Ethereum is adding new wallets at a record pace while recovering from last month’s dump. Over the past week, the network recorded about 327,100 new Ether wallets being created per day. Fresh on-chain data shows Sunday set a new high with roughly 393,600 wallets created in a single day. That was the largest daily increase ever recorded for Ethereum.

This comes in when the global crypto market is printing green indexes, led by bulls. The cumulative digital assets market cap surged by more than 4% in the last 24 hours to hit $3.25 trillion mark. Ether price has jumped by over 7% in the past 30 days as Bitcoin safely regained the $95K mark.

Lower fees spark fresh activity on Ethereum

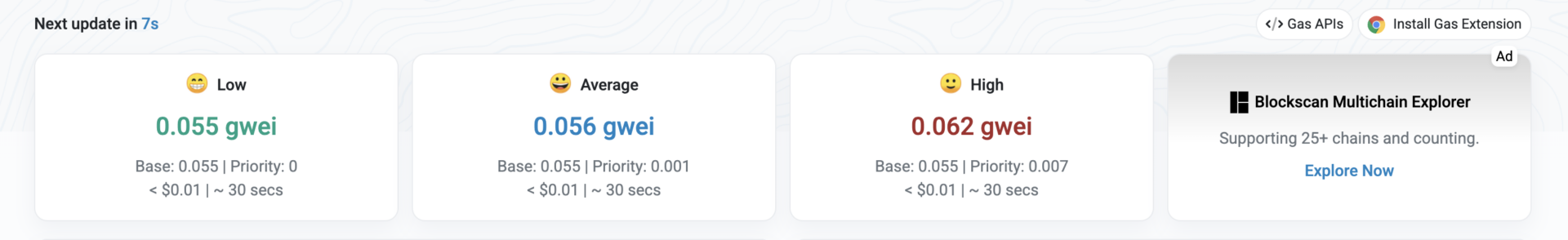

A sudden jump in ETH wallets follows a protocol upgrade that got rolled out in early December. The Fusaka upgrade changed how data is handled on the network. It has lowered costs for L2 systems to post information back to Ethereum. This move has made transactions cheaper and smoother for users on the network. The average gas costs fell to 0.051 Gwei.

A dip in the fees is pumping up the activity for the network. Santiment data shows that the stablecoin transfers on Ethereum reached a record late last year. The total volumes hit about $8 trillion in Q4. Payments and settlement flows at that scale often require new wallets. This suggests that users were bagging ETH when its price dipped, which eventually backed the address growth.

Santiment data mentioned that trends from late December into January also point to new users entering the ecosystem. However, wallets are being created as users explore decentralised finance games and NFT-related applications. It added that seasonal factors may have played a role. Crypto markets often see renewed runs around the turn of the year. Traders and developers tend to reset strategies.

Crypto Fear and Greed Index shows that investor sentiment has turned “Neutral” after spending weeks in the “Fear” territory. Ether had failed multiple times to hold above $3,300 over the past two months. The fresh push has helped ETH to overcome this barrier. Ethereum price surged by almost 8% in the last 24 hours. It is trading at an average price of $3,348 at the press time.

DEX trading pulls back

Activity across decentralised apps seems to be cooling down. DefiLlama data shows that aggregate DEX volumes over the past two weeks totalled $150.4 billion. This number dipped sharply from the $340 billion record set in January 2025. Ethereum seven day DEX volumes have hovered near $9 billion. It went on to peak at $27.8 billion in October.

Derivatives markets also point to calmer conditions. 30-day implied volatility measures tied to Bitcoin and Ether have declined. These indicators reflect hopes for price swings. Lower readings suggest traders are looking for reduced near-term movement. This comes despite ongoing geopolitical risks and shifts in ETF flows.

At the same time, SharpLink Gaming has expanded its exposure to the asset. The company has accumulated more than 865,000 ETH. The stake was valued at about $2.75 billion as of Tuesday. Last week, SharpLink deployed $170 million worth of ether on the Linea layer two network.

cryptopolitan.com

cryptopolitan.com