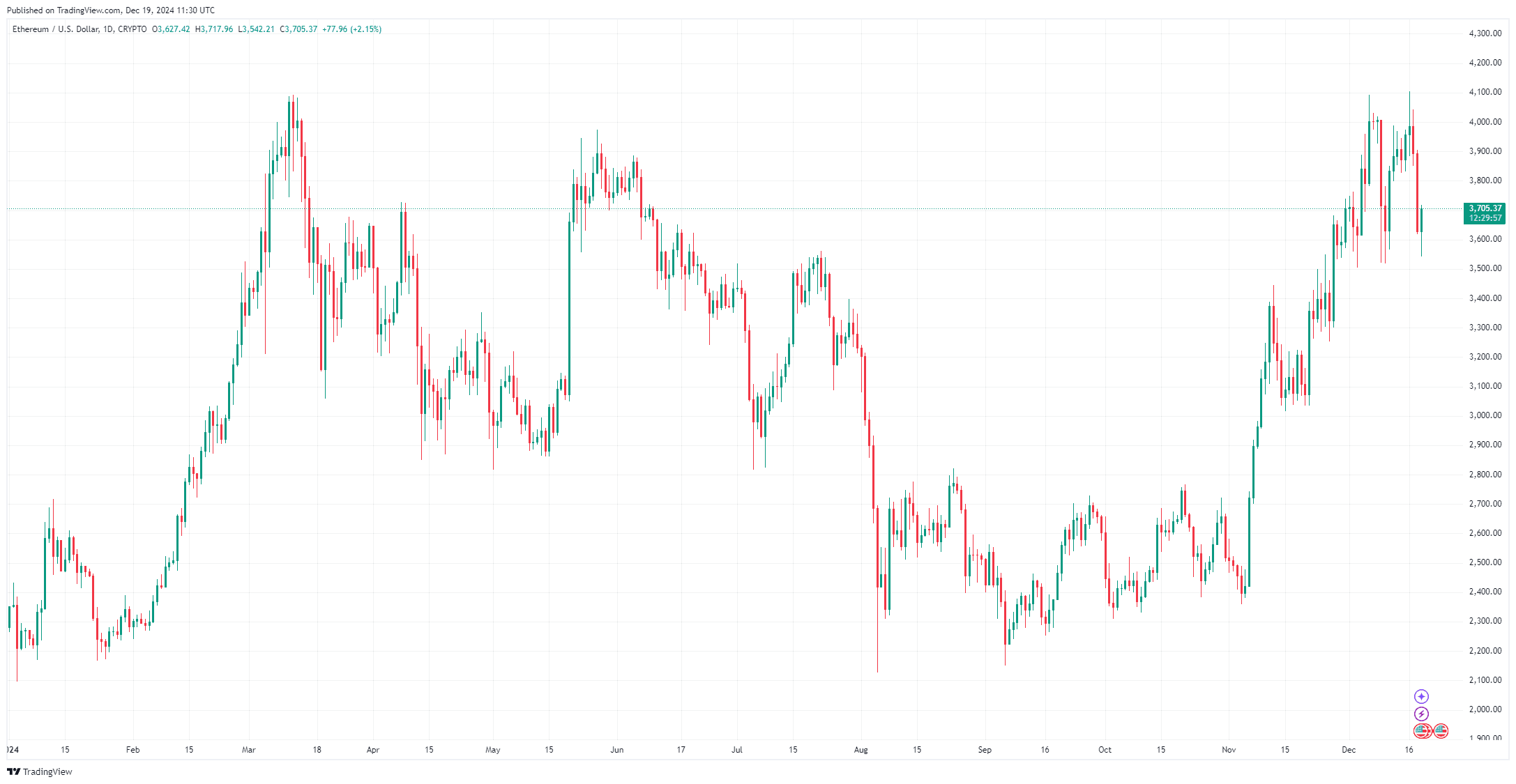

Ethereum price is under pressure, currently trading at $3,699 with a market capitalization of $445.55 billion. The recent downturn has raised concerns of a potential price crash, especially as Ethereum struggles to reclaim the $4,000 level. In this article, we’ll explore key market insights, expert predictions, and technical analysis on where ETH might be headed next.

