- Ethereum ETFs break outflow streak with first inflows after nine days of negative flows.

- Ethereum is no longer "ultra" sound money, says analyst.

- Ethereum needs to overcome key resistance around $2,817 to validate double bottom move.

Ethereum (ETH) is up 0.5% on Thursday following a recent analysis showing that the top altcoin lost its "ultra" sound money narrative. Meanwhile, ETH ETFs recorded net inflows for the first time after nine days of consecutive outflows.

Daily digest market movers: Ethereum ETF outflow streak, ETH "ultra" sound money narrative

Ethereum ETFs posted inflows of $5.9 million on Wednesday, ending their nine-day streak of consecutive outflows. Inflows of $8.4 million and $1.3 million in BlackRock's ETHA and Fidelity's FETH, respectively, outweighed outflows of $3.8 million in Grayscale's ETHE.

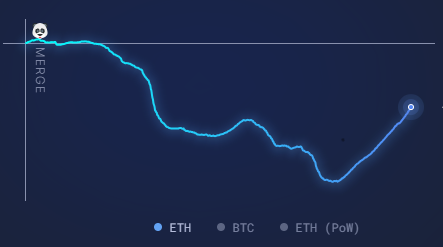

Meanwhile, several investors are increasingly concerned about ETH's rising supply as its annual inflation rate has risen to 0.73% since the Dencun upgrade, per Ultrasound.money data.

For context, ETH's total supply was around 120,060,000 ETH before the upgrade in March. However, supply has increased to 120,309,508 ETH in August, just five months after the upgrade, trending toward levels before the Merge in September 2022. The introduction of blobs in the Dencun upgrade reduced the workload processed on the Main chain and hence decreased the daily amount of burnt ETH.

ETH Supply Growth

In an X post on Thursday, crypto analyst Thor Hartvigsen said that while ETH has become inflationary, the high supply has no negative impact on stakers as the new emissions also flows to them through staking yields. However, non-stakers bear the burden of the rising supply as they suffer a net value dilution of ~0.7. "But this is orders of magnitude lower than other L1s like Solana, Avalanche etc.," noted Hartvigsen.

"Ethereum no longer carries the ultra sound money narrative[,] which is probably for the better. The high $100 tx fees on mainnet were never sustainable and the network is now more usable," he added.

ETH technical analysis: Ethereum faces $2,817 resistance hurdle

Ethereum is trading around $2,520 on Thursday, up 0.5% on the day. In the past 24 hours, ETH liquidations declined to $17.07 million, with long and short liquidations accounting for $10.75 million and $6.32 million, respectively.

ETH is trading within a key rectangle channel, with the lower horizontal line at $2,320 as support and the upper horizontal line at $2,817 as resistance. ETH is also following the W pattern or double bottom move on the daily chart.

A daily candlestick close above the $2,817 resistance could see ETH rally toward $3,300. The 100-day Simple Moving Average (SMA) could help strengthen the bullish view as it's attempting to cross above the 200-day SMA.

ETH/USDT Daily chart

Traders should also watch for a potential rejection around the $2,817 resistance, as ETH has retraced twice in the past few weeks — August 14 and 24 — after approaching this level.

The Relative Strength Index (RSI) is at 42, attempting to cross above its SMA. A successful completion of this move indicates short-term bullish momentum.

However, the Awesome Oscillator has flipped to red bars below the zero line, indicating the prevalence of bearish momentum in the market.

A daily candlestick close below the $2,320 support level will invalidate the bullish thesis.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.

Related news

- Ethereum ETFs see weak reception five weeks from launch, though ETH shows potential for 30% rally

- Crypto Today: NFT platform OpenSea gets SEC Wells Notice, Bitcoin and Ethereum hover close to support

- Ethereum plunges by 9% following selling pressure from whales and ETF investors

fxstreet.com

fxstreet.com