- Ethereum L2s record new highs in terms of transactions per second.

- Gas fees on Ethereum L2s are slashed by 99% after the Dencun Upgrade.

- Anticipation mounts over the ETH’s classification and the pending SEC’s verdict on spot Ethereum ETFs.

The sentiment surrounding Ethereum and Ether (ETH) is now a mix of optimism and criticism. Metrics displayed by the largest smart contract-led ecosystem’s layer-2s (L2s) reflect a bullish outlook, while certain circumstances provoke fear, uncertainty, and doubt (FUD). Especially the question: Will ETH lose its value accrual amid the L2 fragmentation?

Let’s take a closer look at the L2 ecosystem and gradually figure out what’s the real concern about Ethereum.

Gas Fees on L2s Slashed by 99%

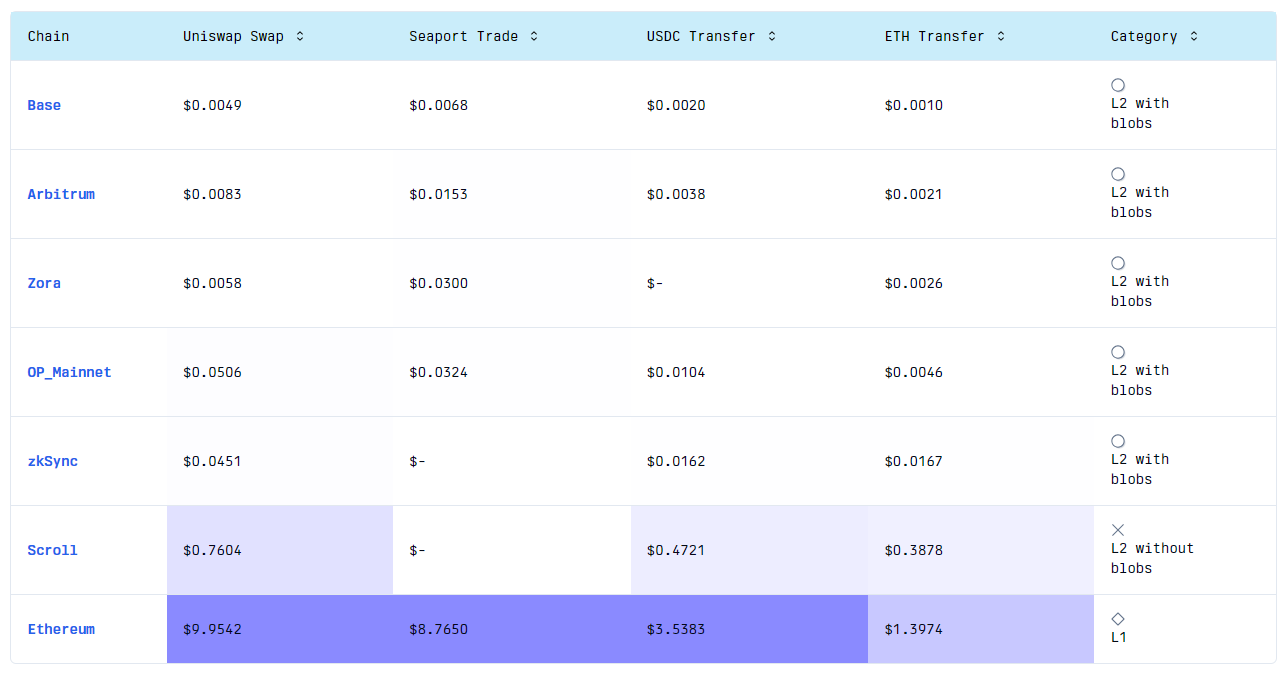

With the Dencun Upgrade on March 13, Ethereum onboarded blobs (Binary Large Objects) via the implementation of EIP-4844. Blobs optimized the data availability and reduced the transaction costs across the L2s. Soon after the implementation, chains such as OP Mainnet (Optimism), Base, Arbitrum, Zora, and zkSync displayed notable reductions in the gas fees for different transactions — swap, transfers, and the like.

The above data from GasFees.io reveals that transfering ETH on Base averages $0.0011, with token swaps costing $0.0049. On Arbitrum, fees stand at $0.0085 and $0.0021 respectively, while Zora’s fees are $0.0058 and $0.0026 and OP Mainnet’s fees are $0.0046 and $0.0508.

L2s Rise to All-Time High

This paired with the viral Memecoin trading season fueled the activity of these ETH L2s to highs. The transaction count of multiple solutions marked respective all-time highs (ATH). Remarkably, Consensys’s ETH L2 zkEVM rollup Linea spiked by 678% and Coinbase’s Base by 605% over the past month, as per growthepie.xyz data. To highlight, asset manager VanEck predicts Ethereum L2s will attain a trillion-dollar valuation by the end of 2030.

FUDs and Criticisms Aimed At Ethereum

Ethereum finds itself in the crosshairs of criticism and mockery. OG Trader Peter Brandt cited flaws in its functionality and labeled ETH a “junk coin.” On the other hand, the famous Solana community Superteam DAO aired a promotional video on Wednesday, criticizing Ethereum. This video mocked ETH maximalists and devs, labeling them as sufferers of Ethmaximymsis (aka ‘ETHMAXI’). It advised ETH developers to migrate and build on Solana via Wormhole, despite its flaws.

Next up is the concern of ETH losing its value accrual over the rising ‘L2 fragmentation.’ Emphasizing this concern, pseudonymous crypto whale “@0xSisyphus” compared it with the scenario of ATOM, the native token of interoperable Cosmos chains and DOT, the token of parachain-focused Polkadot. Per contra, popular ETH educator advocates for the rise of a modular Ethereum era built with ETH powering it up.

Amid this scenario, Ether (ETH) resumes hovering within the $3.2K range. At the time of writing, it traded at $3,269 after recording a 2.4% drop in the last 24 hours. Notably, according to Into The Block, in Q1 2023, nearly $4 billion worth of ETH was withdrawn from various crypto exchanges. Holder accumulation in this data hints at a bullish outlook. Meanwhile, expectations soar as discussions continue on ETH’s classification and the awaited SEC decision on spot Ethereum ETFs.

thenewscrypto.com

thenewscrypto.com