Ethereum Sentiment Drops to a 1-Year Low

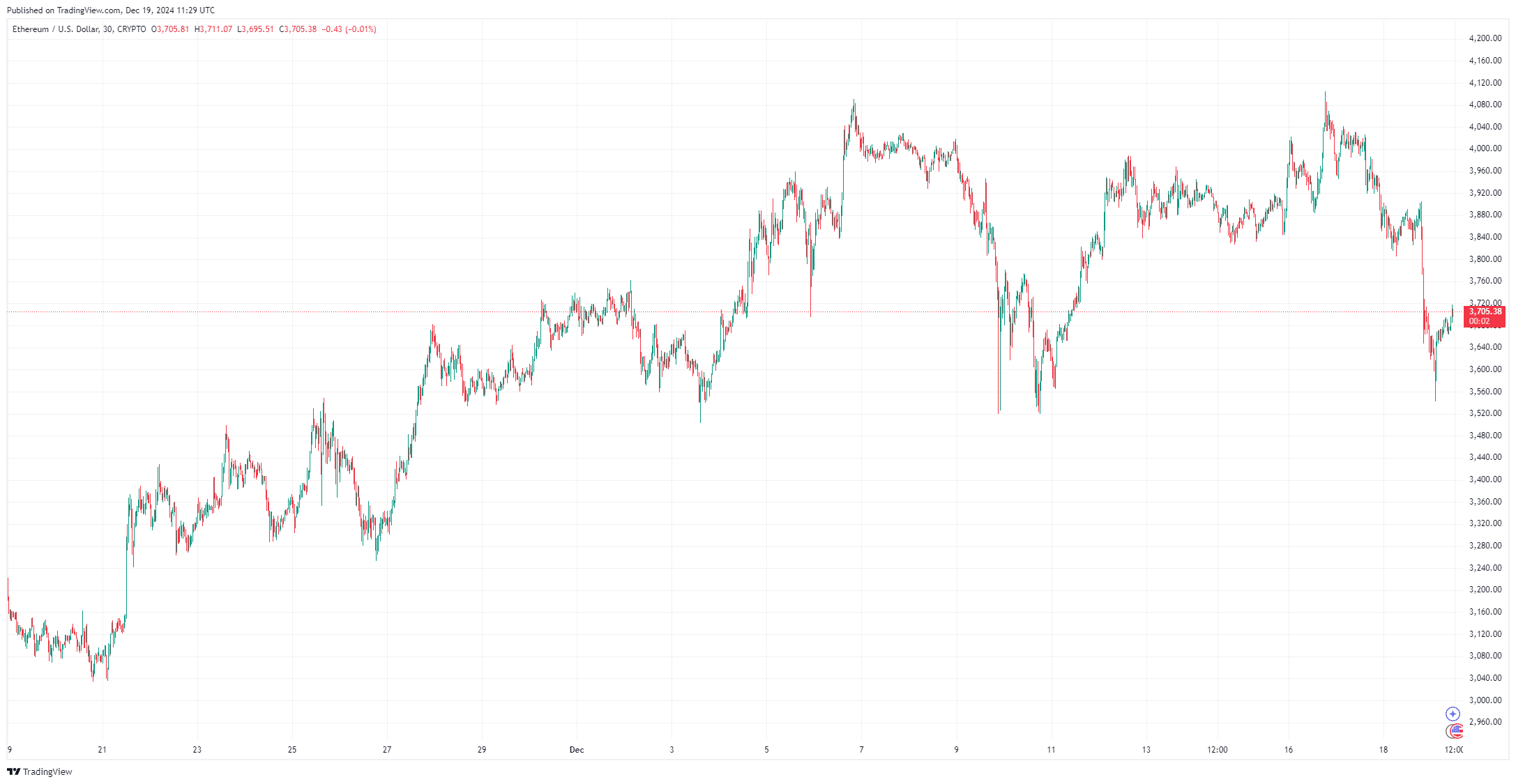

Investor sentiment toward Ethereum has reached its lowest point in a year. According to crypto analyst Ali Martinez, social sentiment for ETH is at its most negative level since December 2023, when ETH was trading between $2,100 and $2,200. Interestingly, this bearish sentiment could signal a bullish opportunity. Historically, when sentiment reached this low, Ethereum’s price rallied by 30%, eventually climbing from $2,200 to $2,700 before continuing its rally to $4,093 in March 2024.

Martinez believes that if ETH follows a similar pattern, the price could rise to the $4,900–$5,000 range. However, for this bullish scenario to materialize, ETH must first break through the $4,100 resistance level. Once that’s achieved, he suggests that $6,000 could act as a price magnet for the cryptocurrency.

