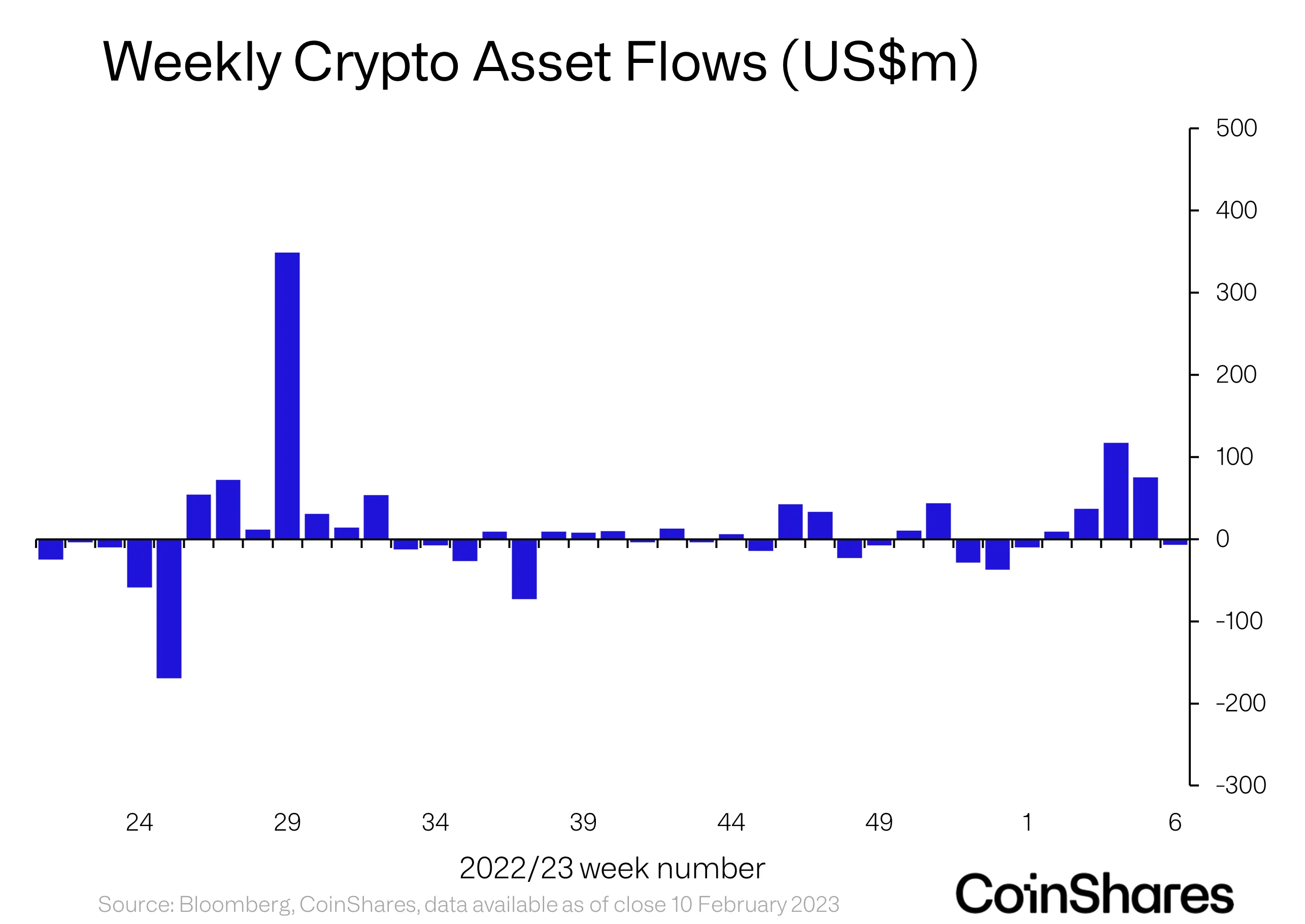

In its latest Digital Asset Fund Flows Weekly Report, CoinShares finds that institutional digital asset investment products suffered minor outflows last week despite specific altcoins enjoying inflows.

“Digital asset investment products saw minor outflows totaling US$7m last week following a week of macro data that significantly beat expectations to the upside…

Investors seem to be more discerning this year, with select coins performing well, while overall 10 altcoins saw inflows last week totaling US$4.8m.”

CoinShares says the overall minor outflows may be associated with investor fears surrounding potential interest rate hikes from the U.S. Federal Reserve.

Both long and short-Bitcoin (BTC) investment products suffered outflows last week.

“The focus was primarily Bitcoin, which saw outflows totaling US$10.9m, although there were also outflows from short-bitcoin investment products totaling US$3.5m.”

Ethereum investment products raked in $5.1 million in inflows last week while MATIC products took in $0.4 million. Ethereum rival Solana (SOL) products enjoyed $0.8 in inflows last week while fellow ETH rival Cosmos (ATOM) investment vehicles took in $1.8 million. While 10 different altcoin investment products saw inflows last week totaling nearly $5 million, multi-coin investment products, those investing in a basket of digital assets, suffered outflows for the 11th week running.

“Multi-asset investment products saw outflows totaling US$2.4m last week, representing the 11th consecutive week of outflows. Investors seem to be more discerning this year, with select coins performing well, such as Ethereum with inflows of US$5.1m last week…

10 altcoins saw inflows last week totaling US$4.8m.”

dailyhodl.com

dailyhodl.com