Key Takeaways:

- BitMEX’s Arthur Hayes executed a major buy—$6.35M in ETH and substantial positions in LDO, ETHFI, and PENDLE.

- Ethereum exploded past $4,300, underpinned by institutional treasuries and ETF demand surges.

- Technical patterns hint at sustained upward momentum, yet cyclical corrections and overleveraged risks linger nearby.

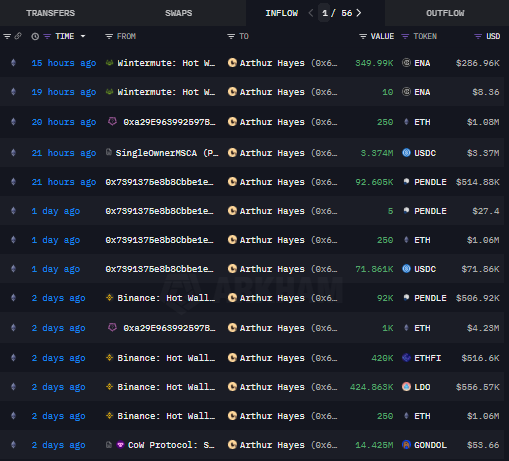

Arthur Hayes, co-founder of BitMEX, made a dramatic U-turn—deploying $8.4 million into crypto. Over the past day, he snapped up 1,500 ETH (~$6.35 million) and substantial allocations of blue-chip DeFi tokens like LDO, ETHFI, and PENDLE. His buying aligns with Ethereum’s breakout over $4,300.

Arthur Hayes’ Aggressive Crypto Accumulation

Hayes purchased 425,000 LDO ($557K), 420,000 ETHFI ($517K), and 185,000 PENDLE (~$1.02M), highlighting renewed conviction.

Arkham Intelligence: Intel Platform – Arthur Hayes

This pivot comes after earlier bearish predictions—reminding markets how quickly sentiment can reverse.

Corporate Demand Lifts Ethereum

Ethereum’s recent surge was supercharged by institutions. BitMine now holds over 833,000 ETH ($3B+), while SharpLink and others have added hundreds of millions more. Collectively, public companies now hold 1.74M ETH ($6.9B), fueling both confidence and price support.

🧵

— Bitmine BMNR (@BitMNR) August 4, 2025

1/

It has been 1-month since BitMine launched ETH Treasury strategy.

2 milestones announced today:

– BMNR now owns 833,137 ETH valued at $2.95 billion

– Bill Miller III announced he has taken a major stake in BMNRhttps://t.co/2w77JQkR8J

Ticker: $BMNR

Moreover, Ethereum ETFs pulled in $461M in a single day, outpacing Bitcoin’s $403M, with BlackRock’s ETH fund alone ending above $11B in AUM.

Over 304K $ETH was added to public treasuries recently.

— CoinGecko (@coingecko) August 8, 2025

In this thread, we cover recent acquisitions from established players like @BitMNR to newer ones like @TheEtherMachine.

Here’s a roundup of who's buying 👇 pic.twitter.com/VljibTy93w

Breaking Patterns, Targeting Five Figures?

Technically, Ethereum has broken out of a long accumulation base—exhibiting textbook breakout behavior from a symmetrical triangle and Wyckoff pattern. Analysts now eye targets between $6,000 and $8,000 in coming months.

#ETH started a buy program. Could see $6k next pic.twitter.com/w8IUZrMDrw

— Lord Hawkins (@lorde_skinwah) August 9, 2025

However, caution remains—ETH has previously corrected from these zones. Open interest and volume spikes suggest broader participation, but also flag potential volatility. Vitalik Buterin’s warning on treasury overleverage further highlights downside risk.

Are ETH Treasuries good for Ethereum?@VitalikButerin thinks they can be:

— Bankless (@BanklessHQ) August 7, 2025

“ETH just being an asset that companies can have as part of their treasury is good and valuable… giving people more options is good.”

But he also issues a warning:

“If you woke me up 3 years from now… pic.twitter.com/W55oUD7Lke

Final Thoughts

Arthur Hayes’ conversion from skeptic to buyer signals high confidence in Ethereum’s direction. Whether this marks a sustained bull run or a speculative heatwave will depend on discipline, liquidity, and macro stability. Regardless, ETH has clearly captured big players’ attention.

usethebitcoin.com

usethebitcoin.com