Technical Indicators Signal More Losses for ETH

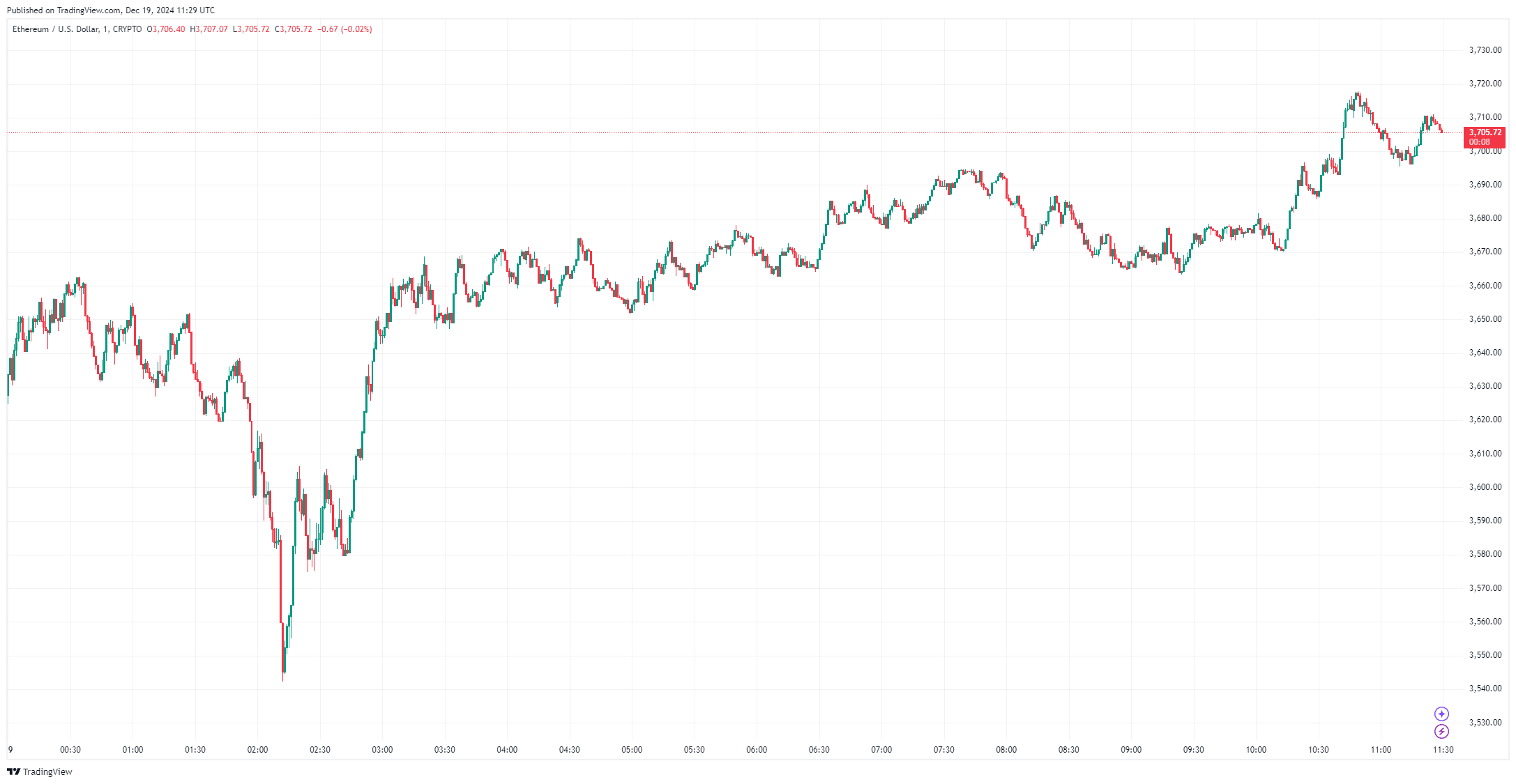

Technical analysis reveals that Ethereum’s price is showing strong bearish signs. ETH recently dropped below key support levels, including $3,880, $3,800, and $3,680. It is now trading below $3,620 and the 100-hourly Simple Moving Average. A bearish trendline is also forming, with resistance at $3,800, which could act as a significant hurdle for any upward movement.

If ETH fails to clear the $3,680 resistance, further declines could be expected. Key support levels to watch include $3,550 and $3,500. A breach below $3,500 could send Ethereum’s price to $3,450 or even $3,350. In a worst-case scenario, analysts see support at $3,220 as the final line of defense before a larger sell-off.

Can ETH Reclaim the $4,000 Level?

Breaking through the $4,000 level has proven to be a major challenge for Ethereum. Recent attempts to reclaim it were met with strong resistance, pushing the price back to $3,800 and lower. Market observers have compared ETH’s current price action to Bitcoin’s performance when it hovered near the $70,000 mark. Similar to BTC’s historical behavior, ETH price may experience multiple rejections before it can sustainably break above the $4,000 mark.

Crypto analyst Altcoin Sherpa notes that ETH’s ability to reclaim $4,000 could signal the start of a new bullish run. However, this would require significant buying pressure, as sellers have been topping up supply at this price point. Holding above $3,800 is seen as crucial to sustaining any bullish momentum.

