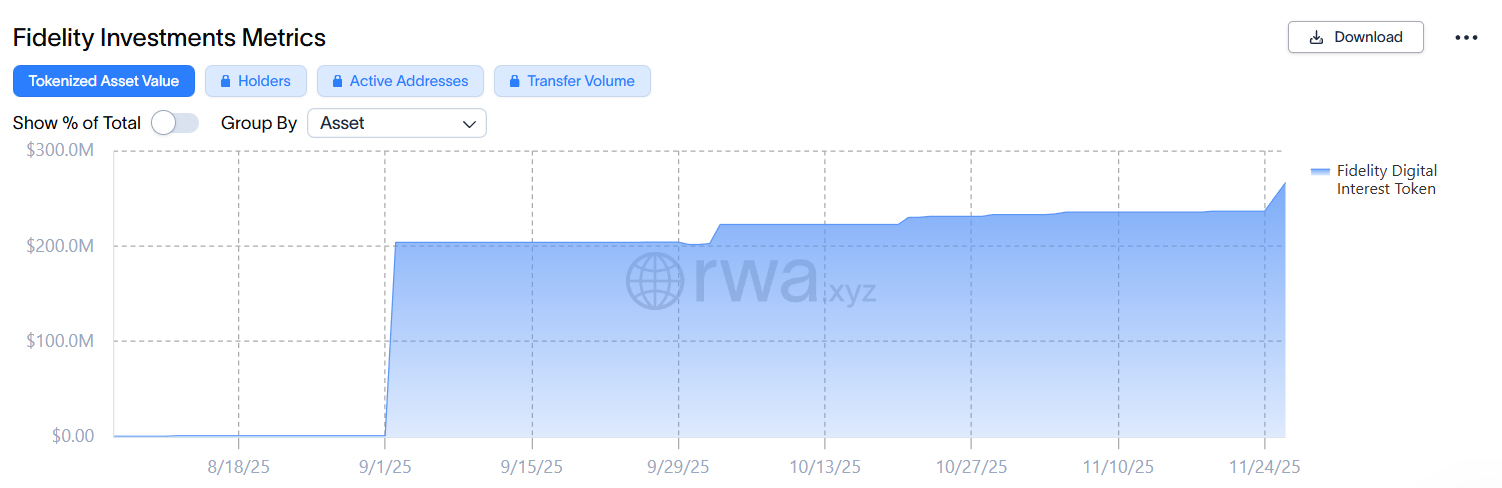

Fidelity’s tokenized money market fund, all of which is on Ethereum, has surpassed $250 million in on-chain value almost four months after its debut.

The fund, known as Fidelity Digital Interest Token (FDIT), is a tokenized share class of Fidelity’s Treasury money market fund, offering on-chain exposure to U.S. Treasury securities and other short-term government-backed instruments.

As of press time, FDIT reached over $266.2 million in represented asset value, up 15% from 30 days ago, according to data from RWAxyz, which tracks tokenized real-world assets.

Fidelity, which entered the tokenized fund space in early September, joined BlackRock, whose BUIDL money market fund is currently the largest product among tokenized RWAs, with $2.3 billion in assets.

The majority of BUIDL's total value was previously on Ethereum, until last month its share on the leading RWA blockchain dropped sharply by 60%, with value becoming more evenly distributed across the fund's other supported blockchain networks.

The Year of RWAs

The total on-chain value of RWAs is now over $36 billion, more than doubling since the start of this year.

The market consists of tokenized U.S. Treasuries, bonds, and private credit. Private credit makes up more than half of the sector's market capitalization, accounting for $18.7 billion. In terms of where these assets are tokenized, Ethereum dominates, holding $11.6 billion in RWAs, or over 63.7% of the sector’s total.

Blockchain oracle provider RedStone predicted in a recent report that total on-chain RWA value will reach as high as $60 billion next year.