Nearly a year after Chandler Guo — the instigator of the Ethereum blockchain’s last hard fork — predicted its rise, the native coin of the breakaway Ethereum proof-of-work blockchain has plummeted by more than 95%. Ethereumpow (ETHW) now trades at a price less than 1% of the U.S. dollar value of ether. The team behind the Ethereum proof-of-work network acknowledged in March that the protocol’s prospects may not be as bright as they were in September 2022.

ETHW’s Gradual Decline

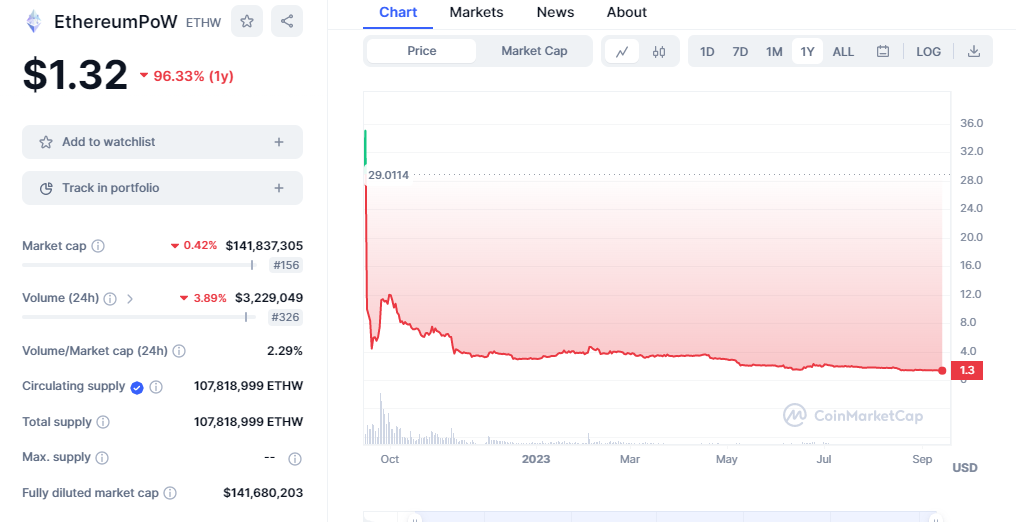

Almost a year after it debuted at just over $100, ethereumpow (ETHW), the native coin of the breakaway Ethereum proof-of-work (PoW) blockchain, traded at $1.32 on Sept. 13, 2023. At this price, the coin is down by more than 95% from its maiden price. In contrast, the main Ethereum blockchain’s native coin ETH, which traded at just under $1,560 at the time of The Merge, was pegged at $1,600 on the same day.

The decline of the forked coin’s value appears to contradict assertions made by Chandler Guo, the instigator of the Ethereum blockchain’s last hard fork. As reported by Bitcoin.com News in 2022, Guo insisted the price of ETHW was “very cheap” and predicted its eventual rise by 100X. At the time, Guo suggested that it would take 10 years for the price of ETHW to match that of ETH.

However, some twelve months later, ETHW, whose value was equivalent to 6% of that of ETH, is seemingly not on course to match the price of ether. Instead, as shown by the latest data, the forked coin now trades at a value which is less than 1% of ETH’s value.

Similarly, the forked coin’s current traded volumes are also significantly lower than what they were 12 months ago. To illustrate, just after the hard fork, ETHW daily traded volumes were averaging more than $100 million for the remainder of Sept. 2022. However, the data shows that between September 1 and 13, 2023, the forked coin’s traded volumes have remained under $8 million.

Ethereum PoW Team Identifies Problems Besetting the Chain

The daily traded volumes of ETH, on the other hand, have largely ranged between $2 billion and $17 billion since the migration to the proof-of-stake consensus mechanism. In addition, ETH has retained its position as the second-most dominant cryptocurrency.

🟩 Proposal: EthereumPoW One — An All-in-One Ecosystem DAO

Since the inception of EthereumPoW, some excellent NFT projects have emerged in the EthereumPoW ecosystem. Through these projects, we have witnessed the enormous potential of EthereumPoW. Nevertheless, the overall… pic.twitter.com/wWtNmXliNA

— EthereumPoW (ETHW) Official (@EthereumPoW) March 17, 2023

Although some supporters of the Ethereum PoW network have remained upbeat, the team behind the chain acknowledged in March that the protocol’s prospects may not be as bright as they were in September 2022. In a message shared via their official handle on X (formerly Twitter), the team noted the project lacked funding as well as “a unified and effective organization to coordinate limited resources in this ecosystem.”

To overcome these and other challenges, the team proposed the establishment of “EthereumPoW One — A All-in-One Ecosystem DAO [decentralized autonomous organization].” However, as shown by the data, even the team’s March 17 announcement of the proposal has seemingly failed to halt ETHW’s price decline.

What are your thoughts on this story? Let us know what you think in the comments section below.

news.bitcoin.com

news.bitcoin.com