Ethereum whales purchased 470,000 ETH, while the RSI indicator reached its lowest level in years. While ETH price continues in its consolidation phase, technical indicators and institutional activity point to an upcoming rally.

Whales Add 470,000 ETH in a Week Amid Price Consolidation

Large Ethereum holders have demonstrated robust buying activity during the previous week.

Santiment data indicates that Ethereum wallets with holdings between 10,000 and 100,000 ETH purchased a total of 470,000 ETH in seven days.

The rise in whale purchases occurred as the token maintained its price between $1,850 and $2,150.

Moreover, large investors have been accumulating Ethereum during its March price dip, which indicates they might be planning for a longer-term market shift.

Wallet balance increases show that investors have become more optimistic about the market despite ongoing market volatility.

Whale accumulation patterns frequently serve as market direction predictors, thus future accumulation activity might shape market trends during upcoming weeks.

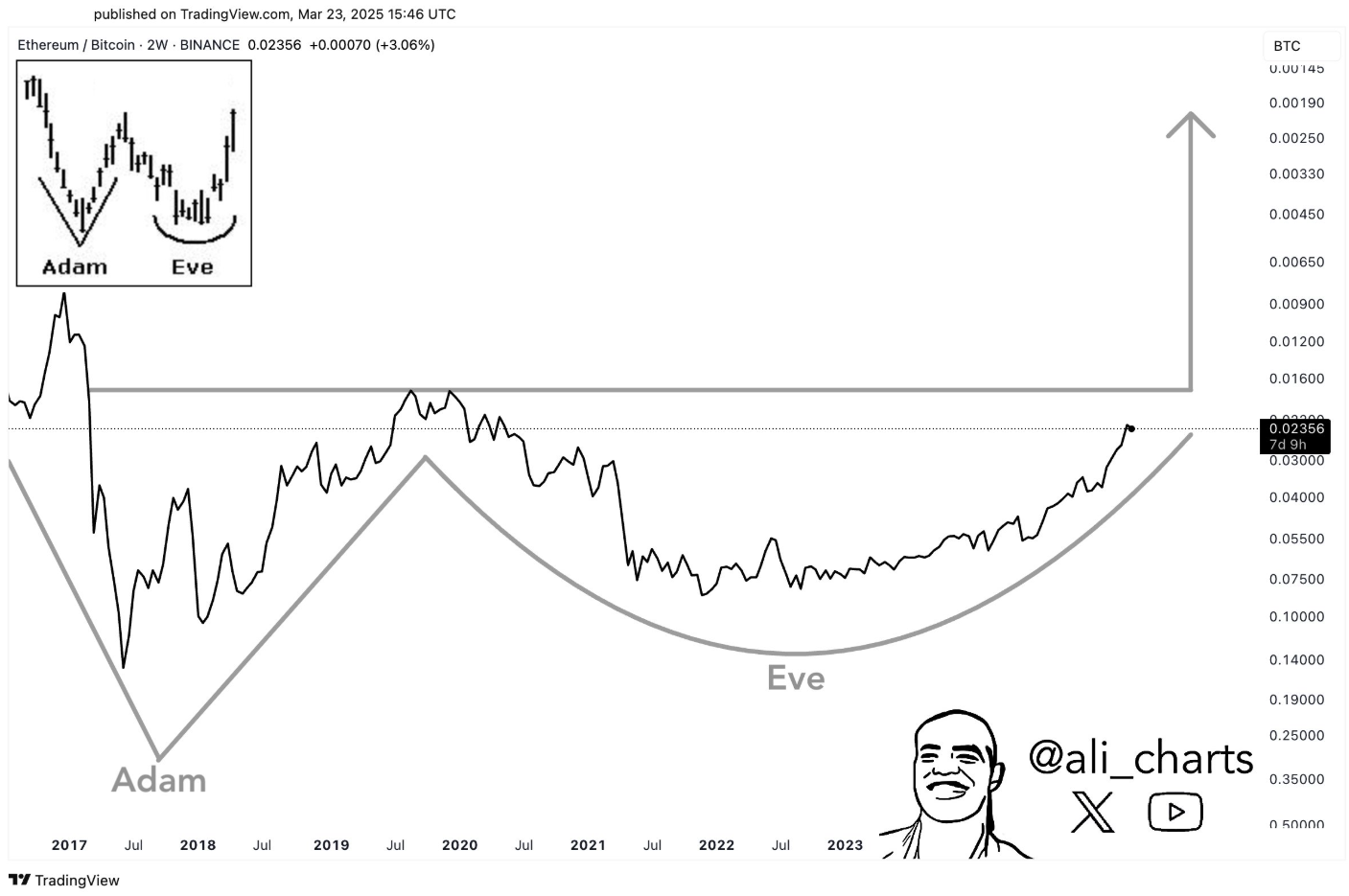

ETH/BTC Chart Patterns Suggest Potential Breakout for ETH Price

Looking at price action, the trading relationship between Ethereum and Bitcoin has gained substantial market interest.

