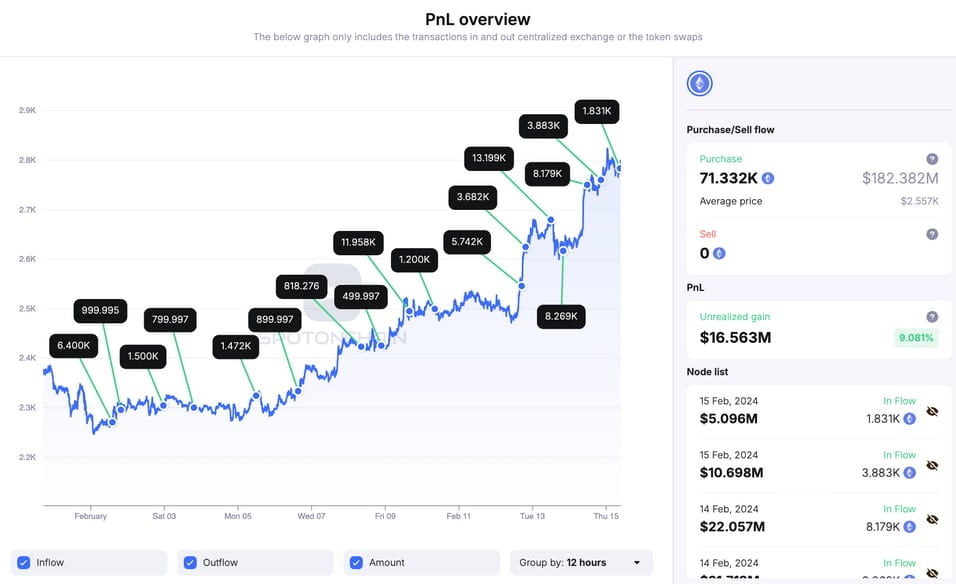

A massive Ethereum (ETH) whale has withdrawn 71,332 ETH worth $182 million since February 1. The accumulation happened amid a bull rally in the cryptocurrency market, with ETH up nearly 25% since the first purchase.

On February 15, the massive Ethereum whale withdrew 1,831 ETH from Binance and Bybit, worth $5.07 million. Finbold retrieved this data from the SpotOnChain Platform less than three hours after the withdrawals, which lasted 20 minutes.

In total, the whale has withdrawn 71,332 ETH from Binance, Bybit, Bitfinex, and OKX in February alone. In particular, onchain data shows an average price of $2,557 per ETH, costing $182 million.

Moreover, SpotOnChain identifies an ownership of 76,369 ETH, which is currently worth nearly $214 million. This amount is distributed among three lending platforms for yield generation and liquidity mining: Spark, Maker (MKR), and Compound (COMP).

Ethereum (ETH) price analysis amid massive whale accumulation

In the meantime, Ethereum is trading slightly above $2,800 by press time, up 22.63% since February 1. ETH/USD’s daily chart shows a strong momentum with 11 ‘green’ candles out of 14 trading days.

Notably, the Relative Strength Index (RSI) just reached an ‘overbought’ level of 77.64. This is bullish as long as no trend-reversal signals exist for the second-largest cryptocurrency by market cap.

In summary, ETH now has $335.56 billion in market capital. The massive Ethereum whale’s recent activity indicates an optimistic forecast for the leading Web3 blockchain and no intention of selling.

Additionally, Ethereum is also known for igniting pumps on altcoins and starting Altseasons. However, investors must remain aware of possible volatility and the market’s natural uncertainties. Cryptocurrencies rely on demand for positive price performance, which massive whale movements sometimes act as an indicator of.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com