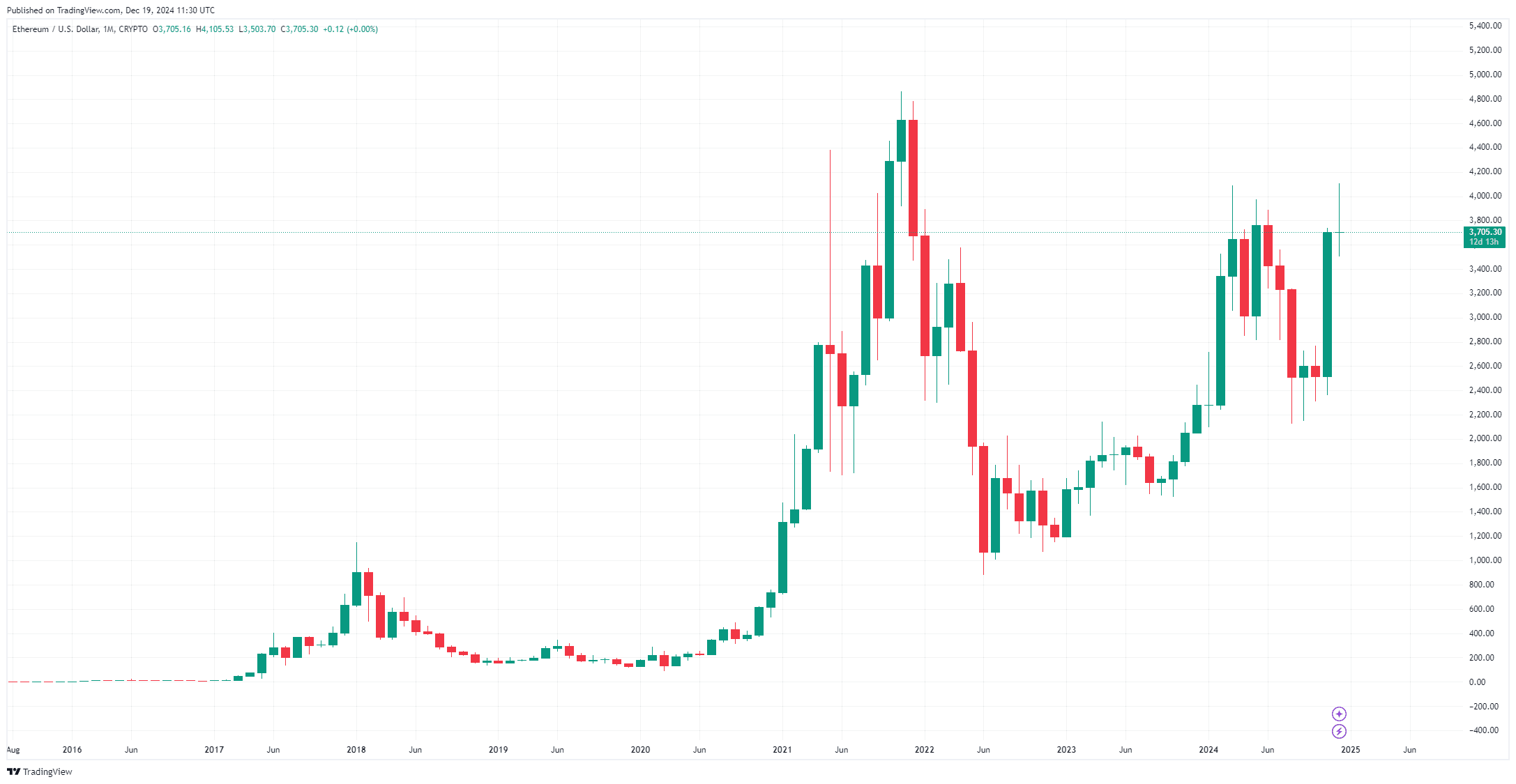

Ethereum’s Role in the Next Altcoin Season

The broader altcoin market may play a significant role in Ethereum’s next move. Market expert Lark Davis points out that the total altcoin market cap is approaching its 2021 high of $1.13 trillion. He argues that once this threshold is breached, it could trigger a historic altcoin season. Given Ethereum’s prominence as the "King of Altcoins," any upward movement in the altcoin market could fuel renewed interest in ETH.

Crypto analyst Miles Deutscher echoes this sentiment, noting that ETH has historically performed well during altcoin seasons. From January to May, ETH’s monthly returns averaged 28%, compared to just 3% for the rest of the year. As Bitcoin’s dominance rises, it’s often followed by a capital rotation into altcoins, which could benefit Ethereum significantly.

Ethereum Price Prediction

Analysts are divided on Ethereum price next move. While some predict a further decline below $3,500, others believe that the bearish sentiment is a classic indicator of an impending bullish reversal. Here’s a summary of possible scenarios:

- Bearish Scenario: ETH fails to reclaim the $3,800 resistance, leading to further declines. Key support levels to watch are $3,550, $3,500, and $3,350. A breach of $3,220 could trigger a sharp sell-off.

- Bullish Scenario: If ETH breaks above $3,800 and reclaims $4,000, it could trigger a move to $4,900–$5,000. Should it clear $4,100, $6,000 could become the next price target.

Ethereum price is at a critical juncture as it faces significant resistance at $4,000 and key support at $3,500. Sentiment is at its lowest point in a year, a potential bullish indicator according to historical data. However, bearish technical indicators suggest further losses may be on the horizon. The outcome will likely depend on whether ETH can reclaim the $4,000 level or if it succumbs to the bearish pressures pushing it lower. Investors should watch key support and resistance levels closely in the coming weeks.

cryptoticker.io

cryptoticker.io