The ETH/BTC pair shows the potential formation of an Adam & Eve pattern, according to analyst Ali_charts, through his post on X.

This pattern indicates that an ETH price increase may occur if it is validated. The pattern has formed over multiple years and could trigger a test of its important resistance point soon.

The current ETH/BTC ratio stands at 0.0235, but Ali predicts a successful breakout could drive it up to 0.0019 BTC.

The historical data indicates that such a breakout would redirect capital from Bitcoin to Ethereum. The pattern’s confirmation requires a neckline breakout accompanied by consistent buying activity.

Furthermore, according to analyst Crypto Patel, the monthly Relative Strength Index (RSI) of Ethereum has reached historically low levels.

His analysis shows that such price movements have occurred only three times since 2017. Each time, a major rally emerged after each previous price movement in the next cycle.

Previous market cycles demonstrated that the current accumulation area between $1,300 and $2,000 provided strong support.

And the current market dip within this price range is a chance to purchase ETH, according to his analysis.

Moreover, the chart shows historical RSI recovery patterns produced returns between 360% and more than 5,900%.

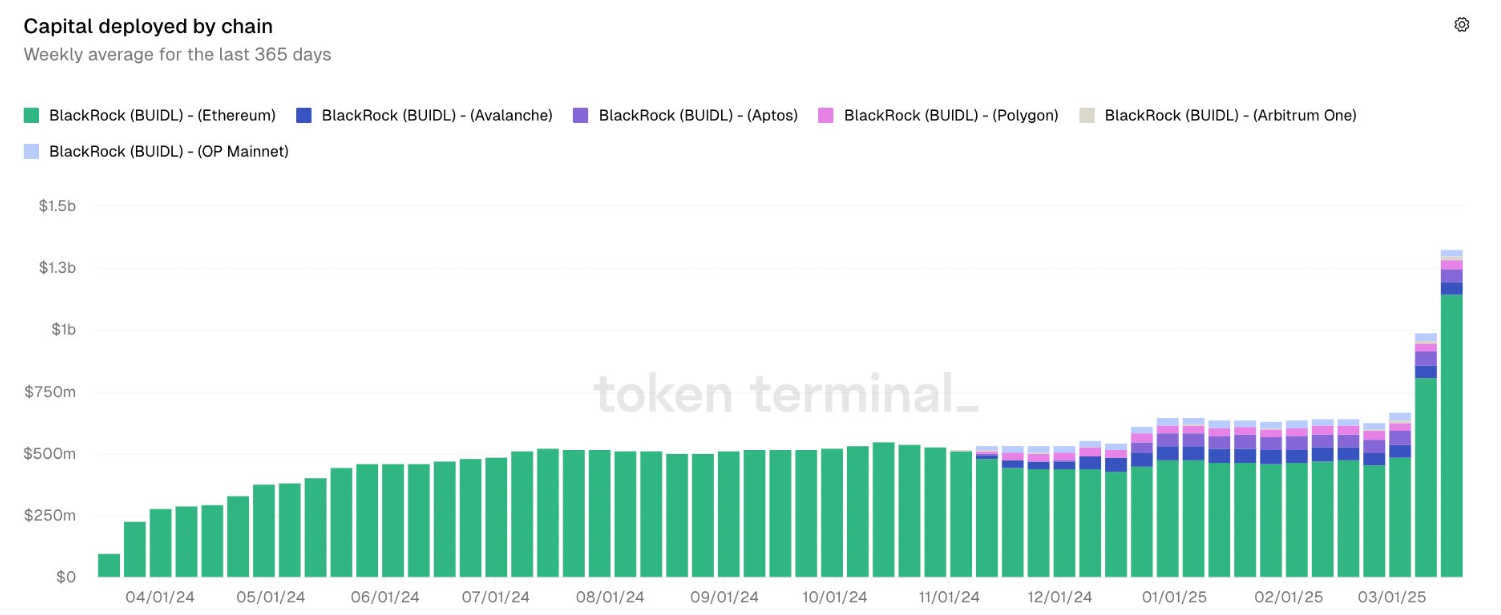

Institutional and On-Chain Interest Builds

The interest from institutions toward Ethereum shows no signs of slowing down.

According to Token Terminal data, the BUIDL fund managed by BlackRock has reached a new peak by accumulating $1.145 Billion worth of ETH.

The large Ethereum position held by BUIDL fund positions it as one of its biggest investments.

The growing number of inflows demonstrates investors view Ethereum as something beyond its speculative value.

BlackRock’s entry could motivate other investment funds to enter the market.

At the same time, the Ethereum network remains active through ongoing usage of its different protocols, as demonstrated by on-chain data.

Meanwhile, the Arkham data shows that Ethereum wallets associated with Donald Trump have demonstrated activity on the Ethereum network.

The fund has invested $3 Million into Mantle, an Ethereum Layer 2 network. The ongoing development and activity on Ethereum’s scaling solutions demonstrate continuous expansion.

thecoinrepublic.com

thecoinrepublic.com